Dear reader,

Congratulations to readers who took a chance on Mkango an Oak Bloke “sucker” idea (now promoted to a momentum trap) just 6 months ago. MKA is now at a triple bag and the OB25 for 25 ideas are now up 25% ITD vs Gold Medallist Mr Jon at 33.2%.

I forecast a 350% return, with a risked moderation taking it to 70%.

Will we see even more upwards momentum tomorrow when UK markets re-open tomorrow?

This evening in US markets we see a 2nd OB idea Energy Fuels ticker UUUU move up 16.3%

The reason?

A fellow rare earth provider in the US called MP Materials is up 46% on news that the Department of Defense is becoming a shareholder. Trump’s elevation of rare earths and critical minerals is well known. For whatever reason shareholders are only now twigging that that will mean shares in such holdings will go up.

Eagle-eyed readers will know Trump riding a Unicorn was a memorable article and a positive heads up back in “UUUU-nicorn REE-known” in May 2025, and Magnet-oh plus Iron Lion Zion even earlier back in “Songwe and a Prayer” was too.

MP Materials Corp. (NYSE: MP) announced a landmark public-private partnership with the United States Department of Defense (DoD) to accelerate the development of a comprehensive U.S. rare earth magnet supply chain, aimed at reducing reliance on foreign sources, particularly China. This strategic collaboration, revealed on July 10, 2025, includes a multibillion-dollar investment package and long-term commitments, positioning MP Materials as a key player in enhancing U.S. industrial resilience and national security. The announcement sent MP Materials’ shares soaring, with pre-market trading gains reported as high as 50%.

A Transformational Partnership

The partnership is a significant step toward establishing an end-to-end U.S. rare earth magnet supply chain, critical for advanced technology systems in defense and commercial sectors, including electric vehicles, wind turbines, drones, and fighter jets like the F-35. Rare earth magnets, particularly those using neodymium-praseodymium (NdPr), are essential components in these applications, yet the U.S. has been almost entirely dependent on foreign sources, with China controlling approximately 90% of global processed rare earth output.

Under the agreement, MP Materials will construct a new magnet manufacturing facility, dubbed the “10X Facility,” at a yet-to-be-determined U.S. location. Expected to begin commissioning in 2028, this facility will significantly boost MP Materials’ domestic production capacity to an estimated 10,000 metric tons annually, enough to “meaningfully support U.S. defense and commercial needs,” according to CEO James Litinsky. The company will also expand its heavy rare earth separation capabilities at its Mountain Pass, California, facility, the world’s second-largest rare earth mine, further solidifying its role as a national strategic asset.

Financial and Strategic CommitmentsThe DoD’s commitment includes a $400 million purchase of newly created convertible preferred stock and a warrant to acquire additional shares, priced at $30.03 per share, set to close on July 11, 2025. This investment positions the DoD as MP Materials’ largest shareholder, holding approximately 15% of the company’s issued and outstanding shares on an as-converted and as-exercised basis as of July 9, 2025.

Additionally, the DoD has agreed to a 10-year NdPr price floor of $110 per kilogram—nearly double the current Chinese market price of around $60—ensuring stable revenue for MP Materials despite market fluctuations. A 10-year magnet offtake agreement further guarantees that the DoD will purchase 100% of the magnets produced at the 10X Facility, supporting both defense and commercial markets.

The partnership also includes a $150 million loan from the DoD to enhance heavy rare earth separation at Mountain Pass. Additionally, MP Materials has secured $1 billion in financing from JPMorgan and Goldman Sachs to support the construction of the 10X Facility, underscoring the project’s financial robustness.

Strategic Implications

This partnership is seen as a decisive move by the Trump administration to counter China’s dominance in the rare earth market and enhance U.S. supply chain independence. As Interior Secretary Doug Burgum noted in April 2025, the administration has been exploring equity investments in critical mineral producers to compete with China, which has historically used its control over rare earths as leverage in trade disputes. The deal aligns with broader U.S. efforts to secure critical supply chains for high-growth industries and dual-use applications.

“This is a game-changer for the ex-China industry and a much-needed surge in magnet production capacity,” said Ryan Castilloux, managing director of Adamas Intelligence. The initiative builds on MP Materials’ existing operations, including its Mountain Pass mine and its magnetics facility in Texas, known as Independence, which is currently being commissioned. By expanding domestic production, MP Materials aims to reduce U.S. vulnerability to supply chain disruptions and position itself as a global leader in the rare earth market.

However, the partnership is not without risks. MP Materials noted potential challenges, including securing additional financing, navigating regulatory requirements, and managing the financial and tax implications of the deal. There are also uncertainties related to legislative or judicial actions that could affect the partnership’s terms, as well as the company’s ability to find alternate sales channels if the agreement is altered. Despite these risks, the long-term commitments and financial backing provide a durable economic platform for MP Materials to scale its operations.

Leadership Perspective

“We are proud to enter into this transformational public-private partnership and are deeply grateful to President Trump, our partners at the Pentagon, and our employees, customers, and stakeholders for their unwavering support and dedication,” said James Litinsky, MP Materials’ Founder, Chairman, and CEO. Litinsky emphasized that the partnership is not a nationalization but a strategic collaboration to catalyse domestic production and secure critical supply chains. He also highlighted the deal’s financial benefits for taxpayers, noting that the DoD “negotiated a very tough deal” that could yield significant returns.

#1 Mkango

Mkango has been rapidly Americanising itself and its SPAC via a business combination with CPTK to create a US listing on the Nasdaq is going through approvals. This rolls up its Malawi Rare Earth Project, Songwe, as well as its Polish Rare Earth refining project, Pulawy.

This US business combination underway but not yet certain for its Songwe and Pulawy projects is valued at $400m (£300m). That’s 3X today’s market cap for half of its business (i.e. excluding the Magnet Recovery business)

The Magnet Recovery business is a British invention from the University of Birmingham. It is a proven technology in fact on Monday MKA announced its expanding commercialisation today. This is a key difference to MP Materials. MKA is here and now to recycle existing rare earths. While MP is a rare earth mine located in the US at Mountain Pass, i.e. a finite resource.

MKA’s technology could scale across multiple countries and via circularity offer a means to re-utilise rare earth magnets via a hydrogen recovery method perfected by British boffins with beards.

Currently MKA is operating in both the UK and Germany with plans to build out a large US operation too. That operation will have a strong IRR and would rival the contribution of MP Materials.

#2 Energy Fuels

UUUU is a uranium miner but also a company that has developed a novel approach to processing Heavy Mineral Sands (HMS). An intriguing fact is that HMS usually contains radioactive materials. In fact eagle-eyed readers will know that top idea from 2024 Kazera was in the doldrums for a long time prior to obtaining a licence to process and handle radioactive material. This is code for do a controlled disposal.

What if you could actually utilise those materials rather than “handle them”. After all, inside HMS is Monazite and about a quarter of monazite is rare earths and about 3%-5% is uranium.

No other company in the world is taking this approach. There is worldwide potential to process HMS and obtain rare earths and uraniuim cost effectively.

It owns a colossal HMS project in Madagascar and an earlier stage project in Bahia, Brazil, with a JV in Australia at Donald.

UUUU is cash rich so doesn’t necessarily need the money so can to some extent play hard ball with the US Gov’t. Its White Mesa is the only US uranium mill. That is currently a single circuit that can process Uranium or Rare Earths but not both at once. Building out a second circuit would enable both at once.

Madagascar faced with catastrophic tariffs with no obvious reason for Trump to be chicken out or cave in….. except perhaps for UUUU to get fast tracking on the permits and go ahead for its Toliara project. This has incredible project economics and would contribute vastly to US rare earth magnet needs, and indeed those of the wider Western world.

#3 POW

OB2024 idea Power Metals deserves an honorary mention too. Last covered in the article “POW-tification” There are REE projects in its portfolio but I’m including this mainly due to the strategic read across from today’s news and the impact on what a deal would look like for its IPO spin out Guardian Metals.

Power Metals still holds 17.71% in Guardian, a Tungsten Project Miner and it’s ironic that it sold half of its holding earlier this year when its 40% holding was worth just under £20m, so selling half raised £9.2m and left £9.88m shares. The remaining shares are nearly worth what they were pre-sale!

Today’s deal at MP provides a blueprint for UUUU and MKA, but also for what we will likely see at GMET in the coming days or weeks. It is the most hinted at deal that hasn’t actually happened yet. GMET is now valued at nearly £100m based on hints and samples as well as the fact that GMET obtained a 2nd Tungsten project in Nevada with a brownfield operation which could be restored to operation relatively quickly delivering tungsten and other minerals.

Today the remaining holding in UK and US listed company GMET is worth £15.8m.

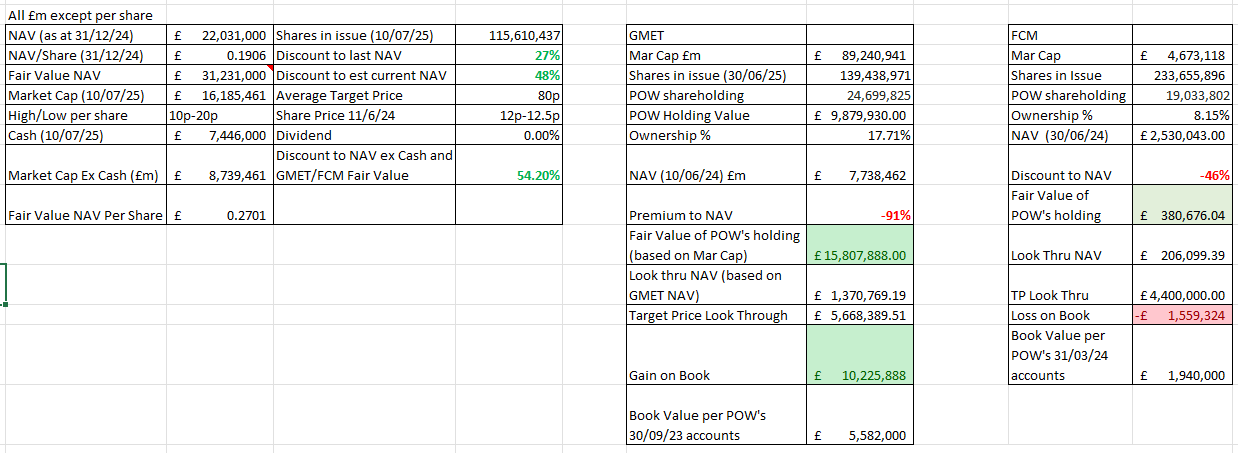

The £9.2m net proceeds from selling about 20% of GMET reduced debt by £2m plus paid off accrued interest (£0.2m estimated) and added £7m cash to the coffers. So “Fair Value” is £31.2m based on the 31/12/24 accounts plus the +£7m cash while reducing by -£2.2m its liabilities too.

What if you strip out cash and listed holdings at POW?

You’re are getting a net over £1.5m cash (£16.1m market minus -£17.6m proceeds) plus getting the following for free.

FOR FREE

75% of a metals recovery business (GSAe) for free,

30% of a Uranium Exploration business with £10m of cash funding for exploration for free,

Various projects in the KSA (book value £0.3m), for free

A PGM project in Botswana called Molopo (book value £2.417m) and Gold project called Tati for free

58.7% of a RARE EARTH and Lithium Australian business called FDR with book value of £1.714m for free

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Is it also worth covering cotec holdings.

As the price of mkango increases due to the spac, you get less leverage to the recycling business.

Cotec are still at 60m usd. 1 plant gives them 300m usd of npv or 5x.

Basically it is an easy recommendation as we believe in the mkango story.

When you approach MKA from a perspective of US REE market, magnet production, MP and DoD etc, you firstly value its HyProMag venture. I have just recently found out that HyPoMag's other owner, Cotec may also give an excellent way to invest into the HyProMag story (adding some other potential hidden value) for a still cheap valuation.