Dear reader,

If this Zombie residing on Gore Street doesn’t brighten up your day, your sense of humour is dead.

What a cheery fellow! Despite losing both limbs in what Monty Python’s Black Knight might call “Tis but a scratch, a mere flesh wound”, he’s a happy chappy.

Perhaps it’s because he read the OB article “Oh Battery Store” and made his way over to Gore Street. Perhaps, and let’s be optimistic, perhaps he only fell into a manhole cover and the blood is just a tasty snack he’s enjoying… well it is Gore Street reader.**

Blood in the streets is how you might describe ticker GSF at a 43.3% discount. But I must confess to following Mr Shuffles the Zombie into GSF shortly after I wrote my article “Battery Store” and realised what a bargain GSF was. Particularly when I realised the fears seemed overblown and misplaced.

** Gore Street has nothing to do with Zombies really. This photo is Gore St. in Ireland, and is where the CEO of GSF grew up hence the name of GSF. Not a Zombie in sight, not even a Mr O’Shuffle.

GSF originally caught my eye in the II’s Discount Delver at a 42% discount. Further eyecatching was a (now) tasty dividend (which has been cut to 7p a year) and internationally located energy storage serving different markets (US 55% and UK 30% with Ireland/Germany the remainder). Digging a little further, the current live 421.4MW battery capacity is due to grow to 750MW by March 2025 with three Californian assets coming on stream or being “energised” as the lingo goes.

In my Battery Store article I spoke to what I believed the market had missed***. This was that GSF have a series of large assets which when operational (in the next few months) these stand to receive IRA tax credits of $60m - $80m (£45m - £60m) which equates to between 15% to 20% of the market cap.

The balance sheet is bullet proof, also, with £50m of cash and while the dividend isn’t fully covered, there’s a clear path to achieve that.

The QuotedData GSF Commentary

*** a reader responded to my comment “the market had missed” and set me straight. He told me about a contrary opinion, that this had been spotted but based on commentary made by Mr Carthew and Mr Hattie of QuotedData about GSF on their weekly podcast some weeks back was unlikely to happen. I disagreed with their findings and this is why. Their comments are in Italics:

“The main thing (for GSF) was the change to the revenue curves of power prices”

The Oak Bloke says: If you follow other companies in the power and electricity sector then you should already know that negative valuations are due to power price curves. This is already well known and has been occurring for well over 12 months. So I disagree that “it’s a change”…. it’s actually the status quo and fully expected.

As I’ve pointed out in other articles like “HEIT me” and “SEIT” the Power Curve or Power Prices is a non-cash evaluation based on future power prices. Notably “power prices” is SUBSTANTIALLY driven by Henry Hub and Natural Gas prices. Yes, natural gas is a form of power, and yes, some electricity is generated by gas powered generation. It is my belief that too much credence is being given to these prices which are broad brush and do not accurately predict the revenue (and profitability) potential of specific services like Grid Balancing, Peak Shifting and future Trading Ranges i.e. electricity arbitrage. Specifically on the latter, if power can be purchased at negative levels and sold at positive levels it is the future range that matters, not just the absolute price itself.

In other words, I believe there is hidden value in the NAV and that future earnings (in my opinion) will surprise to the upside, or at least other factors like the level of competition and demand growth will determine prices not these guesstimate power curves produced by “experts” who forecast a normalisation of Revenue £80k/MW/Yr.

The other point they make is the £60m credit is in doubt apparently. But by his own admission, Mr Carthew on his slide says “may halt” and he has “no idea how fast”. and Carthew bases this on saying that he (Trump) is “negative about the whole Inflation reduction thing”.

The Oak Bloke says:

a/ The IRA took ONE YEAR to pass into Law despite a Democrat majority and President. It required a cross party co-operation which was (unusually) achieved via an 11th hour deal between Schumer and Manchin. Biden had lost hope that he, **THE PRESIDENT**, could get it through.

b/ Therefore the assertion “he (i.e. Trump) may halt”. Nonsense! He can’t! It requires both Congressional And Senate approval, and as stated above that’s neither fast nor easy.

c/ While I agree Trump has a chance of winning it is not certain, and the Democrats show an energy and vigour missing in the Republicans. It is also far less clear that the Republicans could simultaneously win all three of the Senate, Congress AND the Presidency.

d/ Moreover many Red States have been beneficiaries of the IRA. Texas is a great example. Even *IF* the Republicans had an outright majority in all both houses and the Presidency it doesn’t follow that a majority would support abolition of the whole IRA. There would be a lot of horse trading before it were agreed.

e/ I don’t claim to have a detailed knowledge of American politics but I do know that the focus of Republican dislike of the IRA is the fact that money ends up going to China, and in the hands of Chinese EV manufacturers. So the focus of any attack on the IRA is almost certainly going to be against that and not necessarily on a wholesale dismantling.

f/ Not once have I seen or been able to find a Republican complaining about money going to BESS. Here’s a simple fact. Americans love their Air Conditioning. They do! Every time I go to America the indoors everywhere is icy cold. You return to Britain and think what neanderthals we are. Measures that protect the grid and prevent brown outs and black outs are POLITICAL HOT POTATOES. Going after IRA credits for a political hot potato? You’re kidding, right?

In conclusion has this “risk” been actually thought through? Where’s the evidence?

Andrew McHattie also states “The dividend is in doubt”. This is evidenced that the dividend is structured “1p,1p,1p,4p” (and they might pull or reduce the 4p)

The Oak Bloke says:

Is it in doubt though? Let’s look at the numbers:

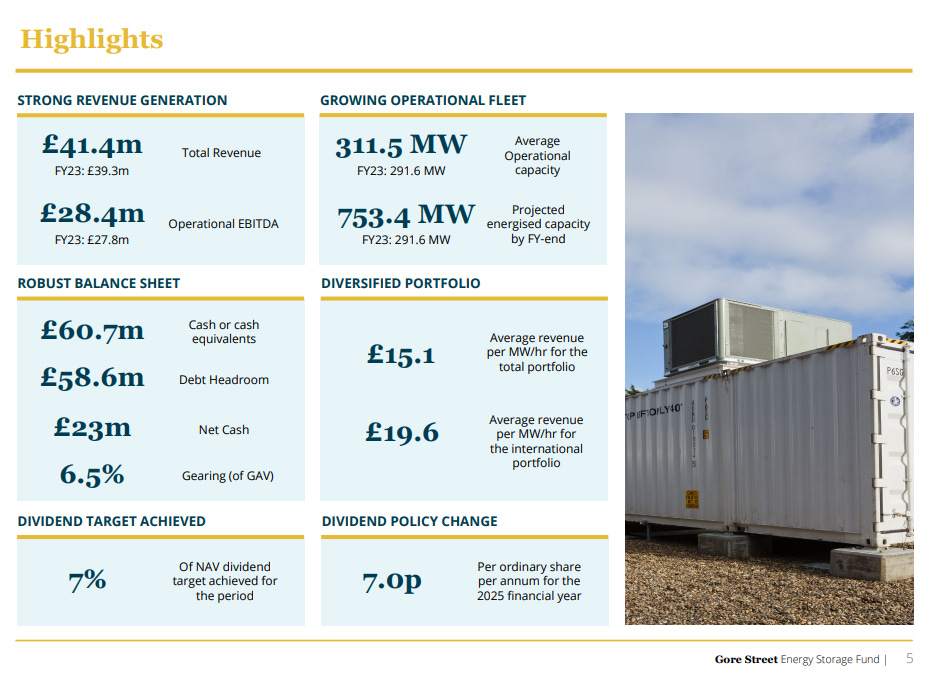

2023 Revenue is £42m; Op. costs are £14m. EBIT £28.4m. Other income £3.1m. Overheads are £11.3m.

Cash/receivables is £61.2m. Dividend (at 7p) costs £36.4m.

I have set out in a chart how the Average MW/Years grows ~20% from 421.4MW to ~500MW during FY25 (ending March 2025).

The basis for the ~500MW calculation is simply based on Energisation dates and pro-rating for the y/e 31/3/25. For example Enderby energises in mid year and Big Rock at 9 months.

FY25 pro-rata would be circa ~£34m EBIT. Assume other income falls to £2m. Assume Overheads grow 5% £12m = £24m NET (so a circa £12.4m shortfall to covering the dividend or 0.67X).

I’m assuming a steady state to the MWh revenue - which I think is highly conservative for the UK given that ESO National Grid have sorted out the software issue which froze BESS out of the grid management services market.

Plus there’s a £48.8m worth of cash “margin of error” (£24+£61.2-£36.4m) to the above calculations.

Plus the FY25 exit rate is 753.4MW which is ***80%*** above the FY24 operational portfolio. I calculate that the FY26 run rate would be circa EBIT of £51.1m - overheads of £12m = £39.1m or 1.1X the dividend in 9 months time.

I’m assuming zero “other income” plus the majority of that 80% would be at the higher (at least in FY2025/FY2026) US prices - which isn’t included in my calculation.

In other words, the “doubt” isn’t borne out in the numbers. Where is the evidence of this unsustainability exactly?

Other points from Andrew McHattie in his podcast are:

“The revenue includes investment tax credits”

OB says - no, nowhere does GSF assume the ~£60m windfall in its forecasts (for example under the APM). Nor do I, in the numbers above, you’ll notice.

“It depends on the build out of the portfolio”

OB says - the build out affects the growth in earnings but not the current earnings themselves. These BESS projects are multi-year and while yes delays can and do occur we would be talking months of delay - and usually there are claw backs/liabilities on the constructors (as is currently the case with HEIT) which compensate for delays. If this is the case then it doesn’t depend on the build out does it?

“There’s the likely path of power revenues which are slightly uncertain, and we do not know if the US revenues will be as strong”

OB says - we know the MW price was at record low levels in mainland Great Britain in FY24 and I do not model for any increases to that in the numbers above for FY25. The share of energised US assets are currently 29.85MW of 421.4 MW, that’s 7% of GSF revenue, so I do not model for any drop, but we are talking 7% of assets delivering 14.5% of revenue so how much of a fall in the US does McHattie expect for this to be a relevant reason affecting the overall EBIT? If somehow the US in FY25 fell (inconceivably) to GB FY2024 levels that would be a 61% drop in prices there and mean a 8.8% reduction overall. Conceivably a more realistic reduction in EBIT could be 2%-3%, which equates to just £1m of my £34m forecast EBIT bearing in mind there is also a £48.8m margin of safety in CASH.

The inconceivable 8.8% drop would be a £3m loss out of the £48.8m margin of safety by the way.

So still affordable even if the extremely unlikely did happen.

GSF Highlights from FY2024: (y/e 31/3/24)

A GSF diagram provides an important clue that falls in the price of Lithium as well as improvements to technology mean LiO batteries cost around $130/Kwh compared to $210/Kwh 5 years ago. This equates to a $433k/Mwh cost for 1 hour batteries reduced from $700k/Mwh 5 years ago given that batteries comprise 30% of system capex. 2-hour batteries are 40% higher at close to $600k/Mwh.

GSF are planning to upgrade some sites to 2-hour batteries which offers a number of benefits as seen with HEIT (less degradation to batteries and better arbitrage opportunities), and this is a hidden form of increasing value at a relatively low cost. Particularly as the cost of this upgrade has fallen.

GSF covers a range of geographies with a high level of energised capacity in the coming months. Demand for storage is also growing as covered by Bloomberg’s BNEF report here. This in part will be core to the “Great British Energy” theme of the Labour government, who are determined to drive UK renewables in a way the Conservatives didn’t. More renewables require more storage it’s as simple as that, but also that more intermittency provides more opportunity for arbitrage both via demand management services but also through the buying and selling of power.

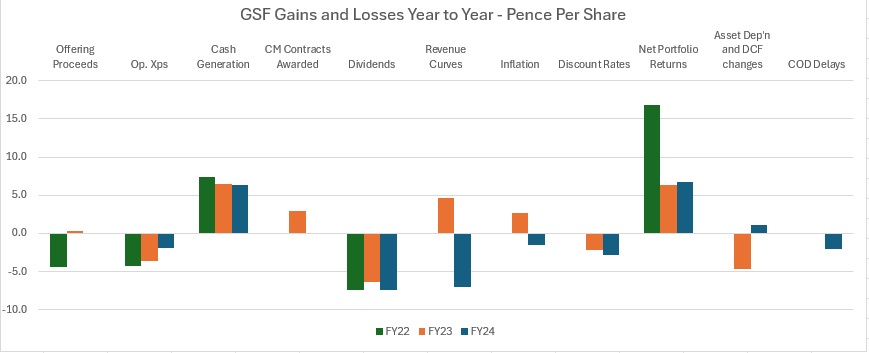

If we dissect the reasons for movements in NAV we see a familiar picture emerge:

We see a lot of red in FY24 (year ending 31/3/24). But not prior to this year. In the year to 31/3/2023 we see improving revenue curves and inflation assumptions. I was surprised to find this - in comparison with other Energy Storage firms.

Anyway, we see 5p/share of losses in FY23 and FY24 due to discount rates, a 2.3p/share loss from revenue curves, and a 2.1p/share loss from COD delays (delay in energisations).

What becomes apparent, also, are strong portfolio and cash returns, reducing op expenses per share and a business punished on a huge discount when the FY24 fundamentals are not substantially weaker than prior years.

In fact if we focus in just on FY24 we see 13.4p of reductions which are temporary of reversible in nature. Namely Revenue Curves, Inflation, Discount Rates and COD Delays. This 13.4p can and will reverse as the tide of inflation, discount rates and revenue pricing turns. COD delays are temporary.

Meanwhile in FY24 we continue to see strong Cash Generation and Net Portfolio Returns and DCF changes of 14.1p/share with a -1.9p/share op. expenses.

We also see a business that’s returned 21.2p of dividends in 3 years - that’s 35% of today’s share price in the past 3 years for goodness sake!

For the reasons discussed earlier in the article, the current year’s 7p dividend looks far safer actually, not least because we are about to see much stronger Cash Generation as the 421.4MW capacity grows to 750MW by March 2025. But also for the £48.8m margin of safety mentioned earlier also.

In my forecasts I see a partial reversal of inflation, discount rates and revenue curves. £60m tax credit I place in FY26 (i.e. on or after next April 2025), while the energisations give a one-off 9p boost to “Net Portfolio returns”.

I would not be surprised to see some sort of special dividend in FY26 also. So have factored in a 3p special.

Including dividends I could see a rerate over the next 18 months where this delivers at least a 100% gain, leaving it on a 15%-20% discount. Bearing in mind this was at a surplus to NAV for quite a while.

Conclusion

I think the market has misunderstood GSF and ponders risks like Trump will somehow magically kill off the $60-$80m IRA tax allowance the day after he arrives into office - and the dividend shall be cut is seen as an inevitability. I’m not so sure. There’s a lot of IF and BUTS to these assumptions and risks, whereas the numbers appear to show a different and more certain story with significant margins of safety.

In any case even if both of those possibilities - however unlikely - do happen you are still looking at a discount of 44% to assets, which will re-rate upwards as they become operational and as inflation and discount rates revert down. Also operational assets that grow 78% through completion and energisation and cash generation also even if future Mwh revenues somehow remain modest.

But the rapid build out of renewables makes the chances of modest revenues unlikely also.

So the odds are in your favour on Gore Street, where while it is not risk free, a flesh wound is a scratch and not a Black Knight scratch - and is unlikely to cost you either an arm or a leg. Definitely one to buy while there’s blood in the streets.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

For all things GSF => https://podcasts.apple.com/gb/podcast/transmission/id1613338951?i=1000655005027

YET ANOTHER Enviro / Green theme reco from The Oak Bloke.

It's time we found a new moniker for our resident substacker....

The Woke Bloke 😁