The NAV Fun Run Part 2

The PS and CA NAVathon

Dear reader,

This article continues from Fun Run NAV Part 1. Paul Scott and Charles Archer ideas get considered today.

Before I start I just wanted to speak again about Cancer. Oh no. Oh yes. This week my partner’s son’s girlfriend’s dad was diagnosed with Stage 4 Bowel Cancer. Just a few months to live, and he found that out this week. A bit of a tenuous link to the Oak Bloke you might think. I’ve not ever met the fella (he lives in Dubai). But he’s 52 years old and it’s damn unfair to be terminal at that early age. It turns out he had the warning signs and chose to ignore them.

If you enjoy reading the Oak Bloke and my articles, and more importantly if you have made some money doing so - like at Cora Gold which I wrote about on Tuesday this week and is up over 50% since:

Or perhaps at IP Group or CHRY where I spoke about the prospective Featurespace sale which closed this week. Both are up this week, and that cash is funding buy backs at both boosting the NAV further.

If you’ve benefited (and only if you haven’t already) please please please consider donating to my campaign for Bowel Cancer UK. To the 1% of you who already have, thank you. To the 99% of you who haven’t, please do. I really don’t want to turn on subscriptions to donate 100% to charity. I would instead prefer to just appeal to your sense of fairness.

Thank you so much.

-

Fun Run NAV Part 1

So back to investments.

I was surprised to see in my poll 5% of readers already regularly calculate the NAV of each of their investments. I thought I’d thought up a new concept - after all in the (very) many investment articles I’ve read over my years no one had ever said about doing that that. Either those 5% of votes are far cleverer than I or they were fibbing. Meanwhile 55% said thank you it’s not something they’d thought to do before. 30% thought it was irrelevant! Err ok!

But reader Jon made an excellent point that looking at changes of NAV over only 12 months is too short a time horizon. Shall I commit to doing a multi year view of Paul and Charles ideas today? I think I will say no for now (due to the time it would require), but it is an aspiration to loop back around on this. Reader Jon is 100% spot on, in my opinion.

Why should you care?

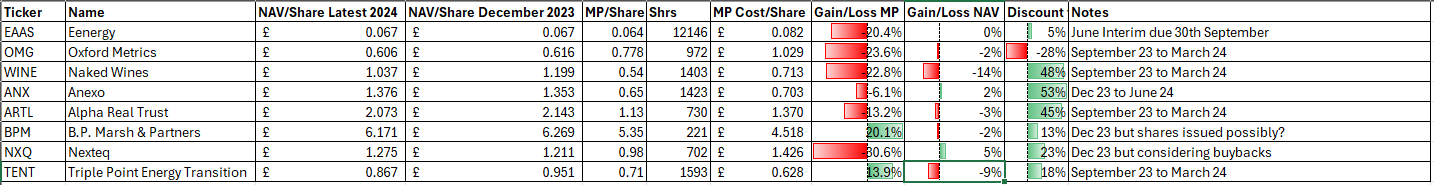

Taking Simon Thompson’s Bargain Shares 2024 as an example the benefit is that I can see almost immediately that Nexteq is down 30.6% but its NAV is up 5% YTD. Or that Naked is on a chunky discount and its share price is down YTD by more than its NAV.

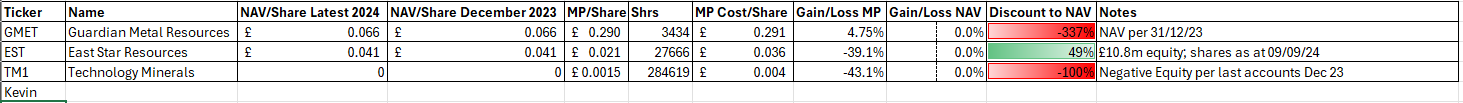

Or Mr Kevin Roast’s 3 ideas where only one appears to have actual assets. The other two depends on how much (if at all) you believe in assets not on the balance sheet. Like Tungsten in the ground at GMET. Personally, TM1 has danger written all over it. GMET has risk but lots of potential reward. But Mr Roast proposed the idea 1st July and it’s down 12.4% since and overall these three ideas are down 43.3% inception to date.

I feel I need to dig (no pun intended) into East Star Resources. That one looks interesting to me.

So onto the final pair.

Mr Archer

Many of these picks are small cap miners and perhaps unsurprisingly we simply don’t have NAV data during 2024 to assess a NAV performance. Some like Sovereign, Tertiary and Guardian are well in excess of their NAV but a NAV in this context is the price of the land (or lease), or perhaps better to say the “mineral rights” rather than the value of those minerals. That’s why you would need to consider the JORC but none yet have those.

Cizzle meanwhile is a pharma so again it’s a question of understanding their IP.

Acuity RM is a gain YTD and Stocko say “might be worth a look” as it is winning a flurry of contracts. Well everyone loves a flurry, so I’m marking this one down for further research.

Mr Scott said in an update back in May “Might be worth nanocap investors taking a look… it seems to be winning contracts (upselling a renewal in this case) to big clients, including UK Govt. £500k over 3 years is a decent contract for a company this small….. Too early to judge, but the flurry of contracts announced suggest there might be something interesting here”

And Mr Archer stated back in January “there are two reasons to be cheerful about this. First, even though getting into the public sector is difficult, once in, contracts tend to snowball. Indeed, these smaller contracts are essentially dry runs for larger contracts. Second, the contract renewal rate is exceptionally high.”

A 52% loss year to date I would suggest is a reason not to be cheerful but the 42% discount and gain in NAV YTD has certainly piqued my interest.

I remain optimistic about Guardian and Sovereign niggles at me as another to look at. Mr Archer tipped this 1st July and the Rio Tinto is an investor here. Its rutile and graphite deposit looks intriguing.

Conroy’s dramatic discount to NAV also intrigues me. It is a Zinc, Lead and Gold prospector in Ireland and Finland.

Mr Scott

I’ve saved the race leader until last.

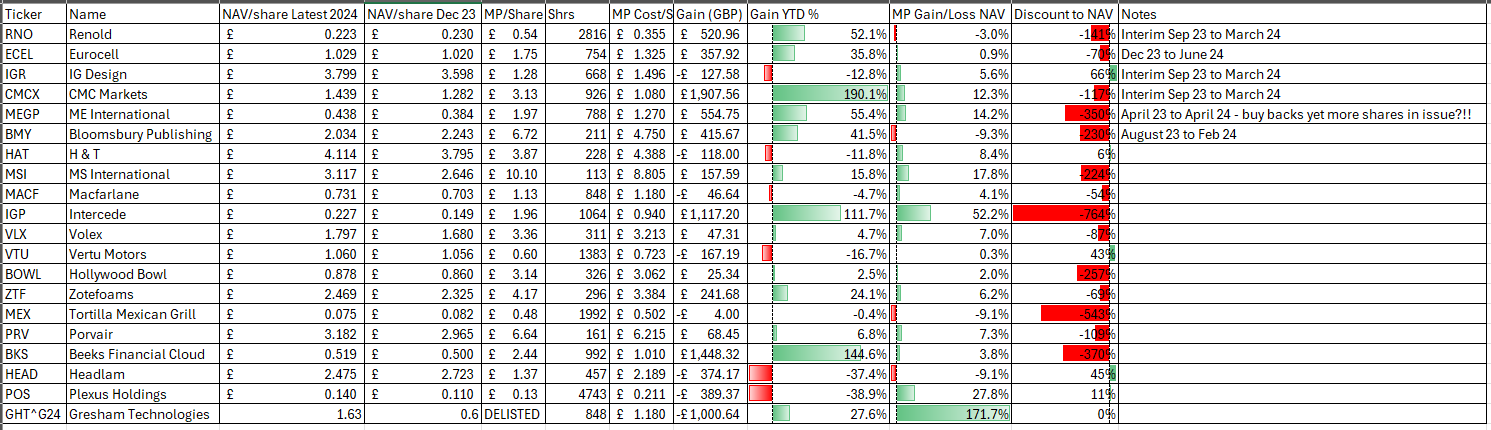

There must be some great insights arising here. Smack. Do you see it too reader?

14 out of 20 are valued at many multiples of their net asset value.

In other words all of Paul’s successes are at a premium to NAV and all of its losses are a discount to NAV. Except Mexican Grill which trades 5.5X its assets.

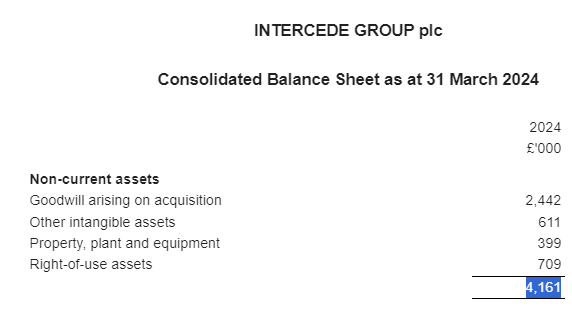

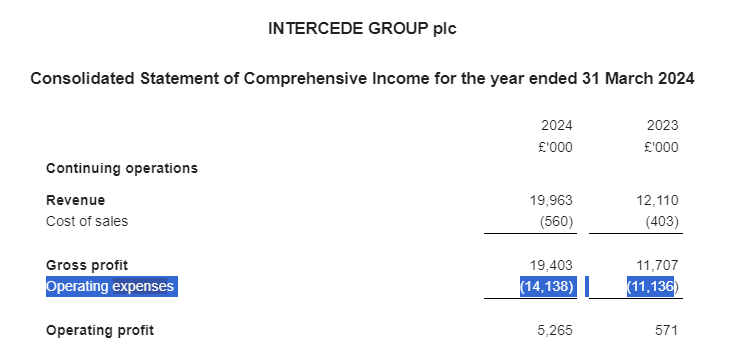

What I also notice is how Intercede has gained 52.2% shareholder’s equity YTD. MSI 17.8%. These are impressive numbers too.

I suppose if you look at the share price YTD gains and CMC for example, the 190.1% gain YTD compared to the 117% premium to NAV is due to the 190.1% increase. In fact Paul’s thesis on CMC was to kind of do what I’ve done with my NAV analysis and say hey the share price of this stock is covered by its assets.

So in a similar way Vertu is at a 43% discount to NAV and judging by the 0.3% gain in shareholder’s equity that that’s a profit, albeit a small one.

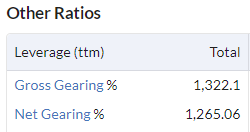

I can’t help but think adding in the EBITDA and Net Profit and also the EV is necessary to better understand the picture. I say that because you could have a bucket load of assets generating great profits where those assets are NET of debt and that’s why you have numerous instances of a premium to NAV. It’s not that Tortilla Mexican Grill can generate profits to justify a share price 5.5X the value of its assets.

Boom. Debt is 13.2X its equity.

Intercede intrigued me a little too. Profit up 783.3%. Wow. Then I see it’s a £0.6m profit increased to a £5.3m. Out of acorns…. come Oaks :)

But that profit has no relation to the assets.

That’s because nothing is being capitalised to the balance sheet. It’s just expensed each year to the P&L. Also of note is the fact that the cost of sale is negligible, a 96.7%- 97% gross profit margin! Astonishing!

So will I be taking an (Oak) leaf out or Mr Scott’s book?

I keep meaning to deep dive into the twenty and so far this year have looked at Zotefoams in my article “Zote Alors!” and felt it was expensive and wasn’t entirely convinced on the uniqueness of the ReZorce milk carton - it’s down 20% since. But y’know I said it was fair valued so with it being 20% below fair (in my opinion) and I notice a not too shabby 6.2% increase to NAV so I think I might need to take another look.

I also looked at CMC at £3.35 per share in “Charlie-Mike-Charlie” and just felt it was pricy and I doubled down on TCAP. Well TCAPs up and CMCX is down 7% since then. Do I feel differently today? No, I don’t think so.

But Intercede is intriguing.

I think MSI given that its NAV is up 17.2% is worth a look too. I see Paul comments “fabulous result, with profit tripling”. Defence division generates the profit. I haven’t owned a defence stock since holding Chemring which I sold at a tidy profit. But these are dangerous times and perhaps defence is a good area to consider.

Conclusion

So ends the NAV Fun Run Part Two.

I hope you have found the exercise useful. I know I have. But not in the way that I thought it would. It exposes a truism in investing that you can’t just use a single metric to work out which stocks to invest in. You have to consider multiple metrics and balance risk and reward.

And whatever you do don’t eenie meanie miney mo!

I also need to write a “proper” Fun Run update as of course here we are at the end of September Q3. This was the H1 update in case you missed it. Well technically I need to do that Monday night don’t I? Then it’s just three months to go! Can Paul Scott’s unassailable lead be assailed? Will there be any upsets?

What about Mr Arby and his passive portfolio? The rest of us racers are active pickers and Mr Arby spent 5 minutes picking out 4 holdings and presumably sat back and enjoyed reading the Oak Bloke and lots of other things. I have taken a leaf from Mr Arby’s book and now have a modest amount in BND (Vanguard Total Bond). I like the idea of having an asset which has unrelated returns. Still don’t like Bitcoin!

Unless something dramatically changes on Monday, then those of you who are cheering on the Oak Bloke will be pleased to hear I am not in last place, nor even 6th place like in the 1H24 update. Far from it actually.

2025

I am starting to consider 2025 ideas. I have a list and I’m checking it twice. I believe I’ve learned a lot during 2024. I believe my 2025 ideas will be both exciting and profitable, but of course I believed the same a year ago. Do I still believe in the OB19 for 2024? Yes, and without exception. Do I think some of them are not going to deliver in 2024 but will deliver in future years? Yes to that also. When choosing ideas you have to think about being on the cusp and not just that they represent long-term value (even though I’m a long-term investor). I guess that’s the lessson I’m taking into the 2025 ideas, if I can.

So reader, the rules.

Same as last year. I invite you, reader, to contribute ideas. You can do that today or do that some time in the next 3 months. Well done to the reader Mr Nick who contributed the idea for Cora Gold. I hope he’s handsomely profited this week. So I will review all your ideas and pick my favourite 10. I’ll then pick 10 of my own.

If there are particular stock ideas of other racers reader and you think I should include those then you can suggest those. I cannot pick my 2024 ideas again. It has to be 20 new ideas. I also want to pick ideas that are traded in the UK. But they could be US stocks, Australian or Canadian as they are tradeable from an ISA or SIPP. I would love to access Japanese stocks but still have not found an effective way to do this via an ISA or SIPP. I believe it’s via trading account only or CFDs and seems very expensive. A great pity as there are bargains galore in Japan. It can be ETFs, funds, ITs, Preference or Ordinary shares. Or Bonds.

A final thought is I’ve taken the decision to bin Research Tree after paying for it over many years. I reached a point where the analysis lacks any proper explanation and the inconsistencies and errors but also the fact that some of the “analysis” is just someone copying and pasting the RNS. Pointless.

But it feels very strange to be without it.

I wrote an article on Water Intelligence for example this week “WATR result” and saw the “padlocked” Dowgate article winking at me. Will my articles suffer because I don’t have the insight from Research Tree? Will I cave in and resubscribe? I would welcome your thoughts on whether you consider Research Tree useful or not.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Hi OB, great blog.

May I propose Helios Underwriting (LON:HUW) for your perusal.

I became interested in this when Sven Lorenz discussed the company as a consolidator of retiring Lloyds insurance 'Names' (or their estates) and the fact that the next few years profits are 'baked in'.

https://www.undervalued-shares.com/weekly-dispatches/helios-underwriting-down-the-rabbit-hole-of-lloyds-of-londons-insurance-market/

The recent Edison note is somewhat less enthusiastic, but it still seems very cheap compared to recent growth and prospective dividend.

https://www.edisongroup.com/research/strategic-shift-from-growth-to-consolidation/34016/

cheers,

Oak...Glad to see that you too are intrigued by EST. I have nibbled...what value for Verkhuba Jorc Inferred Resource Cu 20Mt @1.16% much of which with open pit potential+ local smelter cap+ massive VMS, porphyry+ sedimentary exploration portfolio in one of worlds best mining post codes...oh and with BHP Xplor funding....£4.25MM?....me thinks I should be feasting...