Dear reader,

The second triennial is over. That waning summer sun dips lower each day, rises later and sets earlier. The leaves are turning color and we cling to the warmth of summer as clouds begin to roll in masking that beautiful sunshine for another season. Still we are British so tops off, keep running, and we will call it summer until the bitter end. Brrrr.

Four months remain. The 2025 Fun Run has some of its runners sweating and striding with their ideas delivering some impressive double digit results. Gold leader Mr Jon is nearing a 40% return in 2025.

Can I catch Mr Jon? I close in by about half the distance during August.

NB I’ve not gone through dividends nor any delistings/take privates so these are just the numbers according to Stocko with dividends up to July.

Here’s a thought. If you had £186k today and achieved a 40% return per year for five years compounded then you would be a millionaire by 2030. If only these 40% performances were so easy. 5 times in a row.

As a warning from the past, 2024 results now look very, very different. Race leader Mr Scott achieved 23.2% in 2024. Today his gains at +20 months have shrunk to below 10% putting him at 4th place. Wait, what?

Mr Scott kept his ideas secret in 2025 for his Substack Subscribers eyes only but hopefully he is enjoying double digit success once again in 2025 at his “Y Pilot” site. Is his website inspired by Star Wars? I must ask him one day.

Judging by the snippets he shares on his weekly video with Mr Hill (when the technology works) in 2025 he has focused on REITs and GARP shares and also recycled some 2024 ideas for 2025. Judging by the number of his subscribers (about the same as mine) he must be doing something good behind that paywall. Not heard about any multi bag successes though. He dislikes miners I think so that will have cost him in 2025. I looked at his top ideas last year and wasn’t keen. I reviewed CMC and Zotefoams to examine whether there was more in the tank and I didn’t think so. Both have since fell. I do want to review both again because I really liked Zotefoams as a business just thought their extruded carton was a bad idea. They’ve now binned the idea. I’ve probably missed out by not pouncing at the point of maximum harrumphing when they cancelled it.

Mr K Roast’s 2024 ideas have gone from zero to hero through the Guardian Metal idea up 170%. His other two ideas East Star is down -46% and Tech Minerals down -75%. I’m a big fan of EST and wrote about this two months back and own, TM1 not so sure but perhaps that’s worth another look.

My 2024 idea POW held 40% of Guardian and sold it in two tranches of 30p and 55p but missed the ride up to 80p on the (inevitable?) news of US Defense Industrial Base cornerstone support. That’s a pity but POW remains vastly undervalued and I’ll be writing about that again soon.

Mr P Roast’s best idea from 2024 is actually POW down -13% since including it at 19p while Jubilee languishes -52% although up now at 3.3p. I last wrote my “Arnhem-themed” article on JLP with Kojak riding astride a Sherman, cigarette hanging from his chops, when it was 2.7p so it’s up 20% since then. More to come I believe. Copper nears $10,000 a tonne as I write. You would think Mr P Roast must be incandescent about Incanthera down -85% but no, recently he spoke in its support and how things will turn around. I’m not so sure. It dropped -11% last Friday so shareholders didn’t get that memo. It seems like a good idea but I’ve come to learn you need more than a good idea in investing. A lesson hard won.

Is it flattering or cheating to peer over to fellow fun runners and look at the good, the bad and the ugly? To want to ape the fastest and to avoid the mistakes of the slowest? It seems a solid strategy to me.

Thanks to Mr Jon I am now a proud owner of Thungela and The Works. His best and worst. I will publish the Works article during this week but YouTubers get to enjoy it first. The short version since many people harrumph at my long videos (it’s 1 hour) is that it is attractive even if it has already delivered triple digit results.

USA

Some people are assuming the US stock market is due a massive correction and some massive revaluation event is imminent. I just don’t see it. The earnings are simply too solid. The rally is broadening to the Russell 2000 even if the Mag 7 might tread water. Interest rates are nearly certainly being cut and pressure will remain to cut more. Will inflation rebound? Possibly but much of that will be excused at temporary - and it will be. Tariff inflation and FX inflation is not the same as cost-based inflation and nor is it demand-based inflation.

Some people view the world as governments can “run out of money”. Rachel from accounts has run out of money they might say. There was a note left for the Conservatives in 2010 that there’s no money left. It is simply not true. Not ever. Not when governments control the money supply. And they do. The BoE can print unlimited amounts of money and previously have under QE. Whatever it takes, right? The consequence is inflation. Not tariff induced cost push, not FX at least not at first. Purely demand based inflation. More printed money chasing after too few goods. You end up needing a wheelbarrow - literally in the Weimar republic’s case 100 or so years back.

Therefore this recent YouTube comment on “stagflation” and “RPI” made me think about the macro elements that matter to different shares. Will higher inflation affect Greggs? Probably not. They pass on price rises. Moreover they will have contracted prices for Flour, Pork, Oil and all the other wonderful ingredients months and years ahead. 100% of small competitors won’t have hedged will they? GRG has pricing power to pass on rises. Inflation near 5%? Ok. And wage growth is near 5%. So a Gregg’s is no more pricey. Population rising. Employed population at record levels. Why do we fixate on “GDP” and “inflation” when there are positives too:

More people, who are less indebted, with wage rises (living wage rises are much more than 4.6% mind you), a record UK population with a growing consumer confidence.

Terry Tibbs. That’s a name I’ve not heard in a while.

Stagflation. Something not to be worried about? Talk to me.

Russia and Oil

According to various sources the Ukrainians are targetting and taking out numerous oil refining facilities within Russia. 17% of oil refining capacity. At what point does that create a bullish narrative for oil?

The US shales are not being drilled (baby drill) and the price of oil has caused a hiatus on exploration. OPEC announced they were expanding output and so far have achieved 2.2mbbls of increased output. 20% of that is overproduction and demand growth is estimated at 1.4mbbls in 2025 and again 2026. So OPEC are keeping pace and are notoriously opaque about its true ability to expand production.

OPEC have further announced they will cut production if oil fell below $50/bbl. What if ironically Russia is able to supply far more crude oil due to those Ukrainian attacks? After all it can’t refine crude oil so it has may actually have more to export…. as crude oil.

I notice US Natural Gas has barely dropped below $3/mmbtu all this year, while it barely reached that price in 2024. Canada had $0.60/mmbtu pricing! A BOE for >$4!

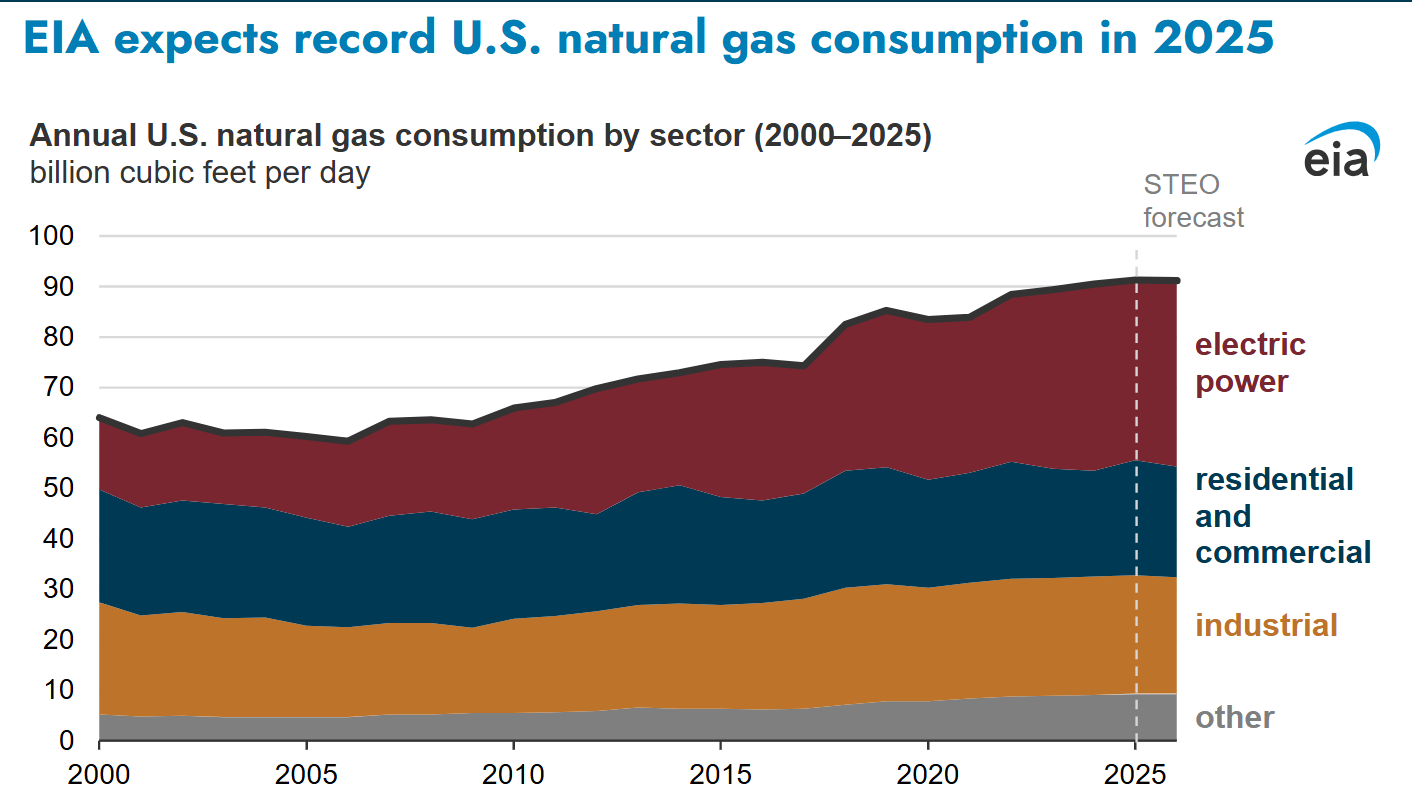

I remain of the view that US and Canadian natural gas could offer strong upside and chart after chart suggests demand is growing (the below excludes LNG exports remember) while supply is not.

Peace with Russia

I am thinking about the implications of peace and beginning to think about ideas which will profit from a peace. More on that in the future.

Nvidia

Nvidia 2Q25 Earnings Update: AI Demand Drives Record Revenue Amid Market Volatility. Computation has increased by one million times in ten years.

Nvidia continues to dominate the AI landscape, reporting blockbuster results for its fiscal second quarter ended July 27, 2025, that underscore the unrelenting appetite for its cutting-edge chips. The company posted revenue of $46.7 billion, a 56% surge from the same period last year and a 6% increase from the prior quarter, smashing analyst expectations of $46.06 billion. Adjusted earnings per share came in at $1.05, topping the forecasted $1.01 and reflecting a 59% jump in net income to $26.42 billion.

This marks the ninth consecutive quarter of over 50% year-over-year revenue growth, fueled by the explosive rise in generative AI and data center infrastructure spending.

Key Highlights from the Results

Data Center Dominance: The star of the show remains Nvidia's data center segment, which generated $41.1 billion in revenue—up 56% year-over-year but slightly below the $41.3 billion consensus estimate. This division, powered by GPUs like Hopper and the newly ramping Blackwell architecture, accounted for about 88% of total sales. CEO Jensen Huang highlighted "amazing" demand for Blackwell, with sequential revenue growth of 17% and production now at full speed. Huang also projected $3-4 trillion in global AI infrastructure investment by decade's end, positioning Nvidia at the epicenter of this trillion-dollar shift.

Guidance Signals Continued Momentum: Looking ahead to Q3, Nvidia forecasts revenue of $54 billion (plus or minus 2%), implying over 50% growth and beating Wall Street's $53.1 billion estimate. Gross margins are expected to hit 73.3% (GAAP) and 73.5% (non-GAAP), with the company on track for mid-70s margins by year-end. Operating expenses are projected to rise in the high-30% range for fiscal 2026, reflecting heavy R&D investments in AI and robotics.

Huang emphasised the "immense" AI opportunity, noting that hyperscalers like Meta, Microsoft, Amazon, and Alphabet are committing tens of billions quarterly to AI buildouts.

Challenges in China and Geopolitics: No H20 chip sales to China were recorded in Q2 due to U.S. export restrictions, though Nvidia benefited from a $180 million inventory release to a non-China customer. CFO Colette Kress indicated potential for $2-5 billion in H20 shipments this quarter if geopolitical hurdles ease, following a recent U.S. agreement allowing sales with a 15% revenue share to the government. Huang stressed China's $50 billion market potential for Nvidia this year, but ongoing tensions—including Chinese security concerns and domestic alternatives like Cambricon—could cap growth. Despite this, Nvidia is exploring a compliant Blackwell variant for the region.

Shareholder Returns and Broader Ecosystem: Nvidia returned $24.3 billion to shareholders in the first half of fiscal 2026 via buybacks and dividends, with a new $60 billion repurchase authorisation approved. The company also teased advancements in robotics (e.g., Jetson Thor modules) and agentic AI, areas Huang sees as multi-trillion-dollar opportunities beyond core data centers.

Nvidia's results affirm that the AI boom is far from over, with hyperscaler capex revisions upward (e.g., Alphabet to $85 billion for 2025) signaling sustained demand.

Rather than investing directly in NVDA I am excited about the impact into business and those businesses which are able to do more than mention the word “AI” lots of times but actually harness it to deliver improved performance and achieve return on investment.

Gold $3,448 an ounce

Gold is my second largest “sector” holding. Notice I don’t self-classify just “mining” if I did that would be 36% and “Extractive Industries” i.e. O&G would take me to 49%. For those who thought I should be called the “Woke Bloke” renewables is actually my 7th largest sector.

I leapt on news from MTL from illegal miners had contaminated the BIOX circuit. The key words were we still expect to meet guidance. Picked up more MTL for below 12p. Wow.

Why?

In my article “MTL-lurgy” I’d assumed 70koz in any case and 3.1p of earnings based on that, so that alone is a 4X P/E at my $2,800 rate in the article. 3X at $3,450 an ounce.

Meanwhile for La India with the Nome Gold Processing plant one month ahead of schedule and on its way to Nicaragua, with the Phillippines Dupax tenement granted and survey and drilling underway. It’s early days but a 10km strike with samples of up to 15g/t and 7% copper that’s incredibly attrractive.

Look at the zinc too.

Meanwhile my top performing idea is THX and I will write about that soon. Other ideas I’ve written about in 2025 are profiting from Gold’s rise too. Some ideas remain in the shade and under appreciated. I’m focused on looking at relative prospectivity. I may need to eat humble pie over UFO (Alien Metals) up 150% since I said I wrote “Take me to your metals”. I thought the lion share would go to WCE and so far that is accurate up 200% since my article of June 20th. It remains the case that UFO will probably end up with 2% NSR on Lizzie Hill unless they dilute shareholders to fund the 30% of costs.

A rebound in Iron Ore above $100/tonne means their proposed Hancock operation will be able to make small profits although at the time of writing it would be loss making. That rebound in Iron Ore hasn’t been reflected in OB 25 for 25 idea KDNC Cadence which is interesting and UFO’s share price possibly reflects giddiness about Silver rather than anything else.

Uranium $76.65 spot a pound

I very wrote recently about Uranium and a further interview from UUUU this weekend only reinforces my view that this could be a huge macro. Can YCA Yellow Cake make money. Sure. A lot? Not so sure.

Is buying gold better than buying a gold producer when gold is going up in price. Your exposure is Linear vs Leveraged. An owner of an ounce of Gold has just over doubled their money since the $1600 lows for gold. Gold miners have (much) more than doubled since those lows. I bought HOC at 60p in 2023, it reached 333p in 2025. >450%. That’ why GCL is my preferred approach.

AIM Best Shares of 2025

I saw this chart and was delighted that seven out of twenty of the top performing shares I’d covered closely. Of course it made me curious about the other 13. Perhaps they will go on a list of ideas.

Shield felt like an opportunity missed and that nearly was part of the OB25 for 25 even if I’ve never written about it. I was surprised to see Eurasia and Illika in there. Those two make me think but where is Mast Energy? That’s up a squillion percent this year. Shouldn’t be as I wrote recently but is.

Empire Metals is an idea that a reader thought I should write about in April when it was just 10.5p. Today it is 52.5p. That’s one that got away for sure. That idea was one I didn’t get to but I’ve covered many ideas from “Vote for the next article”. Perhaps I should create another round of voting?

Missed Ideas - but missed the boat?

I haven’t forgotten FRP and BEGbie’s. FRP is up over 10% since I mused last month in the article “Head Down” that Mr Head’s decision to bin FRP was a mistake. BEG meanwhile is down to a tempting 120p a share. Hmm.

Shield deserves an article and Empire Metals deserves its day in the sun. One reader has contacted me about Cabeletto Bio a few times and that deserves a look. Puretech is in the same space and that deserves some time.

Insurance ideas I’m curious to look at, so Chesnara, Sabre and Helios all deserve a look.

BISI definitely deserves a look, after my excitement at Thungela.

I’m also interested in Oil Services, so Petrofac and possibly some others deserve a look. GMS is not up nor down since I was pretty neutral on it in “Nuclear Wessels” three months back. Paul Scott’s biggest holding Plexus deserves another look at its future “POS-obilities” but it is well down since I looked at it last year. Is its fate sealed or can it rise again?

Forgotten Friends?

OB24 and 25 ideas Agronomics, Andrada, Augmentum, Mkango, Kavango, Kadence, Power Metals, Pinewood, Puretech and SEIT are all due an update.

Couple of quick points.

Tin: With Tin at nearly $35k and Lithium rebounding off record lows it’s no surprise that ATM is rebounding from sub 3p lows. This is a share where admitedly I’ve flip flopped from bull to bear and back to bull. “The Cavalry” sets out why I turned bullish again and my model now suggests ATM should now be net profitable in 2H26 (to Feb 2026) and that’s a huge step forward compared with the -£9.8m loss in FY25.

Banking (and Cancer): Reeves is mooting taxes included a potential tax raid I mean a levy on UK banks. Will that include neo-banks? Perhaps, but disproportionately the large banks will bear more of the burden, probably. Will that be a further reason to favour neo-banks? I’m positioned to those.

AUGM’s Zopa and Tide which I covered in “AUGM-ers well” can be bought at less than 98p per AUGM share so at a 49% discount to NAV, where NAV is not reflective yet of their progress. CHRY’s Starling similarly is at a 35% discount. GROW’s Revolut near 50%.

INOV’s Revolut and Atom Bank holdings are now above a 41% discount or potentially a 64% discount depending on the success of holdings its sold. This includes Araris sold to Taiho Pharma. Araris opens up a new technology for continuous discovery for oncology diagnosis and treatment.

Four months after one year’s collaboration with Taiho paid $400m upfront for Araris and a further $740m deferred depending on product development. The speed of purchase (4 months is very, very fast imo) signals how excited they were to acquire.

The $720m follow on for Araris is potentially worth £46m to ex-owner INOV i.e. 7.2p per share to INOV-ators. That’s part of why I believe today’s 13.1p share price could be a huge opportunity for the patient (investor). Araris is part of the reason why there’s 12.3p “INOV-ious” to most folks.

These excerpts from Taiho’s Q&A relating to the purchase are very interesting:

That’s probably enough musing from me.

A fun run, racing upsets, coal, bargain books and toys, US economy, the fallacy of inflation, macro economics, Terry Tibbs (talk to me), Russia, Oil, War and Peace, Nvidia, gold, uranium, AIM top ideas 2025, new ideas, missed ideas, remembered and reminded ides, forgotten friends ideas, tin, banking and cancer. Who else writes a newsletter covering those topics in one sitting? Phew.

If Terry Tibbs were calling you he’d ask:

A fun run, racing upsets, coal, bargain books and toys, US economy, the fallacy of inflation, macro economics, myself, Russia, Oil, War, Peace, Nvidia, gold, uranium, AIM top ideas 2025, new ideas, missed ideas, remembered and reminded, forgotten friends, tin, banking and cancer. Talk to me.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

The WRKS AGM is next week and Mr Rebel believes a trading update will also come out. Probably just needs to confirm L4L sales running around 5% and the market should like it (famous last words).

PMs may have just started another leg higher. Silver over $40 and Gold nearing $3500. THX is likely to produce 23p EPS full year (my fag packet) so PE is still under 3.

OB - any thoughts on sector weightings or don't you worry and do you let the winners run? I have 30% in commodities with gold about 25% of this. For example THX has gone from 5% to now 10% of portfolio but don't want to cut the winners. Oil stocks like SQZ and DEC have done very well and credit you with the timing of your articles. They still seem reasonable value if happy to hold longer term.

On the insurers (me giving back to you - does fantastic deep dives) - https://www.youtube.com/watch?v=uZpGBjT3ZuI

Sabre is very boring but seems to have 1 bagger potential over a year. Warren Buffett stock for sure. The yield curve returning to normal seems to be good news for the banks and insurers. It would also indicate no recession.

Thank you for the time and effort put into your latest musings