Dear reader,

Will they, won’t they?

Competition has heated up for the Arizona-based Antler project and a rival bid from Kinterra (whose emblem is snowflakes) could pip CAML to the post.

Am I bothered?

An offer of $0.064 has been received from Kinterra vs $0.062 from CAML. So CAML must put up (by the 17th July) or exit. The seller NWC say they “prefer” CAML.

The market meanwhile has driven the price to $0.0655 so believes the bidding war will continue upwards from here. Let’s see.

As I wrote about in the very recent article “Proclaiming” the upside from Antler could be substantial and even $0.064 per share is still a great price (it’s only a $7m increased ask).

NWC’s target price from CG is nearly double that price at $1.2. Given that Trump has since announced a 50% tariff on copper imports any US-produced copper therefore gets a circa $5,000 per tonne price advantage in the market - based on a circa $10k copper price, and Antler’s JORC resource of 557 Mt of Copper that’s equivalent to $1.4bn EXTRA over the life of mine. Of course assuming that all sales are domestic and that TACI does not apply (Trump always caves in) so the 50% tariff doesn’t disappear.

1H25 Ops Update

Did you spot the opportunity yesterday and top up on CAML? Did the price drop give you the hump? Or the double hump?

The Chattersphere was awash with err chatter, but no one seemed to grasp the implications.

Yes Zinc volumes were down -10% the average of the six past quarters, and Lead volumes were down -8.2% too. But Copper was up 2.7% on the average of 18 months results.

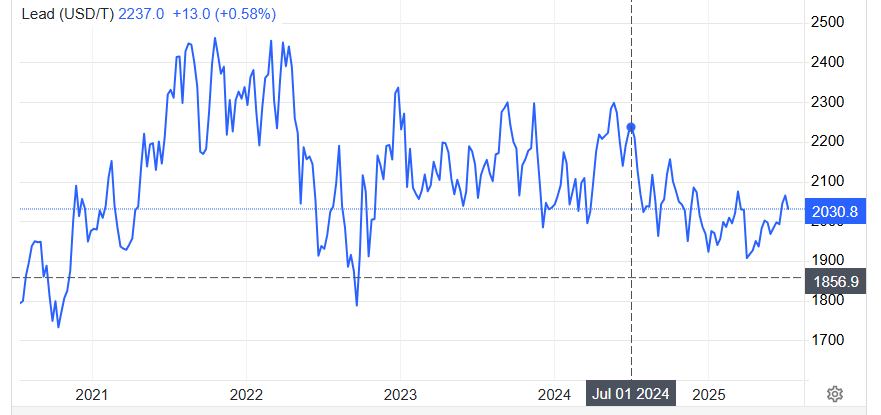

Prices over those same six quarters strongly favours copper while Zinc and Lead and both down about 10%. In 2024 the EBITDA margin for CAML was 73% for Copper and just 35% for Zinc/Lead.

In other words factoring in a -10% price drop and a -10% volume drop at SASA in 2025 (albeit bear in mind the 2Q25 results CAML tell us are temporary and expected while they change mining method) would be a -$5m EBITDA impact in FY25.

A $6.1m PAT in 2024 at SASA becomes a $2.2m PAT in 2025 assuming both the price of lead/zinc as well as the lower volumes continue.

A -$3.9m impact PAT.

Then consider the Copper business. Copper price received in 2024 was $9,219 per tonne. Assuming $9,750 in 2025 seems reasonable. That’s 5.75% ahead.

So an average 5.75% boost in price and a 2.7% boost in volume (if that’s the final outcome) on Kounrad (Copper) segment would be an EBITDA of $96.4m. That translates to an estimated +$5.9m increased profit after tax.

So yesterday’s news suggests an overall +$2m profit in 2025 (ceterus paribus) yet the price dropped -8.1%!!!!

Other news regarding Aberdeen offering drill results in the next few months and CAML X continuing its sampling and surveying is positive too.

If Antler falls through - and it might - then a couple of things follow:

CAML continues its search and I once again wonder whether its Copper future might end up being exactly where it is today…. in Kazakhstan. EST must be a target opportunity that CAML could swallow with ease. Yum yum.

There are vast opportunities in the Copper space and Africa is another destination I’ve written about extensively. What if it launched a bid for Jubilee Metals for say 50% premium to today’s price? Would shareholders sell out? Jubilee is full of harrumphers, angry at Leon, angry at the sale of the PGM operation even though I am bullish about Jubilee as I covered in “selling family PLAT-ver”. It’s an intriguing idea and JLP is a share that languishes even today. Or maybe Andrada, eyeing the Brandberg West project area with Copper resources.

The LSE is full of bombed out options.

In any case CAML own 12.1% of NWC since they bought 5% on June 20th at A$0.055 (costing A$9.84) and then 7.1% on June 26th (costing A$15.72) of NWC at A$0.062 and let’s say a rival eventually outbids and pays A$300m to take over the co. That’s A$0.084 per share or 1/3rd above the last bid.

That’s A$36.3m cash proceeds back to CAML for its 12.1% stake so that would include a A$10.74 profit premium to what it paid.

That is worth 2.82p profit per CAML share!!

Aberdeen Minerals

Interesting to see Aberdeen’s prior results shown below is based on a Ni equiv resource but the 0.36X copper and 1.44X Cobalt is way out, based on today’s prices. It should be 0.64X copper and 2.3X Cobalt.

If we ignore that and instead use the Copper Equivalent then the samples are very interesting. At 0.8%, 1.1%, 1.2% and 1.6% Cu equiv is well above the 0.4% global average for large Copper mines.

The above results are based on the below black lines and they only gone down just over 200m depth. The geo phys indicates that the resource continues to 400m or deeper…….

And that its project might and I say might be comparable to a Western Australia project called Nova-Bollinger. In the case of N-B there were 14.3Mt at 0.9% Copper, 2.3% Nickel and 0.08% Cobalt i.e. 2.7% Copper Equivalent. At as assumed 75% recovery you’re talking about £2bn of revenue (less operating costs).

Pay Up!

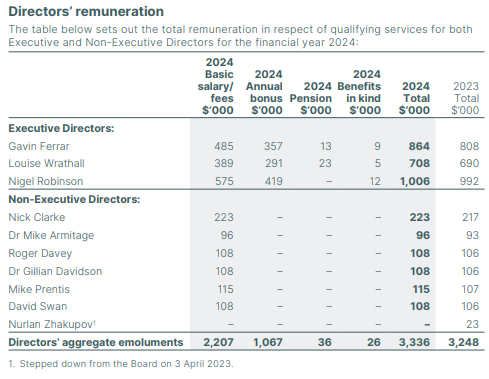

A commentator covering CAML yesterday focused on and criticised Director’s remuneration. Is this excessive? Half their pay is based on a bonus which is 80% tied to the success of production, profit and safety alongside a 20% “personal performance”. Yes there are quite a few (7) non Execs probably earning a bit more than the minimum. The top three Execs made £2.5m between them.

If they can continue to deliver profits and growth does this bother me? Not really. The commentator said the “excessive” pay was a major reason that people did not buy CAML which I thought strange. A major reason?

What do you think?

Conclusion

I added more CAML on the fall, and whether CAML pulls off Antler or the Snowflakes get it, there’s a win-win for CAML either way. There’s also plenty more projects out there too at knock down prices, and its two existing assets still have years of life remaining too.

Meanwhile and until a new project gets into spitting distance there’s an 18p dividend per year which is a 12.2% yield at today’s 148p.

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Disclosures:

I have no commercial connection nor receive any remuneration from any company I write about. I usually (but not always) write about stocks I hold and believe in i.e. I am talking my own book. I ask readers who enjoy and profit from my work to support Emmaus.

Thanks for the clarity in your assessment of the Antler bidding development.

What I like most about the bid is that it's all cash and debt, without shareholder dilution (which I loathe, and which with cash-rish CAML would be wildly unnecessary).

The pay of the non-execs though is well... generous, let's put it that way. The commentator was right to point that out disfavourably, but obviously share prices don't move by such details buried in the reports somewhere.

NWR deal is off.

https://www.londonstockexchange.com/news-article/CAML/update-on-new-world-resources-acquisition/17142749