Fun Run upsets

And a new race leader

Dear reader,

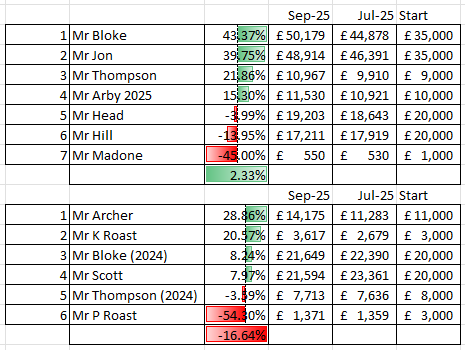

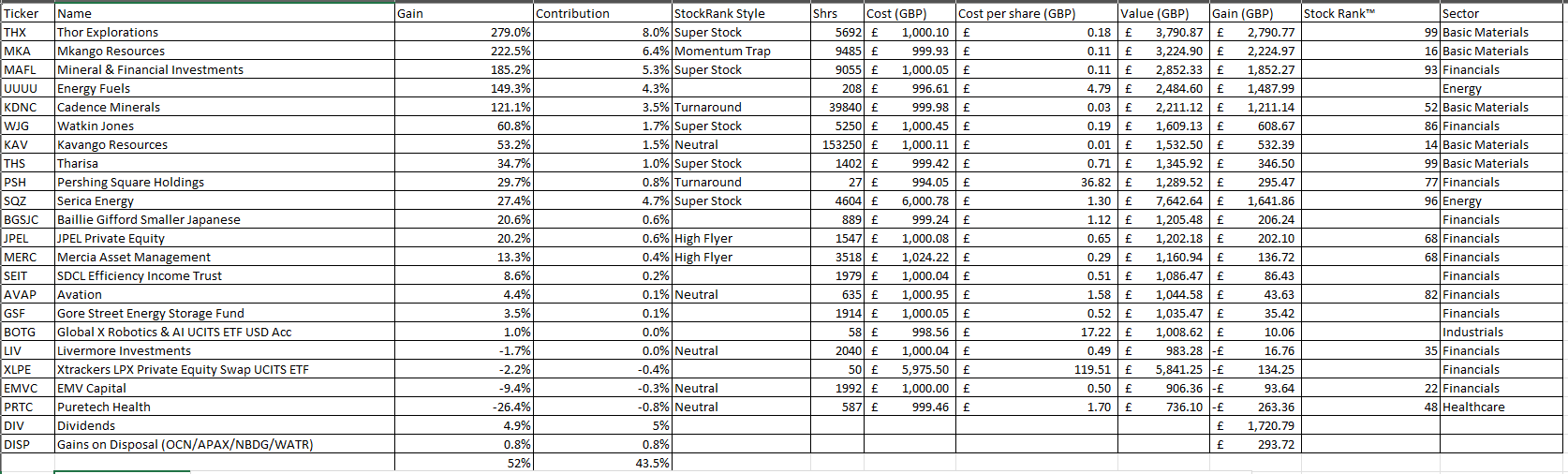

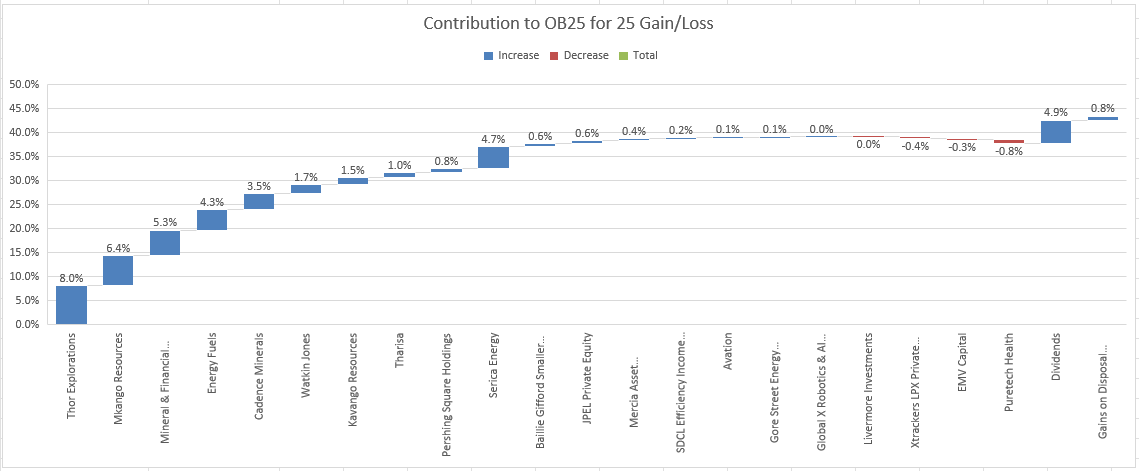

I’m heading off on holidays tomorrow and OB videos, podcasts and articles shall resume after my return 8th October. I have now updated all 2025 fun runners YTD (as of last night) and here are the results to yesterday eve the 23rd September - the 3/4 way mark, effectively.

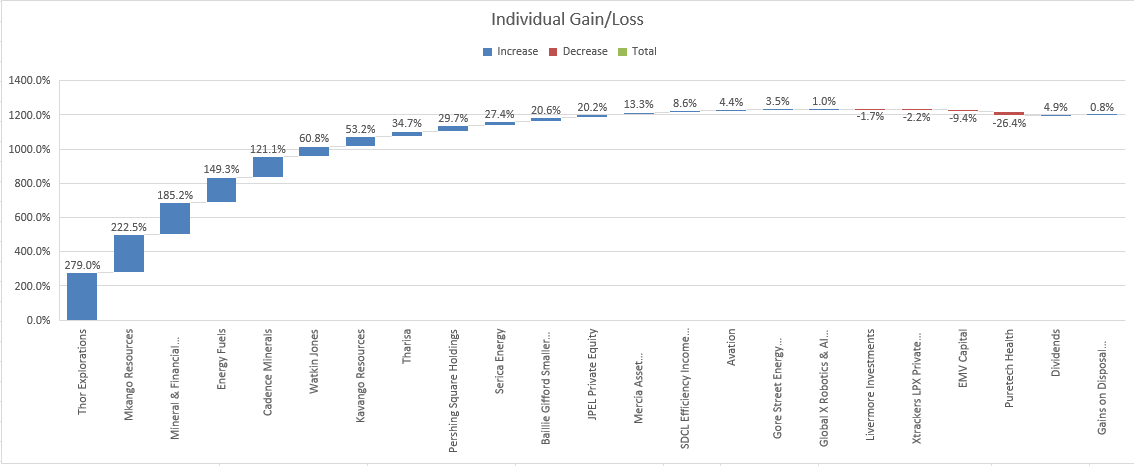

Gains are measured in percentage terms so the £15,179 OB gain YTD isn’t relevant - it’s the 43.37% gain is what is being counted here. I’ve also added the 2024 fun run (although crucially not updated for dividends etc) and we see some upsets there also, with Mr Scott in fourth place and Mr Archer is now race leader. I was hopeful to overtake Mr Scott, although I suspect in reality I haven’t because H&T has been bought out so Stocko shows that at Zero when in fact Mr Scott hasn’t been credited with the proceeds yet. Bah! I’m just kidding, I’m glad he remains ahead of me actually, he deserves it.

Calling Time

I’ve decided to call time on KDNC.

Cadence with a 121.1% gain is simply that I’m locking in a gain for race purposes. Personally, I continue to hold what is effectively now “free” shares having got back my initial stake. KDNC is now a £18m market cap and remains underpriced vs the £217m market cap at SVML. I hold a small amount of SVML, too, and both have tier one projects. It made me chuckle that Stocko promoted KDNC from a “sucker” to a “turnaround”. None of the OB25 for 25 are now suckers in their parlance and a single “Trap” style exists - while Mr Head’s near-uniform list of “Supers” have reduced in number during 2025 to neutrals and other styles. Interesting that even ideas like Yu which have lost -20% in 2025 are still “Super”. Perhaps that needs some closer analysis. Does the algorithm spot something that the stock market doesn’t?

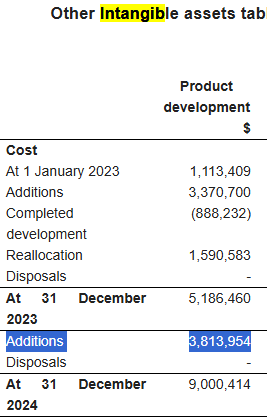

Earlier in 2025 I called time on WATR and it continues to decline in share price now down 20% at 270p, despite many people claiming it is destined for greatness. It caught my eye that the goodwill paid for franchises got posted as a $3.8m product development investment. Please explain that one. They reveal they sell OneStream at “preferred prices” but there’s no way of knowing what margin that is. I think “WATR let down” might need a follow up article at some point.

Meanwhile that loss selling WATR was offset by gains at NBDG, Apax (taken private at 165p), and I tendered OCN at 1543p and since it was below 100 shares all 100% were sold. I’ve since resurrected NBDG (personally not in the OB25 for 25) and since sold it again for a cheeky 5% net profit. So the OB25 for 25 still has 20 ideas running.

Commentary on the OB25 for 25

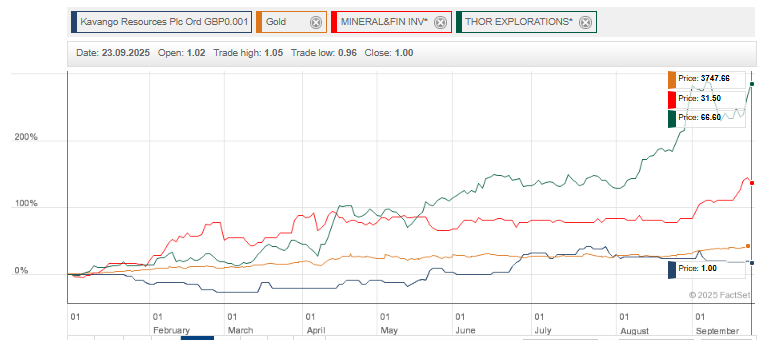

Thor with zero corporation tax, a low AISC and a gold price today at $3766, even today’s 66.6p remains incredibly cheap. Potentially 2.1X price/earnings where 2026 earnings could top 30p EPS. That relies upon a $3766/ounce gold price, 100koz production and an AISC of -$1,000. Not overly aggressive. What would be a fair target 6X earnings? 8 times?

Mkango and Energy Fuels at 222% and 149% gains were candidates for calling time, but the geopolitics and the US need for Uranium and REEs stayed my hand. Neither have really got started and you only have to look across to Guardian Metals to understand that US Government support is a matter of time.

MAFL by my recent calculations has achieved a 6p per share gain in its private portfolio since its last NAV at 31/3/25. I added more at 24p despite buying at over double the price I paid in late 2024 and now it is at 30p vs a 39p estimated NAV. But that’s before gains in its strategic portfolio and in fact even in its gold and silver bullion. There’s no way I’m letting go of my MAFL as I believe there’s much more to come.

I would call out KAV as an overlooked opportunity. Only yesterday it announced 8g/t results over several intercepts and at its level 1, 2, 3, and a new level 4 below the current mine shaft. See the picture below.

Consider KAV hasn’t even risen in line with Gold let alone MAFL or THX.

A reason for KAV’s misfortunate could be it’s marred by its own history, and another is dilution with shares in issue now at 3,609,823,314 on the back on ~$11.8m raised in 2025. Another factor could be the lack of a JORC resource (for now). But then consider the funds raised their use.

A company which is debt free. A 50 tpd operation at Bill’s Luck which began construction 3 months ago and required a 3 month build so commissioning will be announced any day now. The additional funds will enable a 200 tpd plant to follow at Bill’s Luck mine in 1H26. KAV have served notice to acquire Nara with this completing in December at a cost of -$4m.

I think the market is completely missing the strategic progress that’s been made and even that 250 tpd plant could achieve. At today’s gold price and assuming a generous -$1,500 AISC, 250 tpd at 8g/t would equate to an operating profit of $4m…. per month.

Even if it generates only a quarter of that that would be a P/E of about 5X post tax and overheads. Or if it can achieve $4m a month then that’s a P/E of about 1.3X. I feel optimistic that KAV - and its shareholders - will yet enjoy their day in the sun. I will write more on KAV after my hols.

Tharisa also appears overlooked relative to SLP and the 10X more (!!) expensive Valterra on a trailing P/E basis. THS remains on a deep discount to its book value at 0.53X vs 1.21X for SLP or 3.26X for VALT

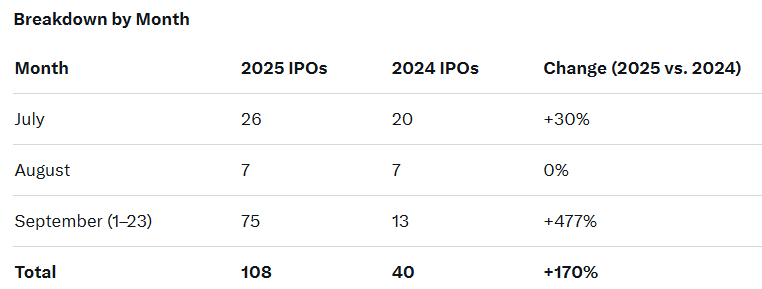

I’ll call out the two largest laggards remaining in the OB 25 ideas: EMV Capital down -9.4% despite closing a cunning deal with Destiny Pharma’s Insolvency Practitioner. The Interim Report is out on the 29th September and perhaps EMV will have more surprises in store. Could we see one of its holdings IPO? There is a definite thawing in the market with IPOs up 170% yoy - and mainly this month.

Just look at IP Group’s holding Hinge Health - up over 50%. EMV have several health techs which should take great encouragement from this.

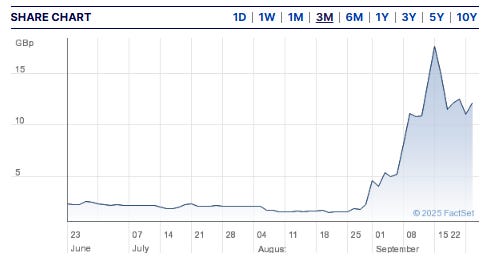

Finally I’d call out Puretech which dropped to £1 and following my “PRTC-e doesnt” article in early September is now at £1.25. I won’t repeat the arguments set out in that recent article but it strikes me that the level of buys, the notifiable activists which popped up on the share register, the re-nascent US IPO environment and when you see spiking interest in minnow companies like Immupharma which rose from 0.85p lows to 11.5p/12.7p today (via a 19p per share high) then you’ve got to wonder whether PRTC will fly upwards at some point. The IMM interim results show the company had £0.4m of cash and -£1.2m of payables as at 30/06 so its good fortune came in the nick of time. Its raised £0.15m via warrants since so it has barely any cash.

PRTC has 3 years of cash and likely more cash proceeds on their way via a possible float (and why not?) of its new founded entity Celea, the spin out of its LYT-100 programme which is awaiting FDA approval to progress to Phase Three and its re-spin of Pirfenidone could be a Total Addressable market for antifibrotics of >$10bn in the coming years. It demonstrated strong Phase 2b results so there’s every reason to think it could progress.

The market is valuing PRTC at its cash assets and nearly zero for its potential - even its CONTRACTED income from Bristol Myers for Cobenfy.

Thoughts on 2024

Ideally I’d also cover those given some large news items today from TEK, PINE and so on. But also to delve into the “upset” to the race order where Mr Archer is the post-period Gold Medallist.

Congratulations to TEK-kies on a rise to 9.5p bid, and perhaps I should have held on for this higher price. Called time later. But I don’t have any regrets. The proceeds went into new ideas like ASA International that reported storming numbers today and which are cash generative, and have risen just as much as TEK, in fact more so. The difference is TEK is not cash generative but booked a paper profit. The question is can it turn to paper to cash? Will Guident capture the imagination of US stockholders? Or will they ask the question: How is it that all the major autonomous vehicle developers have developed their own means to be the human in the loop. So where does that leave Guident in a market where the winners take most and the plucky Estonian and Spanish start ups remain peripheral.

I’ll leave it there for now. Time is always short, although I would love to write an update on ASA International later today if I can. Perhaps it will be a Podcast or a YouTube video - it’s a multimedia experience with the Oak Bloke!

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks OB for all your output, wishing you a great holiday, very much deserved. Hope you manage to switch off from company news for a while, but suspect not! I look forward to a refreshed Oak Bloke from 8 October and beyond.

Congratulations, particularly on ASAI. Only a managed to acquire a few on what I consider one of your best ideas and have no intention of selling. Will be making a small (interim) donation to your fav charity later today.

Have a great hols.

Fluff