Introducing Guident - Part of TEK Capital

An Oak Bloke Top 20 Update

Tekcapital owns 100% of Guident, which owns 91% of Guident Corporation, its US subsidiary.

In a 22nd December RNS we learn “Guident ltd intends to accelerate growth of its Software as a Service (SaaS) Remote Monitoring and Control Centre (RMCC) solution that is currently generating recurring revenues. The Company has engaged a leading US investment bank, Paulsen Investment Company, to raise capital for expanding its RMCC business. In addition, the company plans to conduct further testing and appraisal of its proprietary Regenerative Shock Absorber technology after completing successful trials with a tier-1 tire company.”

When a glass half empty person reads that - they see “Dilution!”

When I read it, I immediately think expand it to who? (See Customer #3 later on)

About Guident

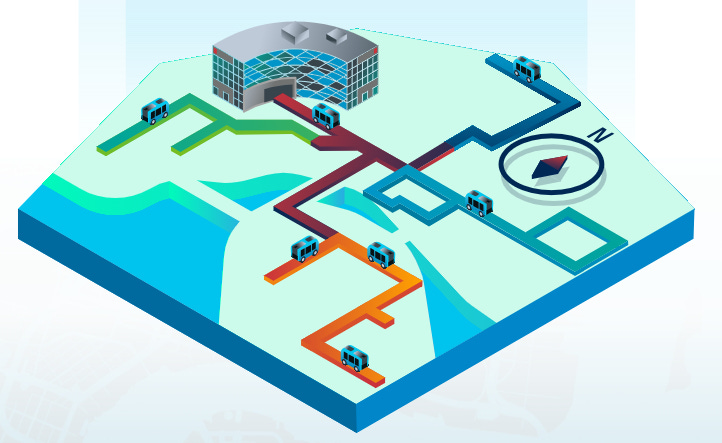

Guident’s mission is to improve the safety and efficiency of autonomous vehicles, robots and land-based delivery drones with a software platform for remote monitoring and control.

Their services are designed to ensure safety and offer real-time communication with passengers and pedestrians. The company holds a portfolio of seven patents and boasts a world-class team, providing competitive advantages to AV fleet operators in the public and private mobility markets.

(NB: Reader, I know the above RNS mentions the regenerative shock absorbers but this is now a separate subsidiary company to Guident called ReVive so I will cover it separately)

Customer #1 Jacksonville Transportation Authority - Public Transport

You can learn about JTA’s AV program at this link, which describes a 3 phase project 2023-2026 where phase 1 is awarded and underway, phase 2 worth $240m is being tendered for now, and a phase 3 is covered too. $240m includes the vehicles but it’s not unreasonable to think the contract for Guident is worth $300,000 per licence + $10,000 Per Seat to Guident per year. Based on 198 vehicles you’d man that with 4 seats maybe? So $340k a year (With perhaps 60% margin?) equates to EBITDA $0.2m/year - this is assuming Guident provide SaaS and the JTA themselves man the desks with people.

(I had initially assumed Guident running a kind of call centre of their own and manning it with people then managing different organisations’ vehicles, robots and drones for them. But they more recently speak of a SaaS model, so this suggests customers self manage their own autonomous vehicles.)

This is the Jacksonville 3 phase plan over the next few years. A key point however is you would need to switch on and begin paying of Guident early on in any project - at the point the vehicles are supplied. So the fact these projects take years doesn’t mean Guident faces lengthy delays to earn SaaS revenues and implementation fees after a purchase order’s been given.

Video 2: JTA showing leadership around AVs You’ll notice the CEO and the partially sighted gentleman who appeared in the above video appear again here. Watching the video clearly the JTA see being a leader in AVs as an area of great pride and kudos.

Is the JTA unusual? No, Houston, Las Vegas, Connecticut all have programs too. But JTA is one of a few leaders. And where one leads, others will follow. There are 7 other transit authorities in Florida alone. Moreover there are 1,500 members of the American Public Transport Association, reader and 6,800 organisations providing public transit in the USA. There are 300 cities in the USA with above 50,000 population, so even just a 10% share of these at an average EBITDA $0.2m a year could equate to $6m-$12m EBITDA a year for Guident. Just from 10% of Public Transport in large US cities. $30m annual revenue to safely automate 30 major city transportation systems is a drop in the totality of US public transport operational expenditure.

Public Transport is funded approximately $75bn/year by the US Government. $50bn towards operations and $25bn on capital expenditure. Fares from travellers generate a further $25bn per year. There is a similar set up to the UK where people on low incomes get free or reduced cost travel and Senior Citizens travel for free.

Customer #2 Boca Raton Innovation Campus - Private Transport

300 miles to the south lies Boca Raton. It is one of 4,000 US University Campuses. It has signed a letter or intent.

It’s still undergoing testing - and hasn’t progressed (as far as I can tell).

But again, these Universities speak to one another and where one leads others follow. There are 4,000 campuses in the US alone, and add in the number of government and large industrial premises where a private transport option is desirable. 20,000-30,000 in the US isn’t an unrealistic number.

Customer #3 “European Partners” for fixed-route electric bus services.

Does anyone realise the significance of the 22nd December RNS?

The market doesn’t.

Electric buses are growing rapidly in Europe.

But these “European Partners” I believe are going to be those involved in the AV programmes in Switzerland, Germany, Norway and Spain.

How do I know that? Well spot the AV - does it look familiar? And read the World Economic Forum web site too.

Guident’s Partners - per the Guident Christmas newsletter.

Guident has three partnerships. Partnering will rapidly grow Guident’s footprint in 2024 and 2025 - where these lead through the provision of AVs or retro-fitting AV technology to vehicles - Guident’s “in the loop”, so to speak. Guident de-risks the technology and its monitoring gives a no brainer value add service. Just look at what Guident could be hopping on to:

US-based Adastec is actively in Norway, Sweden, Turkey (with a Turkish AV manufacturer supplying into all of Europe) and Romania

Auve Tech an Estonian AV Manufacturer providing hydrogen powered vehicles in Estonia, Japan, Abu Dhabi,

Perrone Robotics an Intel-backed AV and Robotics Manufacturer working with

the University of Wisconsin, Virginia Tech, Johns Hopkins University, University of Hawaii, University of Virginia, Eastern Michigan University, and Drexel University as well as Houston Transit Authority

So now we know the significance of the fundraise in the 22/12 RNS. 2024 will be establishing sales into Europe and growing SaaS revenues. There are 12 times the number of buses in Europe compared to the US, and there are 2,706 University campuses in Europe. Plus probably another 20,000-30,000 private transport opportunities across Europe.

What about MORE Upside? Surely not!

But what if the opportunity for Guident is FAR FAR bigger than the 75,000 or so customers so far discussed?

What if Guident had a patent over DRONES and ROBOTS too?

Er, but yeah, but no, but yeah, but….it does.

“THE” PATENT

Guident received a Notice of Allowance in June 2023 (aka it’s been GRANTED reader) from the United States Patent and Trademark Office for its patent application related to remote monitoring of vehicles, robots, and drones. This significantly expands its patent portfolio in the secure and safe operation of autonomous vehicles within the human-in-the-loop concept. The new patent describes an architecture and methods for near real-time, intelligent monitoring and controlling of AVs and delivery devices fleets. It includes an in-vehicle intelligent monitoring and controlling device that predicts, detects, and reports incidents to a Remote Monitor and Control Center (RMCC) and provides real-time assistance services to passengers, while a human-in-the-loop supervises the AI applications.

Do I have to put up a WILL SMITH and SONNY the Robot picture or maybe an ExMachina picture to make my point?

Instead, I’d like to show you how close humankind is to experiencing robots in their day-to-day life i.e. that aren’t a fixed arm in a factory. This next video is the best way I know how to do this.

Boing!

I can’t paste in the next video but here’s a link - 10 ROBOTS for 2024 - the Tesla robot is one of the 10. All are due to be released in 2024.

The point I’m trying to make is that Science Fiction is quickly becoming Science Fact and 2024 - I believe - will be a big turning point in the topic of robots. Go and google it, if you doubt it.

But at some point soon, we will say, hey, how do we control these robots walking about? What happens if they start glowing red? How do we override them?

What is the value of the kill switch reader?

Or will the world just rely on Asimovs 3 laws of robotics?

Unmanned Aerial Vehicles (Drones)

What’s the difference between a robot and a drone? Nothing. Legs versus Propellers and wheels.

We think of Drones as flying. Robots as walking. But an insight from years ago was Musk saying Teslas (i.e. Tesla cars) are just robots on wheels. Assuming we continue to make this distinction of drones (flying and driving) and robots (walking) as having 2 different names then it’s useful nonetheless to think that the underlying autonomy technology is evolving largely in tandem. There is some additional complexity with flying.

Guident is very well positioned to help with this brave new world.

Assuming I’m right about the value of the first customer - JTA - and its 198 vehicles generating for Guident $0.2m gross earnings a year and asuming $10m/year overheards there’s a breakeven point probably in 2024 with a forward PE in 2025 of perhaps 9 and then a PE of 1 in 2026.

If you have already read my “Is Cliff doing a Cliffhanger” prior TEK article this chart is familiar. I’ve updated it with current prices but - critically - I previously assumed Guident to still only still be worth $18m in 2025 (whilst speaking to potential geometric gains in all TEK’s other holdings)

Having written this article, an $18m valuation now feels very conservative. On a forward PE 2026 of 1 the 2025 valuation would be 15X today’s $18m. A PE of 15X itself is conservative if its achieving rapid growth. Guident quote a CAGR of 83%.

What are you worth if you’re essential in a $445bn marketplace growing at 83%?

But on top of this how do you value a technology which gives humans a kill switch in real time? That’s what “human in the loop” is after all. Taking the TAM of 75,000 at $0.2m average per customer is a $15bn EBITDA long term theoretically (for Europe and the USA). But add to that robots/drones in their thousands, growing to millions, growing to billions. Once automation is accepted, it will rapidly grow far faster than just safe guarding AVs for Public/Private transport. Look again at the Boston Dynamic robots video, and how they have developed year by year and tell me I’m wrong.

If Guident is still only worth $18m in 2025, I’ll eat my Paddy Ashdown Hat.

Final thought: buy Guident in the New Year half price sale

(and I’ll bundle in 2 businesses for free too)

TEK is a £11.6m market cap i.e. $14.8m. Excluding BELL and LUCY (at their publicly listed values) you can buy Guident (via TEK) today for $9m i.e at a net 4p a TEK share. (And get Microsalt and ReVive for nothing)

(Today is the 2nd Jan and even as I write BELL is up 12% so you’re getting another $0.5m off Guident today, so $8.5m not $9m)

RI-DI-CUL-OUS!

This is not advice

Oak

Great Read

That was an excellent write up and you've been proven correct... so far! Which = it's not 1/2 price now!?