Dear reader,

Gold blasting through $2,100 today and the increasing likelihood of interest rate cuts, made me want to re-consider gold-mining shares i.e. Gold Producers. But which to choose? In my HOC-key article, a reader suggested comparing HOC to other gold miners, and this set me thinking.

I embarked on a game of top trumps but quickly found it’s not all that easy. Hours of poring over various company accounts, to try to get comparable results. Some P/Es are based on results several months old, others have a forecast P/E.

Is it possible to find a single Gold Stock which beats all others?

Here’s the result of my investigation:

I’ve included shares I hold, as well other choices. I chose some that have previously been recommended to me, and others which are “big and famous” and listed in Canada/USA. What was more difficult, was to compare the future outlook, growth and profitability when inevitable uncertainty exists.

Caledonia (CLDN)

CLDN based in Zimbabwe, this was an ultra low cost mine for years. Last year it bought Bilboes. Baker Steel was one of the owners therefore sellers of this privately-held asset. Baker (ticker BSRT) received shares and a NSR of 1% over Bilboes. CLDN’s Blanket mine is producing, while Bilboes mine is in development with a revised mine plan as they didn’t like the one that came with the mine. Meanwhile Maligreen is pre-development and Motapa early stage. Motapa is adjacent to Bilboes so there are substantial synergies to this. CLDN has provided a strong yield of over 5% for a number of years and while the AISC of $1,268 has grown higher recently and is forecast at $1,380-$1,480 in 2024, this should reduce again as the LoM plan changes. While CLDN has a number of pluses, the growing AISC feels like a real negative, although this is potentially a short term factor as I know Bilboes has a DFS for a $1000/oz AISC mine.

This morning’s negative trading update based on higher labour and electricity costs is disappointing - but “another” short term factor, maybe.

Metal Exploration (MTL)

MTL has been a huge success with phenomenal cash flow, an extremely low P/E and is now on the cusp of being debt free with 3 years of mine life remaining. It’s already bought new concessions at Abra in the Phillipines and is rapidly seeking to develop those which I covered in Baked In. The forecast AISc is due to grow to $1,275 - $1,375 in 2024. Its forecast fair price is 4.25p which offers just 10% upside but that is at a DCF based on $1,580 gold, so is of limited relevance.

Serabi (SRB)

This is a gold (and potential copper) miner in Brazil. My thoughts on this were a very high AISC I felt was offputting but its cash flow is strong, as well as its price/book. Management tells us in their presentation that the AISC is forecast to reduce to $1,400/oz “in time”.

I struggled to find an attraction for Serabi, today, even though it is forecast to improve. Tamesis tells us it has replenished its reserves at Palito and derisked its production growth. It tells us that FCF yield should grow and AISC should shrink sub $1300/oz leading it to a PE of just 1.9X justifying their price target of 75p. How does the AISC shrink further than what management tell us it will? Answers on a postcard, for that one please reader.

Pan African (PAF)

PAF is a South African and Sudanese Gold Miner with several operations. The 146 years of resources struck me, and the growth struck me next. I can see how this is well liked and it scores decently on a lot of criteria. Being picky and knowing how much trouble has existed for South African mines with power availability, strikes, industrial action etc there is a political risk element - but certainly too for Hummingbird, Caledonia, Hochschild and even Centamin.

Centamin (CEY)

Certamin is a single mine in Egypt and a humdinger of a mine. It is currently exploring new concessions in Egypt and Sierra Leone. It moved from a contractor stripping to self managed operation and that has improved the AISC and other investments such as solar power has helped too.

Overall a strong option with the largest production outside of the US monster duo. It also is in a relatively stable political regime, Egypt, although that point could be debated.

Hochschild (HOC)

I’ve covered this share in several prior articles, and lining it up against its peers it doesn’t show any top trump characteristics.

I’ve stripped out all the silver (40% of production) from the reserves and production, but not the PE calculation, but also stripped out what it calls its growth projects (like Volcan) since I know these are years away from any meaningful production and are up for sale. If I’d included them the AU Eq. makes this one actually the largest reserves.

The mining regimes of Peru, Argentina and Brazil are currently stable but Peru has been challenging in recent years and Milei is a wild card for Argentina (but possibly a positive - too early to know?).

I re-ran my HOC profit model given that the gold price is now at $2,125 and Silver at $23.80. I found forecast profits rise by 20%, and in fact for every $11 increase in the price of gold or 12c on silver HOC adds a further $1m to net profit.

Newmont/Barrick

I’m not going to seek to describe these in detail but these are the largest players in gold mining, I think. Also heavily weighted if you hold any kind of gold mining fund/ETF/IT.

But you clearly pay a premium to hold them, comparatively.

Hummingbird (HUM)

The final one I picked at the last minute was Hummingbird. This now has two producing mines in Mali and Guinea with 51% of a third project in Liberia at an exploration stage. Again, this carries political risk with Wagner group present in Mali, political insurrection in the region and past disappointments - I remember seeing its AISC hit nearly $2,200/oz at one point! It also comes with high debt and 2023 was touch and go - but they achieved funding, just. On several metrics it is incredibly cheap e.g. 30% discount to NAV - therefore tempting.

Early Stage (POW)

POW - Power Metals has a number of gold plays in its portfolio albeit at exploration stage both in its own portfolio and via its holding in GMET and FDR. I’ve chosen to limit my choices to actual gold producers, but explorers would do well where gold prices rise (since the forecasted DCF rises).

(It deserves an honorary mention)

Conclusion

Does the security of Newmont/Barrick tempt me? No, not really. But I can see how others with other investment objectives would want that.

Does the cheapness of MTL and HUM tempt me? Sure! But MTL depends on its Philippines success and HUM on staying the course but also on factors outside its control. CLDN on a day where it announces a disappointing FY2023 trading update, is not on my buy list - at least directly. I’m happier to hold BSRT which holds MTL (3.1%) and CLDN (4%) but also a future NSR worth 5.2% over CLDN’s Bilboes mine.

For Serabi, my eye gets drawn back to the high AISC, although the cash generation is a positive, surely that must change with only 5 years of reserves. What does Tamesis see that I don’t? Perhaps I should study it more closely.

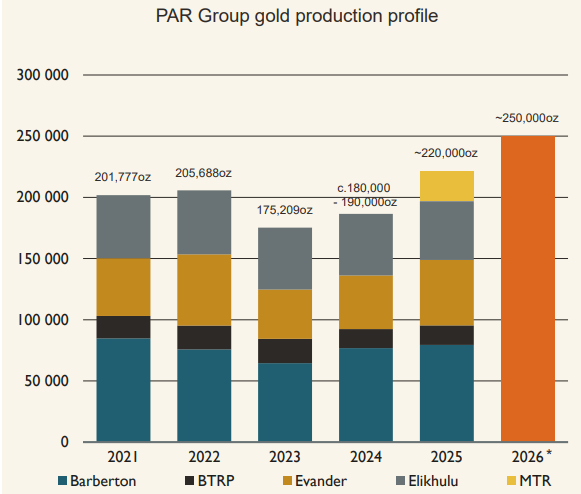

PAF looks a decent play as well and its PE is a third of its peers, Newmont and Barrick, although the political aspects and challenges of South Africa do attract a health warning too. For example I know electricity costs have risen fast in 2023. The production growth they forecast to FY2026 could make this extremely attractive.

HOC is a recovery play, with new leadership, and growth plans, given the environmental approval for extending its Inmaculada mine, a first pour of its Mara Rosa Mine, in Brazil, and although it’s outside this “gold” article, the silver production from HOC may one day put this in the limelight and offers some advantages. Silver is at $23/Oz today but its past high was $50/Oz, and “should” be doing well as a transition metal for achieving net zero. There are a few such metals not reaping the Net Zero premium right now.

Surprisingly (for me) I conclude Centamin which trades at less than half it reached in 2020 (about 94p today vs above £2 a share in 2020), actually comes out my favourite and far stronger than I’d expected.

It has cash generation, exploration upside, dividend, half the price (vs earnings) of the big boys, large reserves a low AISC, and a management team under Martin Horgan who appears to be a strong, capable leader. PAF outpaces it on a PE and reserves basis, possibly a growth basis too, but CEY offers a number of advantages in its overall characteristics and - to my mind - Egypt as a jurisdiction is preferable to South Africa - touch wood. Am I tarring the South African brush too heavily from negative experience at other SA shares like Jubilee and Bushveld - yes, probably. I know some readers are going to provide a strong counter why PAF beats CEY, so I look forward to their thoughts and comments also.

This is not advice

Oak

Polls only allow 5 choices so I’ve grouped them according to style:

Appendix: The Lyrics of Goldfinger, as sang by Shirley Bassey, copyright Sony.

Goldfinger, he's the man

The man with the midas touch

A spider's touch

Such a cold finger

Beckons you to enter his web of sin

But don't go in

Golden words he will pour in your ear

But his lies can't disguise what you fear

For a golden girl knows when he's kissed her

It's the kiss of death from Mister Goldfinger

Pretty girl, beware of his heart of gold

This heart is cold

Golden words he will pour in your ear

But his lies can't disguise what you fear

For a golden girl knows when he's kissed her

It's the kiss of death from Mister Goldfinger

Pretty girl, beware of his heart of gold

This heart is cold

He loves only gold

Only gold

He loves gold

He loves only gold

Only gold

He loves gold

The most interesting aspect of gold stocks is that they have languished while the physical metal has traded in a range near all time highs. The leverage in miners when the public rushes in will be awesome.

My top pick for Tier 1 assets in Tier 1 jurisdictions with (relatively) low AISC(CA/US) is AEM. Top pick for a high growth junior is KNT(CA) in PNZ. Top pick for a potentially high growth developer is IAUX(US). For segregated physical gold, I like PHYS(US) held direct custody in the Canadian Mint. I own quite a bit of all 4, especially AEM.

Did you consider RSG for this article at all?