Dear reader

Predictions are old funny things.

Soon as you hang your hat then you’re under pressure to come up with the goods. I wonder what the sickness rate is for Gypsies with Crystal Balls? The stress of successfully predicting stuff to earn a crust must be pretty awful. Even if you’re successful, things don’t get much better as Cassandra would tell you.

Consider that in my 1st article POW in December 2023 when at 15p (equivalent) I said POW was “astonishingly cheap” and “I can see 2024 being very interesting for POW”. 2024 came and went and POW remained “astonishingly cheap” and POW remained interesting to the OB and to few others (judging by the share price).

Fellow writer Mr Archer wrote similarly in November “it will recover soon. This is the low.” POW was at 13.5p. It wasn’t the low. It since has dropped to an ask of 12.475p, and I know that because I’ve been buying - hoovering - more at that price.

Meanwhile against the Mining Index POW has underperformed by nearly 50%.

So is the future different this time? Let’s contemplate that. Let’s make new predictions.

The disconnect with POW and its listed holdings is one interesting aspect of 2024. When you consider the newsflow since 01/01/24 POW has made great strides in proving its valuation.

GUARDIAN (GMET)

Consider that its holding GMET has delivered £9.22m cash to POW recently. How? A partial disposal of shares at 31p each.

That disposal still leaves POW with £9.88m of GMET shares and a 19.44% ownership of triple bagger GMET.

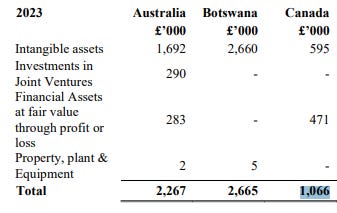

POW’s 30/09/23 accounts show GMET as worth £5.58m. The 31/3/24 and 30/09/24 accounts show gains of FVTPL (fair value gains) of £6m and I’m chalking those gains 100% to GMET. That gets me to £11.58m. Deducting the cash proceeds of £9.22m plus the remaining GMET shares held worth £9.88m that is a £7.52m GAIN post period (from 30/09/24 and as at 21/3/25)

Post Period we also add £4.2m for FERMI (the FVTPL gain of a JV funded with £10m from ACAM) so that gets us to a fair value NAV of £30.24m or 26.15p per share.

That means POW is trading at 28% discount to NAV per the 30/09/24 accounts or a 51% discount considering the post period FERMI and GMET gains. Since GMET, FCM, RRR and AAJ are all listed if you liquidated those into cash then the remaining portfolio would be less than free.

Incredibly at a 116% discount - for every POW share at 12.75p you’d get paid the equivalent of 14.75p cash - and still be left with its other holdings.

Will Guardian go higher?

Some say certainly. Tungsten is a critical metal and Donald Trump is encouraging the production of critical minerals - although nothing is yet announced specifically for GMET.

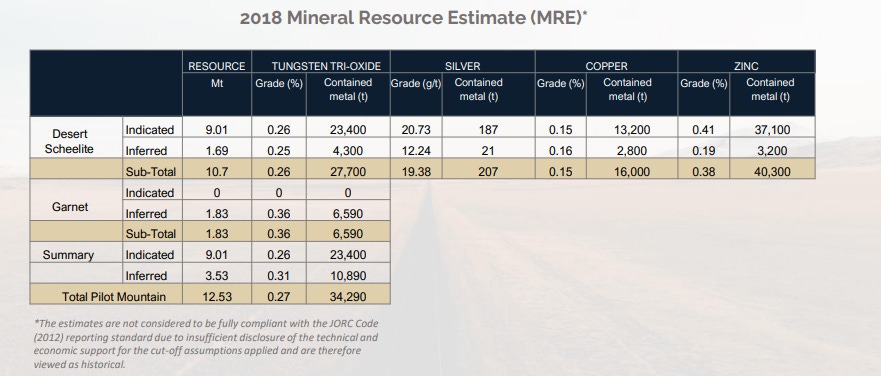

GMET’s pilot mountain project is polymetallic and has Zinc, Silver, Copper, Molybdenum and Garnet too. Drill results do look very promising.

Plus it now has the Tempiute project too. Bought for a song. Yet its 2003 report valued the infrastructure at $17.9m and multiple workstreams are ongoing to assess advancing Tempiute, as well as assessing its tailings for possible reprocessing. The existing infrastructure, including but not limited to ore loading facilities, mill & concentrate buildings, foundations, load out bays, and water pipes & pumps, were evaluated and are considered usable for potential future operations. Potential co-products of copper, zinc, silver as well as gallium and germanium at Tempiute are also all being investigated.

The problem I have with the theory that Tungsten is about to go nuts is why aren’t Chinese Tungsten producers going up in price? CMOC for example, below. And why isn’t Tungsten’s price per tonne going up either? As at 21/3/25 it is $25.2k per tonne according to the Shanghai Metals Market. Nothing to see here says the market.

That doesn’t mean it won’t happen - but it does mean apart from bullish sentiment about the possibility, the actual restriction of Tungsten is NOT IN THE PRICE yet.

STOP PRESS: but will this Executive Order released last Thursday change that?

How will POW spend its £10m cash?

1. An IPO for FDR?

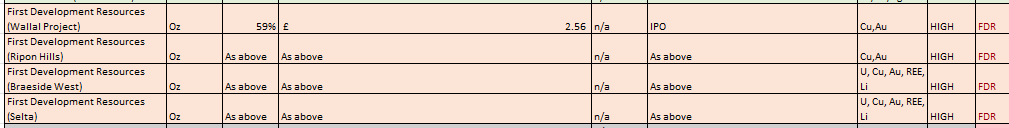

Will we see an IPO for First Development Resources? Its Australian Copper/Gold and Uranium/Rare Earth holdings listed on the ASX could be a great success. The land rubs shoulders with various majors and you can see their presentation here.

2. Direct Projects?

Let’s consider its direct projects Silver Peak, Molopo Farms and Tati Greenstone

2a. Silver Peak Project

Silver Peak has had to activity since September 2021, when Power Metal completed a 588-meter diamond drilling program across 10 holes. Results confirmed high-grade silver, with highlights including 0.6m at 5,625 g/t silver (181 oz/t) and 0.6m at 2,443 g/t silver from the Victoria Vein (RNS, September 24, 2021). This validated historical grades (500–658 oz/t) and near-surface potential.

With Silver at $33/oz then potential for nearly $6k/tonne of ore is equivalent to a gold find at 56g/tonne - a bonanza!

27/03/25 - POW announce a potential sale of its 30% holding at C$10k up front and $320k until March 26 - that’s worth £0.18m, rising to £0.2m or £0.22m if exercised in 2027 or 2028.

2b. Molopo Farms Complex Project (Botswana)

Status: Molopo Farms is a flagship project for Power Metal, targeting a district-scale nickel-copper-PGM discovery in southwestern Botswana.

Power Metal holds an 87.71% effective interest after acquiring a majority stake from Kalahari Key Mineral Exploration (KKME) in 2022, becoming the operator. Exploration focuses on steeply dipping geophysical conductors within the Jwaneng-Makopong shear/feeder zone, with drilling ongoing to test massive sulphide potential.

Last Updates:

March 19, 2025: Power Metal reported progress on its latest diamond drilling campaign, launched in Q1 2025. Drill hole DDH1-14C at target T1-14 (700–800m depth) intersected ultramafic rocks with visible sulphides at 650m. Assays are pending, but this builds on prior success—e.g., 2022’s DDH1-6B hit 14.7m of nickel sulphides (announced October 20, 2022).

January 2025: The company secured a drill contract for T1-14, identified as the highest-priority conductor after 2024 ground audio-frequency magnetotelluric (AMT) surveys refined targets (RNS, January 15, 2025). This followed a £1.3m strategic financing in late 2024 to fund the push.

Earlier work (2020–2023) identified multiple conductors (e.g., T1-6, T2-3), with assays like 0.6m at 1.69% Ni and 0.55 g/t Pt from T1-6 (2021). The current focus is on deeper, larger-scale targets.

Current Outlook: Molopo Farms is in active exploration, with high expectations for a significant Ni-Cu-PGE find. Drilling continues, and assay results expected in Q2 2025 could be a catalyst. Power Metal’s managing inbound interest from potential partners, per a March 2024 shareholder Q&A, hinting at future monetisation if results impress.

2c. Tati Greenstone Belt Project (Botswana)

Status: The Tati Project, 100% owned by Power Metal, is a priority gold exploration asset near Francistown, Botswana, within the Tati Greenstone Belt. It targets orogenic gold deposits and potential magmatic Ni-Cu-PGE mineralization, centered around the historical Cherished Hope mine. Recent work has delineated an 8km gold-in-soil anomaly, with drilling confirming near-surface, high-grade gold.

Last Updates:

February 20, 2025: Power Metal announced soil geochemistry results from late 2024 sampling, identifying a southwest extension from Cherished Hope with samples up to 1.076 g/t Au in soil i.e. at surface before you dig (RNS, February 20, 2025). This expands the anomaly’s footprint beyond the 175m strike drilled in 2022.

2023–2024 Recap: Drilling in 2022 hit bonanza grades (e.g., 1m at 47.1 g/t Au, 3m at 16.77 g/t Au), per RNS dated August 2022 and February 2023. A 2023 program (reported May 30, 2023) included geophysical surveys and trenching, yielding 1.9 g/t Au over 1m, refining targets for future drilling.

Current Outlook: Tati is advancing toward a resource definition phase, with near-surface gold and favorable logistics (e.g., proximity to processing sites) enhancing its production potential. Power Metal’s managing small-scale mining interest at Cherished Hope (noted September 15, 2023), suggesting a dual track of exploration and near-term revenue options.

3. POW ARABIA?

3a. Balthaga

The results on a big pile of samples (66) from the 15 tenements stretching 1,500 Km2 are imminently due and indications of Lithium, Nickel, Rare Earths, Copper and Molybdenum are hoped for.

POW has a 30% earn in agreement with EV Metals Group Plc (EVM) in return for sole funding $500k of expenditure. That implies the project has a $1.66m valuation for now.

Balthaga has recently qualified for a £1.53m exploration grant from the KSA too.

POW geologists have been out sampling the Martian landscape. Desktop work is continuing now on potential targets to define the next steps and exploration work.

What is interesting here is the 70% JV partner EVM is not a miner but a processor. They are imminently building a 50KTPA chemicals plant for producing Lithium Hydroxide as a way to diversify KSA’s reliance on selling oil. A 50KTPA Lithium processing plant is fairly enormous (equates to 6.25m EVs per year), and the intention is to triple it to 150KTPA in the future (18.75m EVs).

If POW can find Lithium there is a ready market for it because the Saudi’s are imminently building processing for it. If no Lithium is found in the KSA then they will have to import it. Potentially they will expand the plant too. So the Lithium processing could triple the demand for Ore if they expand it to 150KTPA.

At a supposed 1% purity, even 50KTPA would be a monster 5m tons of ore per year mine and discovering a 50m-100m JORC resource would support a 20 year mine life.

If I compare this theoretical mine which doesn’t exist yet to European Metal Holdings, which at a $17k/t LiOH price is only 60% the size an operation (once they proceed) at 30KTPA but even that delivers a $2bn post tax net present value (at 8% discount) and a 36.3% IRR.

Now POW are nowhere near as far advanced as EMH are, but that’s actually a compelling pressure. With the potential imminent build out of capacity, finding a resource to feed that plant is going to quickly need to happen. Will KSA throw some money at POW to solve that problem? Seems a likely outcome. POW could be a beneficiary to this urgency.

Owning 30% of a tenement that could support a 50KTPA operation supposing it was a similar $2bn NPV8 is equivalent to paying $0.5m to get ($2bn* 50/30 * 30% = a $1bn NPV return back. So a theoretical 200 bagger. Just theoretical for now.

Obviously all of the above is just conjecture of the possible but I do know that Saudi Arabia are set on securing Lithium…. that’s not news, err well yes it is from Reuters for example. They want to be in the Sauidi Arabia of Oil for Lithium, if you follow me. They are spending billions.

3b - Block 8 (Awtad Copper-Gold)

A 12.5% earn in is based on a $740k spend so implies a $5.92m valuation to Block 8 overall. ASX-listed Alara (£12m marcap) is also involved there with a 10% holding and an option to increase to 70% and at other places nearby.

The exploration fieldwork completed to date includes two phases of stream sediment sampling, geological outcrop mapping and rock sampling, an ionic leach soil geochemical sampling orientation study, trenching on the Al Mansur target, the planning of a proposed gravimetric geophysics survey and sourcing of a geophysical contractor. Recently received assay results from an initial 13 rock and float samples (see Table 1) have returned two significant copper results: an in situ outcrop sample at the Al Maider prospect returned 4.46% Cu while a float sample from stream sediment sampling returned 1.75% Cu from an area within 2km of Al Maider.

These copper results are considered very significant in a previously unexplored area and provide excellent potential for the discovery of a copper deposit within Block 8, subject to further exploration work which is planned to follow.

POW’s partner Alara has another holding Al Wash-hi nearby this has been in open-pit production since 1Q24 where Alara owns 51% so is GENERATING CASH.

21.8Koz of gold is >£50m (at $3000/oz), and 79.3Kt of copper at an assumed US$9.5k/tonne is £580m. A$31.2/tonne for a 1Mtpa operation is £62.5m revenue and £15.6m cost over 10 years with £60m Capex, suggests there’s good money to be made.

An EBIT of perhaps £40m a year.

In fact a stonking 43% IRR according to this RNS at $9,500 copper (today it’s $9,800) and while the gold credits aren’t shown you can bet back in 2021 it was not based on $2700/oz!!! :).

So a JV with a partner who is highly cash generative, with a nearby Copper-Gold (40Km away from Block 8) which has phenomenal economics. This one looks to be pretty exciting too. Even 12.5% of a prospective find which turns into a Project NPV of US$137m equates to £13m …. nearly POW’s current market cap.

But the positivity doesn’t end there. Read on reader, read on!

US$0.74m is what POW needs to speculate but…. think about your neighbours

Alara also owns Block 7 cunningly named because it’s immediately west of Block 8. And Block 7 contains Daris East measured and indicated: 240,024 tonnes @2.37% Cu

Err reader, that’s 3x more Copper by tonnage than Al Washi. And 2.37% Cu?! Most copper mines are mining at a sub 0.5% grade!

So good economics whilst not guaranteed certainly appear exciting! May I say the word compelling.

3c - Qatan

The partner here AMAK is a £255m market cap generating £51m annual net profit (based on its 2Q24 P&L) and about £100m annual FCF.

The POW RNS does kind of say this but it’s good to understand who you’re working with.

So this one is a bigger stretch - for POW - in cash terms - an almighty US$3m spend (so about 25% of the GMET partial sale proceeds) - but to earn 49% in the Qatan licence. So a £4.7m valuation. And Qatan is just one of 21 tenements which AWAK hold (cough cough this could be 21X the opportunity in time).

AWAK has two mines already.

Its Al Masane mine is a 0.8Mtpa underground Copper/Zinc mine with gold/silver and produces a ~£24m/year net profit.

Its Mount Guyan is a 0.4Mtpa Gold/Silver only open pit and a net profit ~£18m/year.

Moyeath is a 0.4Mtpa extension to Al Masan which will drive a 50% increase to Copper but 80% increase to Zinc. So prospectively a £12m+ operation.

Will Qatan prove just as lucrative?

49% of an operation generating even just a fraction say £10m a year at 6X earnings is a £60m x 49% = ~£30m prospective valuation. Meanwhile knowing there is a mine to the west demonstrates that the Saudis are well able to defend their borders (and do) and this business is thriving also.

4. Other Listed Holdings

4a. FCM

First Class is now majority owned by the 79th Group with its £500m of property development assets, and it is progressing its North Hemlo and Sunbeam properties. Both are gold prospects and potential jackpots. Marc Sale is a 1st class geologist too. There is also ZigZag with its Lithium prospects too. POW owns £0.24m of shares and a find could propel that higher.

4b. Red Rock Resources RRR

RRR bought New Ballarat Gold in exchange for:

A CLN of £250k convertible to shares in the next 6 months at their placement price - or paid in cash in 6 months time.

Shares equal to 3.87% of Red Rock Resources (RRR) which is 166.67m shares at 0.04p so worth £64k today. (3.87% is 166,666,667 on top of 4,138,978,811 existing shares.)

Warrants (expiring in 2027) at 5 times today’s market price of RRR mean if a bonanza is found and RRR shoots up, then POW can increase their holding to 7.75% at a fixed 0.25p/share cost (i.e. £0.4m cost).

£250k nine months after Completion

£250k on a 20Koz gold JORC (in cash or shares)

£250k on a 200Koz gold JORC (in cash or shares)

So the downside scenario is £814k (£750k cash and £64k shares) and the upside is £1250k + Warrants.

The upside could be worth much more. Nearby to New Ballarat, Chalice Gold literally struck gold in fact 32Moz of it and 15 bagged as a result. So the deal gives zero downside to POW-wowers, and **if** RRR is the next Chalice, then POW’s 7.75% holding would be worth £11.2m (£11.6m is 7.75% of A$308m less £0.4m paid for the warrants).

What’s more: POW will retain the royalty interests namely a 0.75% GPR (which is gross proceeds and uses the higher contained ounces, and is without deduction of costs) over the licence. If we were talking 32Moz then that’s worth US$552m to POW too.

What’s more if RRR stiff POW they can charge 2% interest a month and if it all goes horribly wrong can also take back their 49.9% holding for A$1 (e.g. if RRR go bust).

4c. Aruma ASX:AAJ

Today’s announcement is, subject to successful drilling intercepts of Uranium or Copper, that 79m shares in ASX-listed AAJ be issued. AAJ currently has 196.2m shares in issue so the shares in issue would rise to 275.2m. 20% of the 79m are POWs so 15.8m shares. And that equates to POW owning 5.75% of AAJ in the event of success. Plus POW would receive a NSR of 0.4% of any minerals mined.

AAJ is a A$3.55m market cap so the theoretical value is about £80k. If they find something that holding could move to a £1m or more.

For an asset which POW didn’t even bother to list on their web site having an asset they’ve turned into £80k today and perhaps more tomorrow is alright for a day’s work.

5. £10m program FERMI

POW’s £10m cash is supplemented by a 2nd £10m cash in its JV where it didn’t contribute a penny. It contributed its 16 holdings and the drill program in Canada’s prolific athabasca basin is the 2nd largest Uranium activity in North America.

POW was loaned some money as part of the deal, so will pay off its £2m loan note to ACAM presumably, thus avoiding paying the 10% interest. ACAM received 13.33m warrants (non-diluting) at 15p if/when actioned would bring in £2m equity to POW. And dilution of 0.6% to shareholders.

The JV on a 70%/30% ACAM/Power Metals values the JV assets at £14.3m. That valuation is based on £10m/0.7 = £14.3m. POW own 30% which is £4.29m. Meanwhile the book value of the assets POW contributed was just £1.606m! So a £2.68m profit.

With a £4m future profit too for an earn in.

The earn in is: “The Company will potentially receive an additional cash payment of up to £4 million, conditional upon a sale transaction completing or other value realisation by the Investor, subject to the Investor achieving a minimum return threshold of three times its initial investment.”

Plus the increase of 30% of the future value of the JV too.

Fermi is the uranium-focused joint venture involving Power Metal's entire portfolio of uranium licences. UCAM has made an initial equity investment of £10 million into Power Metal Resources Canada Inc ("PMC"), for a majority interest in PMC of 70%.

The proposed Joint Venture is expected to provide Power Metal shareholders with exposure to at least five significant, high impact drilling programmes with an experienced financial partner, with significant advancement on several more.

UCAM have investments in mining and exploration projects globally including the Gardaq joint venture with TSX and £370m MARKET CAP TRIPLE BAGGER AIM listed Amaroq Minerals of Greenland.

A £6.68m potential gain to POW, £2.68m in terms of uplift of NAV and a £4m future earning, but crucially 5 drilling programs in the prospective Athabasca basin so this accelerates the value recognition of the assets.

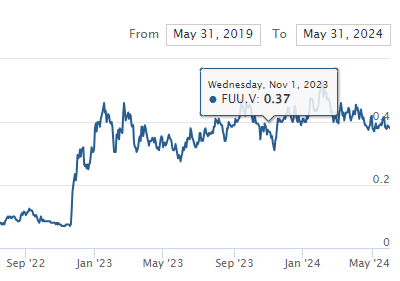

Finding a uranium JORC resource will propel the JV to multiples of its current £14.3m valuation. Fellow Athabasca miner F3 Uranium (FVE:TSE) 4x bagged as pictured below when their drilling programme 18 months ago intercepted 7%-9% uranium. Of course back then Uranium was $50/Lb whereas today it’s $88.6/Lb. So 4x Bag is pretty conservative.

If I’m right, and if a successful drill discovery is made, it would probably bring a FURTHER £17m-£21m uplift to POW (i.e. its £4.3m holding x 4 plus would the £4m earn in kick in at that point?) if POW’s share price reacted similarly to F3’s.

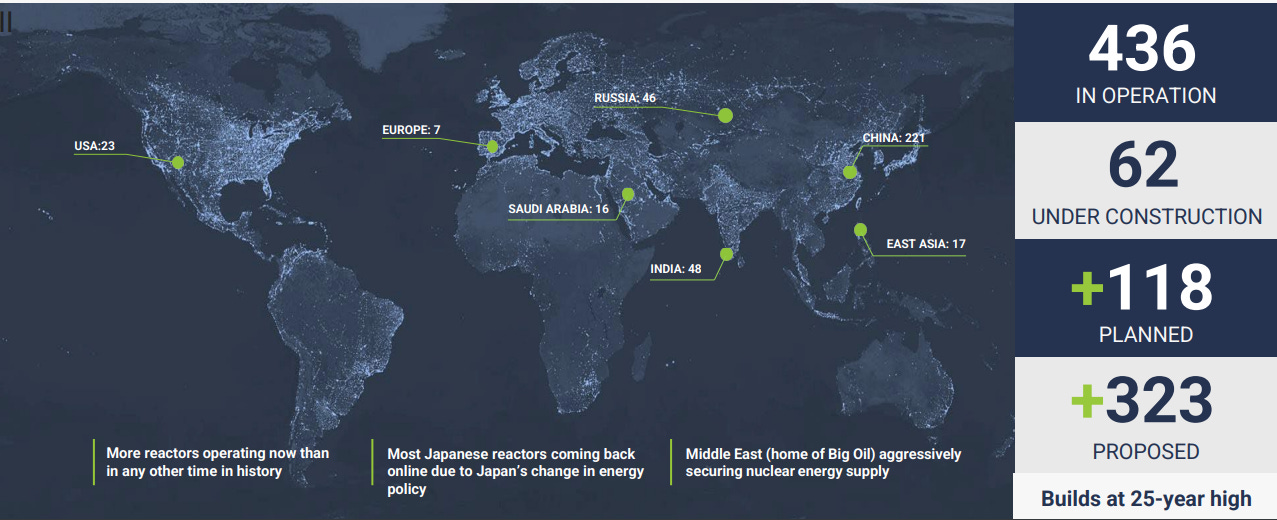

This slide from F3’s presentation gives a view of the number of planned Nuclear power plants - so driving Uranium’s current and future demand.

These are FERMI’s active programmes as at 21/3/25:

Perch River

Following the staking of Perch River in summer 2023, Power Metal commissioned a hyperspectral data compilation and processing study. Results from the study highlighted the presence of several very strong hyperspectral helium anomalies2, the source of which is postulated to either be buried uranium mineralisation, gas leakage from a helium reservoir at depth, or leakage from a buried hydrocarbon reservoir. As noted at the time, the hyperspectral helium anomalies were recorded to be in a prospective location for unconformity-related uranium, with major fault structures, a gravity low and recorded electromagnetic conductors.

A combined helium, radon, and soil survey has been completed in the centre of Perch River, including within the footprint of the helium hyperspectral anomaly, and secondary potential emissions of helium along the Font du Lac river. The helium survey was completed by global expert in helium geochemistry; Dr David Seneshen of Geochemical Exploration Services Ltd. Alongside the helium survey, a combined radon and soil sampling campaign was also successfully completed on Perch River, the results of which will be released in due course.

Tait Hill

On Tait Hill, the work aimed to refine the anomalous radon and soil results highlighted during the 2023 work programme over the Mullis Lake Target, and investigate a further potential intrusive related uranium target in the northwest, which has been named the Tait Lake West Target.

The Tait Lake West Target is located approx. 7 km to the north of the Mullis Lake Target, and overlies a radiometric high, at the apex of mapped intrusion. Previous work3 identified multiple radioactive boulders, but failed to locate their source. During the 2024 field season, soil and biogeochemical samples were collected across these main target areas.

Cook Lake

In 2023, Power Metal completed a magnetic survey over Cook Lake4 to aid in delineating prospective structures for mineralisation to support future fieldwork. The completed 2024 fieldwork includes radon and soil sampling on a target located across a prospective fault structure, down ice of which is a radioactive boulder train composed of similar geology to that mapped in the vicinity of target5.

Reitenbach

In 2023, Power Metal completed an airborne full tensor magnetic gradiometer (FTMG) and radiometric survey across Reitenbach. This survey identified multiple radiometric anomalies with prospective structural geology. These targets are largely underexplored, with no systematic exploration and no exploration in these areas since the 1970s.

During the summer of 2024, combined radon, soil, and biogeochemical sampling was successfully completed across selected targets on Reitenbach.

Thibault Lake

In July, a combined magnetic and radiometric airborne survey was completed to better understand the geology across Thibault Lake. Following the receipt of preliminary results, the Company successfully completed a combined radon, soil, and biogeochemical sampling campaign on areas of promising geophysical and geological characteristics in late August.

Clearwater

Following the magnetic survey completed over Clearwater in 2023, two main targets were identified along clearly defined fault structures, which, although they had historically known radioactivity, had never been formally tested. Alongside the fieldwork at Thibault Lake, one day of prospecting was spent on one of the targets.

Soaring Bay

Fieldwork in 20235 confirmed the presence of a significant historical radon anomaly along an inferred fault structure. The work completed in 2023 also identified significant radon enrichment to the southwest along the fault structure. To better understand Soaring Bay's structural geology, a combined magnetic and radiometric survey was completed in mid-July, which will feed into future work programmes on Soaring Bay, and will enhance the Power Metal technical team's understanding of Soaring Bay's geology.

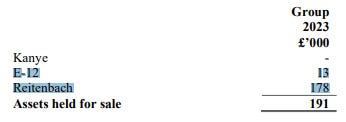

E12

In 2023, a magnetic survey was completed to provide information on E12's structural and subsurface geology. In early September 2024, a follow-up field programme comprising radon and soil sampling targeted two fault structures was completed on E12.

Drake Lake - Silas

In early to mid-September, a combined radon, soil, and biogeochemical sampling programme was completed on two main targets including, 1) a largely untested but highly prospective geophysical trend, and 2) an untested gravity low.

Pending Work

Airborne electromagnetic surveys covering Perch River, Badger Lake, Hawkrock East, and Hawkrock West are currently in advanced planning and are expected to be commissioned in October. Depending on assay results, weather, and contractor availability, scope exists for small, targeted field-based surveys to complement the work completed this season.

In 2023, Power Metal commissioned an advanced airborne passive EM survey over the Durrant Lake and Kernaghan Properties. The results of these surveys are pending, subject to enhanced QA/QC by the contractor which is currently in progress.

6. Technical Signals

I’m not a great believer in technical analysis (or at least it predicts what’s already happening from a fundamental analysis point of view), but some believe in these signals so here’s a Bottom Triangle that foretells a sharp increase at POW.

7. GSA

POW owns 75% of GSA (Environmental) Ltd (GSAe) which adds an interesting skill set to their business - even if the match isn’t immediately obvious.

Will money flow into GSA? Money that progresses the Black Goo project?

GSAe is a UK engineering services provider and process licensor, which specialises in the extraction of strategic metals from 'secondary sources' including power station ash, refinery waste, titanium dioxide waste and spent catalysts, while also producing much more environmentally friendly residue. This is their range of services delivered worldwide:

GSAe's robust and adaptive technology enables the production of high purity strategically important metals at production costs that substantially undercut traditional mining routes. Using hydrometallurgical techniques, GSAe's metals extraction technology allows for improved sustainability/environmental impact by preventing otherwise harmful compounds being released. It also substantially reduces the volumes of waste materials sent to landfill.

There are several reasons O&G and industrial firms engage with GSAe:

1.Compliance - HazOps and reducing noxious substances since both vanadium and nickel pose serious health risks according to the CDC. Both of these metals are present in crude oil. Don’t let your workers breathe your profits.

2.Revenue Stream - the same metals are valuable by-products.

3.Circular economy - the production costs of extracting metals is substantially cheaper than mining them. This will become more and more prevalent as mining projects dwindle. Chemical expertise is as important as geological skill.

4.Reduced volumes sent to landfill.

Expertise

Judging by the case studies, GSAe’s expertise takes them all over the world. The Flexicoke market is worth $400bn worldwide.

To contextualise this, for example, in the Amuay Refinery they produce 630kbpd heavy crude. This generates 38,000 tonnes per year flexicoker residues (largest flexicoker unit Worldwide).

GSAe helped Amuay produce:

4,500 tonnes per year vanadium pentoxide (worth about $57m)

450 tonnes per year nickel (worth about $8m)

So a $65m annual return on $87m Capex. No brainer?

Interestingly, the extraction process GSAe follows appears to be from this expired patent where Flexicoke is blended with an alkali metal source, such as sodium sulfate or sodium carbonate, and then roasted in an oxygen-containing gas until carbon is removed and a fused mixture is obtained. Thereafter, the vanadium is leached from the mixture with an aqueous solution, and nickel is contained in solids remaining from the leaching.

GSAe speak to this project needing “25,000 hours”. Assuming $250/hour (and that’s an educated guess) then a $6.25m project (of that $87m) for GSAe maybe. The accounts tell us there are 5 people working at GSAe so on a 40 hour working week equates to 625 days (or 125 for all 5). So about 4 months worth of work. Assuming £100k cost per engineer, that’s a profitable business - so long as you’re busy.

The RNS tells us during the period of 1 June 2023 to 31 December 2023, GSAe made £0.15m profit and, as at 31 December 2023, and net assets of £0.04m. The performance milestones agreed with POW suggest there is profitability improvement to come. Could a cash injection speed this up?

Roll of the dice?

The initail roll cost £0.075m POW shares - so a net £45k loss to POW (75% of £40k net assets). We also know that GSA has achieved a contract win of £0.16m or more. That has meant the award of another £0.075m POW shares. On a 20% margin a net £50k loss (£0.16m*0.2 margin*0.75 ownership = £25k-£75k). So £0.15m shares paid and a £0.1m net loss to POW in dilution.

There are then future performance milestones (Year 1 is imminent):

2.Year 1: Subject to profits of £0.45m (£0.34m belong to POW). Either £0.25m cash or shares so POW “make” £90k net. (£0.4m total gross and breaks even on a net basis)

3.Year 2: Subject to profits of £0.65m (£0.48m to POW). Either £0.25m cash or shares so POW make £0.23m net

4.Year 3: Subject to profits of £1m or more (£0.75m to POW). Either £0.35m cash of shares so POW make £0.4m net.

Why do it?

Can you think of a country beginning with the letter S which is trying to diversify away from being the world’s 2nd largest Oil producer? Being able to more broadly cater to that important country is a powerful proposition.

Can you think of another country beginning with the letter U which has just passed a strategic minerals act and is the world’s 1st largest Oil producer? Being able to more broadly cater to the mineral requirements of that important country is a powerful proposition. e.g. Vanadium extraction.

Chemical engineering also can be used to provide rapid assaying of rock samples (albeit unofficial ones). So GSAe’s skills in assaying will be crucial in speeding up IPOs and trade sale of assets.

Particularly GSAe have experience with REEs (Rare Earths), which is errm rare. This will be valuable, for example, for some of FDR’s projects.

Mr Grimley the previous owner gets his money out and being a future POW millionaire may turn into many more millions - as presumably he believes in what POW are doing.

Increased credibility with clients - including government bodies across the middle east like Saudi Arabia (and Oman). Skills of geology/lithology but also EPC skills and Chemical Engineering.

So synergies around clients and projects perhaps?

GSAe already has a Memorandum of Understanding in place with a major Saudi Arabian supplier of fly ash with several further discussions ongoing.

Cash generation from GSAe could help fund POW overheads.

Perhaps further similar acquisitions/partnerships to follow?

Conclusion

If you’ve successfully read this tome on POW then well done. There’s a lot of potential. Mr Bloke, Mr Archer and others have been “digging in” to this idea for a while. The partial disposal unlocks a flywheel effect for the rest of POW’s portfolio and it will be interesting to see how the money is deployed. Meanwhile there are numerous throws of the dice with a highly positive commodity backdrop where speculation could envelop at any time.

The Digging in Phase is taking a while. Patience is required. Will it be worth it? Only you can decide that - and ultimately so shall the market.

Even just adding up book values along with listed holding current values I can get to £33.64m - and that assigns zero value to the future upside potential of holdings.

£33.64m less the potential cash commitments described in the article above nets to £25m which is 66% higher than the £15.2m market cap today.

It chimes perfectly with the technical signal of a price target 17.3p-18.3p. Whether your triangle is a technical one or a fundamental one the direction of travel appears to predict the same. Upwards.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

The most frustrating thing about POW is that it has it all; decent cash position, solid assets, capable management - and yet for years the share price has been disconnected from the fundamentals.

It does mean when the rise inevitably happens, it will deliver relief akin to breaking a fever or perhaps reaching the top of a mountain during a summer biking trip....

I remain of the view, like you Mr Bloke, that POW remains an obvious buy and look forward to the day we can share a bottle of whisky (even virtually) to celebrate when our mutual patience becomes financially rewarded.

An astonishing piece of research, congratulations!

Yet just 12.2p to buy today! What are we missing?