Dear reader

Poor Avacta has been in the wars recently. And I don’t mean the war of delivering potent warheads to tumours - per this recent presentation from CEO Chris Coughlin.

From highs above £1.50 to recent lows of 39p it has had a turbulent 9 months. Back in April 2024 at 54p in my article avct-ce to go I spoke to caution given the share could have further to fall. I kept a tiny position but otherwise exited, but sub 40p I’ve rebuilt a larger position. Why?

Well it wasn’t because it’s been getting good coverage. It was used as an example of “don’t trust story stocks” by Stockopedia. Ouch! Bit tricky to find a stock that has no story, so good luck with that. But the underlying message is don’t let a story override either common sense, risk or the numbers/facts which is of course are vital. By “the numbers” I’m talking cash, profit, growth, market potential. By risk I mean the risk of a loss or part or all of your investment.

Let’s consider is Avacta just a “story”? Or something else?

Well for a start any kind of stock scoring system is only going to consider history. The efficacy of science is not going to be determined by past results or stock scores, although it is fair to say many therapeutic drugs fail to commercialise. So you could apply past results.

If you consider progress to be linear - like an aircraft flying through the sky then if your business is burning cash that’s like losing altitude and a stock scoring system can give you the equivalent of a “Pull Up” “Pull Up” alert. It uses established techniques to score and therefore tell you the aircraft most likely to arrive unharmed at their destination. Scores change and as risks diminish and results improve today’s “sucker” is potentially tomorrow’s “trap” before further upgrades follow, potentially.

Consider the first aircraft to exceed the sound barrier. Before they actually achieved Mach 1 there was doubt as to what would happen. Some speculated the sonic boom would immediately destroy the aircraft, others theorised it was impossible. The British were first to break the barrier but the “official” record goes to Chuck Yeager and the Bell X-52 which was essentially a British design. I’m Whittle-ing on about sound barriers because an altitude warning device would have not been the success objective, and I’m sure to break the sound barrier required some degree of diving towards the ground (cash burn). Yet the reality of hitting the ground (running out of cash) is true of an X-52 as much as an Airbus 320.

To determine an experimental X-52 is more risky than a 320 and therefore no a good investment rather depends on your appetite for risk and ultimately whether you believe a/ the science b/ the people managing that science c/ the world around you and the market it operates in. Avacta and measuring Avacta requires different and additional measurement to stock scores. Breaking the sound barrier is an endeavour to prove the efficacy of a biotherapeutic. To gain backing for your design. If it can sufficiently demonstrate this, it will get bought or it will succesfully sell licences to its technology. There are estimates to the longevity of cash and cash flow and of course a 2nd diagnostics business which is forecast cash generative and profitable - and today’s RNS potentially suggests it’s up for sale.

Today Avacta Group announced the appointment of Shaun Chilton as its non-executive chairman. Chilton brings more than 30 years of experience in biopharma leadership to the role.

Chilton was previously CEO of global pharmaceutical services company Clinigen Group, leading its sale to Triton Partners in 2022 for around £1.3bn. Highly impressive numbers were achieved at Clinigen, from modest sales and profits.

Chilton has a strong track record in growing sales and enterprise value with significant board experience, including roles at MAP Patient Access and C7 Health, where he also led a successful sale to a strategic buyer in 2022. Let’s examine those.

Profits quadrupled at C7.

Chilton’s other appointment - MAP - have expertise includes accelerating oncology drugs progression.

So the focus is on advancing the clinical development of its 'preCISION' platform.

Off with ‘is ‘ead

I wrote in Avct-avct-a cashflow factor that shareholders wanted a change of leadership. They blamed Alastair Smith for their ills. They got their wish. Dr Christina Coughlin, previously head of research and development, was appointed as CEO. Previously the CEO of Cytoimmune Therapeutics, and chief medical officer at Tmunity, Rubius, and Immunocore. The board added that it planned further changes to bolster Avacta's transition to a therapeutics-focused organisation.

"Shaun is keenly aware of the potential that exists in our oncology pipeline to bring value to patients and shareholders alike and we will work together to deliver on that potential.”

No mention of diagnostics is significant.

Therapeutics

Avacta, in 2018, secured the global exclusive license to a patented technology invented at Tufts University School of Medicine, Massachusetts, US. Rebranded pre|CISION it is a way to keep chemotherapy inert until it encounters “a high expression of fibroblast activation protein”.

A precision bomb. Avoids collateral damage. Higher and higher doses were given in the Phase 1a trial. After the 6th dose escalation a maximum tolerable limit had not been reached. It’s early days but the somewhat circumstantial evidence is compelling. Make the bombs as big as you like.

Let’s recall the numbers….

We know that Cash was £16.6m at 31/12/23 and I estimate it at £31.3m currently. We know that Convertible Bonds were £40.8m 31/12/23 and £35.70m at 31/3/24.

So shareholders now have 13.2p NAV/share. The value here is in potential future cash flows…. it it can commercialise the tech.

Cash Burn

The convertible bond issued in October 2022 is repayable in 20 quarterly amortisation repayments, of principal and interest over the five-year term, in either cash or in new ordinary shares at AVCT's option. On the basis further share issues would make natives even more restless and in keeping with the RNS which says “enough cash until the end of 2025” I assume AVCT pays the debt/interest down by £11m a year.

So half the cash gets ear marked there straight away, leaving a projected £20m cash. Projected cash burn of £20.6m in my forecast below more or less gets us to the end of 2025 - per the RNS.

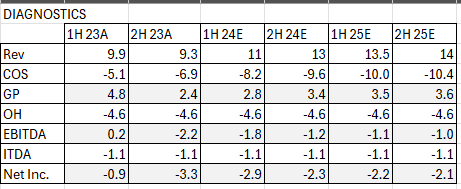

I’m holding numbers static from prior periods projecting forwards. The ITDA component is £2.9m tax rebate and £0.6m depreciation which of course is non cash but I’m assuming replacement capital expenditure equals this. - £32.3m across the businesses exceeds the £31.3m estimated cash reserve (estimate) as at 20/06/24.

Upside?

Half of cash burn is paying down debt. So a NAV of £43m remains at the end of 2025 plus the value from the Phase 2 and the Value of the diagnostics business. On a PE of 15 of forecast FY25 earnings the diagnostics business could be worth £30m+. Selling that would get Avacta to debt free and a further 1-2 years runway to 2027. Will Chilton do this?

An investor has to consider the chances of a “take out” event in the next 18 months. I spoke recently about how biotech is heating up in my article IPO for IPO and in IP and Arix how $150bn of acquirable Biotechs have been taken out and Bristol and Merck face patent cliffs. RTW continues to climb.

Negotiating and future cash flow raises equipped with Phase 2 results is completely different to Phase 1a.

Raising a further bond with Phase 2 results is completely different too. Another £55m debt raise (if that’s possible) probably takes the business through to cash profitability.

Or issue shares in place of cash repayment. Further dilution but a longer runway.

Is £2m therapeutics revenue per half-year period too low? If the revenue were £5m+ (like in 1H22) then that extends the runway by 1 year.

Diagnostics revenue growing just £0.5m per period in FY25 may be too low?

What about revenue streams from Point by the end of 2025 when there’s been over 4 years development since 2021?

What’s the POINT?

Avacta have licenced Point Bio, who is now part of Eli Lilly, specifically for the microenvironment targeting of radionucleotides. Avacta will receive development milestone payments for the first radiopharmaceutical FAP-activated drug totalling US$9.5 million. Avacta will also receive milestone payments for subsequent radiopharmaceutical FAP-activated drugs of up to US$8 million each.

The problem is we don’t know the timing - and the timing is confidential.

But royalties and milestone payments from this could potentially extend the runway by 6-9 months, maybe more.

It also make Eli Lilly a prime candidate to buy out Avacta because they’ll be able to see 1st hand how well it works.

Market Opportunity

If pre|CISION™ technology is proven with Doxorubicin next gen precision therapies are estimated at $98bn by 2030. Meanwhile according to Statista Oncology drug sales were $176bn in 2021 and forecast to grow to $320bn by 2026.

AVA6000 is one form of treatment for one form of cancer. Another candidate AVA3396 treats multiple myeloma and mantle cell lymphoma which I read is a $2.8bn opportunity.

What is AVCT, a $0.2bn company, worth if it could take a good chunk of that $400bn+ market? 100 times? With 20% dilution for existing s/h’s it’s now “only” 80 times? 80 times of something and not 100 times of nothing.

Conclusion

Historical metrics and the danger of “a story” don’t really explain what could happen next here. It’s clear there are risks but also potential of enormous upside. Writing off as “a story” ignores that companies get bought out and that the scientific results, whilst early, are very promising. Quality management often determine a successful company and we can see both commercial and research quality - and track records - at Avacta.

Dilution extends the odds and reduces the return. But if the return is parabolic when does a little less matter? The answer is - given that you are taking a risk - when the return divided by the probability exceeds the cost of losses.

For example, if you consider a 100X upside is possible given the market size and impact of a technology which enables precision guided delivery using markers like FAP. Then if you consider there’s a 10% probability of success. Then statistically speaking you should be able to tolerate a 90% loss before this is statistically a failure. That loss could be a loss of share price or a loss of dilution. If 100% of the remaining bond were converted into shares at 45p then £35.7m is 80m shares…. that’s a further 18% dilution. Yet focus and fixation is made on avoiding dilution. The mathematics of full dilution of the debt actually improves the NAV from 13.2p to 18.9p a share. (£47.5m NAV + £35.7m / 440m shares)

If you simply give yourself a margin of safety then you can set a lower pain threshold of loss.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Just to say that "whittling away" was not lost on the entirety of your readership

Thanks for your articles ... Most interesting