Dear reader

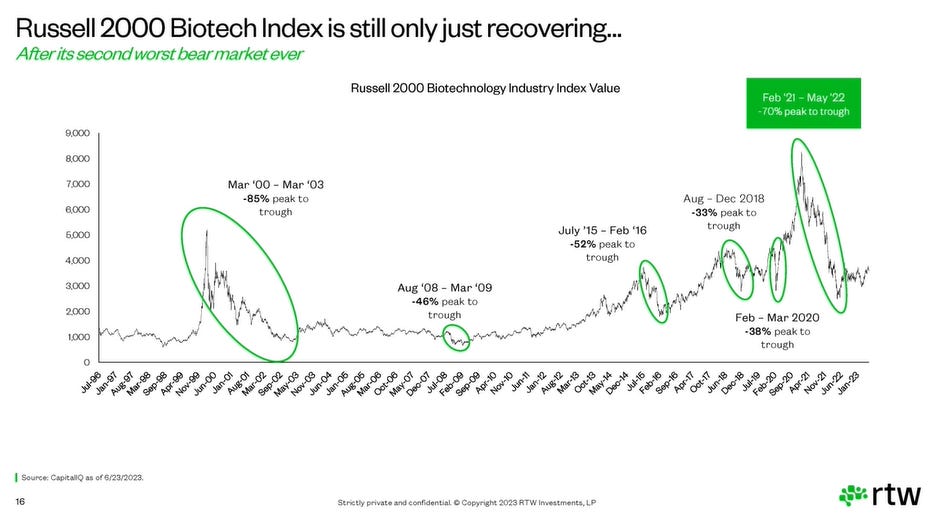

I recently wrote about a new-found confidence in Biotech.

Further evidence I see today, and interesting to see Gilead-backed Kyverna IPO’d yesterday at $22, then rocketing up on its 1st day to $34 before settling at $30

This is one of RTW (soon to be combined with Arix) holdings. Prior to listing, it was valued December 2023 at $425m and RTW’s stake at $1.8m so at $30 a share that values it at $1,226m so a $5.2m reval and a $3.4m gain.

Not huge numbers admittedly (about 1% of RTW’s NAV) but this is following a 19.1% NAV increase in Q4 2023 so is yet further evidence of a re-rate and affects several shares I’ve spoken about:

IP Group - OB Top 20 (also its holdings IUG and ONT) and here

NSCI - OB 11th Placer and here

Taken together it would appear Biotech is coming out of the wilderness and a land of milk and honey may beckon. Ark Invest speak to a substantial market opportunity around precision therapies and RNA based therapies and see 28% CAGR.

At the very least, it’s a sector to keep an eye on.

With healthcare costs rising, longevity improving and the prospect of costs falling through technology, AI, automation, advancing understanding of biology along with improved probabilities of success, there are a number of reasons why the feast and famine long associated with drug discovery and development might be changing - for the better.

Ark are not alone in this belief. RTW speaks to the same trend.

While valuations remain at historic lows relative to trend….

This is not advice

Oak