Dear reader,

A vast chorus of harrumphing could be seen on the chattersphere yesterday as Cadence raised £1m at 1.5p. The New Zealand rugby team would be impressed, no doubt.

Did Oak Bloke readers harrumph too? Perhaps not if they read my “1 to 100” article which set out to brace for massive dilution… and to imagine the worst Dragon’s Den experience yet.

Even with yesterday’s dilution this idea still holds vast potential - if it completes. My calculations are that Amapa is still worth £1.83 per share based on the Net Present Value (down from £2.38/share), and that assumes the 34.6% ownership hasn’t increased - and it probably has.

In fact eagle-eyed readers might have pounced because at today’s 1.6p buy price you are getting Amapa for about 1/3rd less per £ invested than back on my article of 4th December EVEN AFTER today’s 23% dilution! As seen above my calculation are you’re getting £150 worth of Amapa for every £1 of shares you buy today vs £97 per £1 2 weeks ago.

In other words the drop in price is disproportionate to the dilution.

Besides yesterday was a curve ball.

Why raise £1m? Was it because Amapa needed £1m? Not really. “General working capital” was needed but the use of funds is for the potential 40% investment into Hesperian. More on that in a bit.

What about to pay back the £850k owed starting from March 2025 at an estimated £120k a month (inc. interest) until November?

It’s true the loan needs repaying (assuming it can’t be refinanced) but KDNC could elect for repayments via the issue of shares and dilution at the 5 days average price (which would’ve been 2.7p a share if not for the raise).

So why?

Amapa awaits its “LO” or installation licences.

That £1m is not to have a jolly and pay themselves fat salaries. Least that’s not been case until now.

So why?

Letter of Intent to Acquire up to a 40% stake in the Pompeya and Sarzedas Tungsten, Antimony and Gold Exploration Tenements, Completion of £1 million Fundraise and Investment Updates

Think about this logically. You are about to close a huge deal, called Amapa. You are nearly there. Cash is short. You and your two co-Directors own 8.8m shares or 3.9% of the company. You raise £1m and dilute yourselves down to owning 3%. Crash the price to 1.5p. Why? A dramatic act of self flagellation?

There are three “facts” or “likelihoods” in my opinion.

Amapa could be a done deal from a financing point of view. I really struggle to think that the Directors would have taken on a new, albeit not fully committed yet, to this Hesperian JV without this. Yes, we need to wait for the “LO” but once that happens I don’t believe there’ll then be prevarication or uncertainty on the lending. Common sense suggests there “should” be a queue of Dragons keen to fund this Tier 1 and (once fully permitted) de-risked mine project with excellent economics.

Yesterday’s RNS shows I believe the Directors are planning for life after Amapa. This is based on little things said in interviews in 2024 like “we are an investment company”.

The prospectivity of this new opportunity is extremely good.

Consider that Tungsten is on average 0.0015% of the crust. Yet samples are returning 220X - 320X that concentration?!

Those sample levels are insanely good. For example levels of 4.8% Wo3 assuming 100% recovery rates equates to a mining operation of just 28.5 tonnes of ore per day. I mean you literally could do a Gold-Rush-esque 2 people, a small trommel and a digger and a toothy smile and smash that number.

But for now they are just samples. They are the big nugget waved in front of a prospective investor to tempt them in…. but it is tempting.

Eagle-eyed readers will also know (and have connected) from reading “Tungsten just got tougher” that Western production of Tungsten is inadequate for the west’s needs and reports tell us China the majority producer has placed restrictions.

Almonty’s Portugal Panasquiera Tungsten mine is mining grades 30X less rich than 3.3% yet is achieving a $2.8m operating profit which is due to grow to $16.8m post extension (Almonty tell us). That profit, reader, in 2024 was selling at an average $290 per tonne - Tungsten today is $390 a tonne. So that would’ve been a $7.4m profit at today’s $390/tonne - or the extension would generate $29m a year based on $390 prices.

So a potential neighbour is vastly profitable.

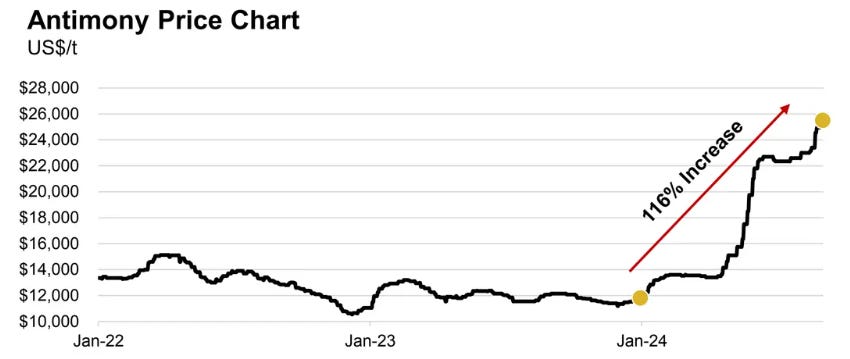

We know that Gold prices are high at $2650 Oz but Antimony is $26,000 per tonne. There are also restrictions on Antimony from (you guessed it) China. So there is an antimony opportunity plus what if Tungsten increases like Antimony? Increases to $1,000 a tonne or more?

Couldn’t happen? You don’t know your history. You don’t know the demand requirements for these minerals.

Also I spotted reprocessing waste dumps is a far cheaper affair than mining. And with 109.9g/t and 30.9g/t samples of gold, again, these are incredibly encouraging numbers!

Gold at $2,650 per ounce potentially heading higher in 2025.

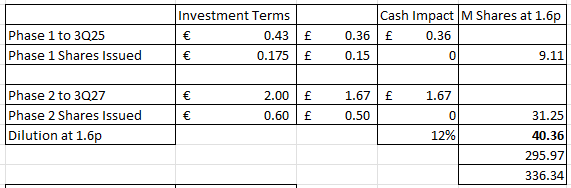

So if after due diligence KDNC proceed in 1Q25 with Phase 1 then £0.36m and 9.1m shares (at today’s low price) is the cost - at today’s 1.6p share price - which could be seen as a worst case price.

If KDNC continue in 3Q25 with Phase 2 this boosts ownership of the assets to 40% and involves £1.67m plus more dilution.

40.3m shares for Phase 1 and 2 equates to a further prospective 12% dilution* and the £2m spend if capitalised means a £1.2m net spend to buy in (since KDNC will own an asset worth £0.8m).

*12% dilution at 1.6p or say 2% dilution if the share price is 9.6p in a few months time following future news flow…..

If KDNC is flush with cash post Amapa, it also seems reasonable to think further favourable terms could be obtained to increase the percentage higher than 40%.

Conclusion

My take on the news is that the very fact a new asset is being brought in to the mix suggests Amapa is further forward than we think - it’s the logical explanation (unless you do think the BoD have simply gambled and diluted on a whim)

But also that at 1.6p the logical way to look at the assets is the ROI of buying in just increased - even considering the dilution at that 1.5p price point - and that’s before you consider the prospective upsides of this new JV. A jovial way to look at the news might be leaving comments on the article like “oops” and a “40% off sale”. A calculating way to look at the news is to consider the high risk vs the high(er) reward.

Specifically, shareholders according to my calculations have “lost” 2.8p per annum of income from Amapa for 13.5 years (of undiscounted profit) assuming we also lose 70% of our 34.6% holding plus pay 10% interest on borrowing the 30% of the Construction Cost (Zero Carry) so have to borrow the value of our 30%, and pay that too will be repaying that for the first 18 months of Amapa’s operation.

On a per share basis the £1m dilution means 2.8p per annum income loss. And that means undisounted Amapa will deliver £1.21 per KDNC share instead of £1.57 per share over its lifetime. This is still one heck of a return for a share you can buy for 1.6p!!

And guess what? You need to consider whether that £1m dilution gives us extra cash that makes those harsh financing terms potentially less harsh. Also whether that £1m increases the 34.6% ownership higher (potentially £1m expenditure equates to a ~1.2% higher ownership to 35.8% ownership which would equate to 6.3p per share gain based on the NPV of $1,977m diluted by 297m shares)

You also need to consider what lifetime returns 40% of a series of Tungsten, Antimony and Gold mines in a safe jurisdiction could potentially deliver too? Is hoping those mines and mine dumps could deliver 36p per KDNC share earnings over their lifetimes a hopeless aspiration?

You finally have to weigh up the minds (and pockets) of the Directors and then you can judge this appropriately.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Sorry, forgot to say - Oak Bloke - fantastic deep analysis on this one.

With it now being into February '25, what are other people's thoughts on the timeline for the necessary licences and financing?