Dear reader,

Copper

Everyone is talking about Copper all of a sudden. The newspapers are full of it, Bloomberg, CNBC, investment sites. Even yours truly recently wrote the Copper and Copper Two articles. In fact of 234 Oak Bloke articles 25 are actually about copper (26 articles including this one).

As I write this, Copper is up 38.3% from a year ago. It might go up another 10% to around $12,500 a tonne in 2024. There’s definitely more money to be made from copper.

But I also spoke to how much of that gain is actually already in the price - particularly in the Large Caps. Anglo is already poised for takeover battle, ANTO is eye wateringly expensive on a P/E basis. Copper mid caps offer much better value - CAML, ARG, ATYM all offering juicy divis with capital growth although each offer pluses and minuses. Even Jubile (JLP) is now finally on a tear. The upside to Jubilee is far greater than the broker 11p target price. But Anglo Asian and Phoenix (AAZ and PXC) also offer intriguing growth prospects.

POW (via GMET), KAV, ARCM are prospecting for copper. News is imminent from all. None of these have exploded in price yet.

BSRT with its Nussir Norway mine awating FID. Will it need to wait much longer? Bizarrely (at least) I think so BSRT has dropped the value of Nussir from £3.3m to £3.1m. The IRR at $11k copper is upwards of 40% with an upside case based on the inferred resources. At a production rate of 15ktpa $11k copper translates to $67.5m additional revenue compared to $6.5k prices - or £53m per year. BSRT’s 12.1% ownership means that’s £6.4m ADDITIONAL revenue per year attributable to BSRT that flows straight to the bottom line.

BSRT’s Metal Exploration Plc holding is exciting too! Not only is its target price from H&P 50% higher than today’s 4.5p buy but nowhere in that target is any copper. Nick, an eagle-eyed reader, alerted me today to Manikbel (ding a ling).

I stress it’s early days and next news is expected in 2H24 but evidence of upto 15% copper could be a whopper - where is that in the price? Nowhere!

Finally TRR and ECOR are royalty co’s with copper in their portfolio. Neither have risen much in price so offer plenty of leveraged upside.

I would encourage you to listen to Jeff Currie who speaks an awful lot of sense about Copper. I would draw your attention to how Jeff speaks to how China’s housing crisis has been more than offset by energy transition. What I felt was absent was India’s copper demand, Indonesia’s copper demand. Jeff spoke to how the poor disproportionately consume copper as they grow richer. Applying this principle there are many developing economies who can absorb China’s slowing demand. There are more Indians than Chinese. Indonesia is 250m people. If you then add the Thais, the Vietnamese, and other non Chinese/Indian peoples you arrive at not far off the population of China. Meanwhile even if Chinese houses are stalling, Chinese industrial output is up 6.7% for the year to April 24 so fewer houses but more stuff being made containing copper.

What else than copper?

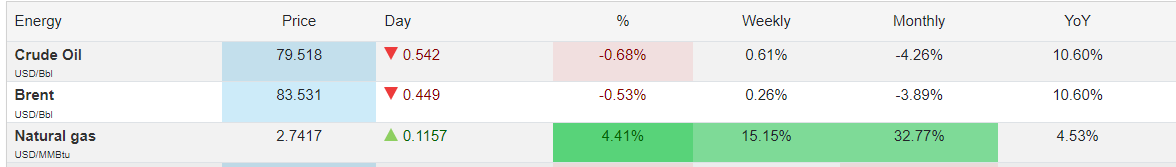

US natural gas is up 33% in a month. Judging by the hedges DEC is locking at around $4 gas will not stay at $2.74. DEC remains bombed out at £11.25 and at over 50% discount to its NAV. LNG exports will rapidly rise leading to a change in Henry Hub prices.

Oil offers further upside too. There’s plenty of scope for upset in the Middle East. The US still need to refill its strategic reserve too.

Uranium

Very excited for uranium.

The UEE spin out from Power Metals will drive value. Cosa resources is a £10m market cap and is arguably similar to POW’s athabasca basin holding.

POW is a £17m market cap minus its GMET and FCM listed holdings and cash it’s a £6.5m market cap. So £3.5m and other holdings are in the price for free.

Base Minerals which I discuss I like the base base base is another way to get in to Uranium - and rare earths. You will end up with a US listed holding in UUUU which is buying up monazite miners to obtain rare earth (REE) feed.

Tungsten

Tungsten is now at $43,000 a tonne, up 40% YTD so more than copper. Tungsten West (ticker TUN) is a compelling mine - if it can get environmental approval. The locals already believe it’s a done deal if the Plymouth Newspaper is anything to go by. Tungsten is important for military applications and weapons but also for Nuclear Fusion. Guess who controls 82% of the world’s Tungsten, ‘ow d’ya guess tha’ me’ ol’ China.

The economics of TUN’s Hemerdon mine in Cornwall, UK, are IRR 22% based on Tungsten at $34k a tonne and Tin at $30k. The NPV was £232m at a 6% discount. Of course discounts are now NPV10 not 6 but based on a 6-9 month construction time and a year 1 production of 1.8kt of Tungsten with 0.25kt Tin the gross profit doubles and net profit goes from -£1.3m to £7m PAT. And that’s just year 1. Production doubles by year 3 with profits growing.

Today’s market cap for TUN is £11.5m (and that’s tripled this year from below £3m). But the share price will go much higher if they can get EA and FID.

The Oak Bloke Top 20 Idea BSRT is currently the largest shareholder in TUN with 15.4% and in addition, the Company holds approximately 12% of Tungsten West's £10.35 million convertible loan stock. H&P previously saw a target price of 60p on TUN and that was at those old commodity prices and IRR of 22%. That would make it a 12X bagger and 27.4% of 12x£11.5m is a £35m upside for BSRT (whose own mar cap is £56m as of today)

GMET (owned by POW) also have a prospective Tungsten resource at Pilot Mountain in the USA but that’s much earlier stage than TUN. However intimations have been made that the US government are going to provide support. There’s precedent for that. The US Government have recently provided a $2.3bn loan for Thacker Pass’ Lithium. But Thacker is near production, so I do wonder whether investors will have to have lots of patience to see value from Pilot. The OB has applied patient capital in POW, but TUN feels closer.

Tin

Tin is up at least as much as Copper and is around $34.2k/tonne today. Andrada is expanding its production via its Continuous Improvement 2 Funding, and developing its Lithium and Tantalam too. Quite how ATM remains at 5p baffles me.

EMH has vast amounts of Tin, Tungsten and Lithium too. Just considering the Indicated volumes (149kt) the PFS considers the credit at $21k/tonne (equates to $3.1bn of credits). At today’s $34k/tonne that’s $5bn of credits - a $1.9bn difference. That works back to an $100 extra credit per tonne of Lithium. The DFS will be released soon. Investor’s patience will be rewarded.

BSRT’s First Tin (LON:1SN) now has its DFS for Taronga and the IRR is a delicious 34% post tax at a tin price of $33k. If Tin gets to $40k the IRR gets to 45%

Silver

I’ve been perenially disappointed with Silver so have mixed feelings. Yet 1 year performance equals copper. HOC is a great way to play silver and BSRT which holds Silver X but also owns a royalty over the largest silver mine in the world…. in Russia. Can it collect?

My data models show that BSRT’s 5 listed holdings covering Silver, Tin, Tungsten and Gold since 1st May have gained £3.55m for BSRT. That’s a 3.3p NAV boost a share.

Gold

There are plenty of gold mining opportunities, and I wrote Gold Finger Part One and Two recently.

Of the producers Pan African Gold stands out with CMCL following, although I still like Centamin. I notice Hummingbird finally went back to work today.

Junior miners excite me like POW, KAV and MTL (via BSRT).

Trident’s large gold exposure is also very exciting.

Central banks drove the price of gold but by doing so Gold is now firmly back in peoples’ minds after being in the wilderness since 2021.

SALT

Microsalt got its patent pending approved for the US. It also had a very positive write up in Shares Magazine and previously the Investor’s Chronicle. (Although the Oak Bloke was there first ha ha).

Salt is going up more than copper!

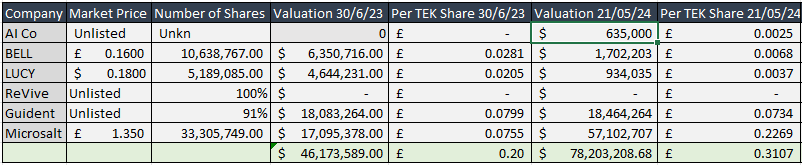

As an aside it is interesting that TEK holds 33.3m Microsalt shares and which has recently been at a 60% discount to its NAV but is now at more than a 60% discount. You can buy TEK for 10.8p and 60% discount on a 28.6p share is 11.5p.

Each TEK share holds about 1/6 of a SALT share which is worth 20.2p. Why you’d want to discount a double bagger asset like Microsalt by 60% - particularly when it is PUBLICLY LISTED is baffling. TEK have a lock in period until next March. To bide the time Microsalt will be releasing commercial updates meanwhile as it is negotiating with multiple global food brands such as Pepsi perhaps, and CVS Pharmacy. BELL and LUCY are also listed and add another 1p per TEK share. BELL has staged something of a price recovery, albeit on no news, but LUCY languishes langourously on the Nasdaq. Intriguingly however, multiple institutional investors have bought into LUCY and a local fund manager in Boca Raton, FLA has spent $200k acquiring 1m LUCY shares.

And now for the Unloved

a/ Spare a thought for unloved Vanadium - used for steel and for VRFBs, I’ve written about those recently. For the patient investor Vanadium has lots of future potential. The Bushveld crisis rumbles on and the vote to agree the sale of Vanchem is under debate. A powerful letter from one of the shareholders has emerged championing an alternative course of action.

b/ Met Coal - BSRT’s Futura was featured in an Edison 20% yield article, driven partly by its Futura Met Coal. No one loves coal but that’s why it is cheap and unfortunately still necessary (unless we are happy to forego stuff made from steel)

c/ Hydrogen - another unloved area is hydrogen and hype in 2021 led to a strong backlash in the past few years. But here in 2024 a lot of money is going in and regardless of whether it will succeed or not, the level of support the EU, the US and much of Asia is affording hydrogen it’s hard to not think it will see glory days again. I like HGEN and wrote about this recently.

d/ Renewable Energy and Storage - we endlessly are told the discount rates have risen, and it’s crashed all the renewable stocks. The double whammy is that UK power pricing has “collapsed”. But renewables have index linked revenues, usually contracts for difference, they usually can pre-sell at locked in prices. It’s true that electricity consumers are enjoying slightly lower prices relative to the energy crisis but power remains extremely expensive relative to history. Something smells here. This sector is incredibly unloved and I intend to write more about this area soon.

e/ The AIM market - we are back to the same level as 12 months ago but a 50% rise from here would return AIM to its 2021 levels. The FTSE 100 is already at all time highs, while the FTSE250 would need to rise 14% to return to 2021.

Conclusion

I’ve advocated for quite a while for commodities and particularly for prospectors and high growth opportunities, but also high yield opportunities in commodities. The market has finally caught up to the reality that energy transition requires copper - and lots of it. It is my belief this theme has further to go.

But other metals and commodities hold opportunity too. Uranium, Tungsten, Tin and Gold all appear to have strong support from macro themes.

I’ve thrown in some contrarian ideas too. What’s your view? (Feel free to leave comments below too)

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

MTL also prospecting for a large copper / gold resource in the Philippines. Might be worth inclusion in this group

Good article, have a look at BNKR in Canada, hasn’t moved yet