Dear reader

FLASH UPDATE

Return of up to £37m

Eagle eyed readers will know I said 10 days ago the ex-cash value at INOV was a discount of 72.9%. Well £37m of the estimated £50.40 liquid funds is being used for a tender. Smoke out the weak hands!

This is up over 60% since I wrote about this last October. Is there more upside to go?

Based on the Estimated Net Asset Value per Share of 21.36 pence as at 31 May 2025, less the pro rata anticipated costs of the Tender Offer, the Final Tender Price would be 21.119983 pence per Share as at the date of the Circular (the "Indicative Tender Price").

This would result in the purchase of approximately 21.42 per cent. of the Company's issued share capital as at the Latest Practicable Date (excluding Shares held in treasury). Completion of the Tender Offer is expected to take place on 28 July 2025.

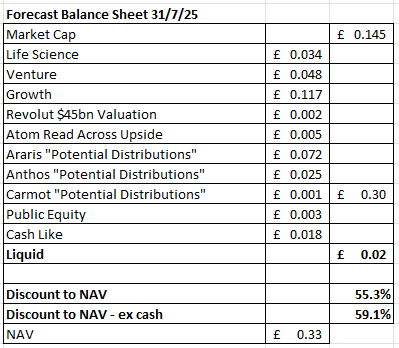

If that’s accurate then the resulting balance sheet would look like this:

I’m assuming the market cap drops by the £37m from today’s £130m.

Shares in issue would fall from 808,582,899 to 635,384,442 and the NAV per share would RISE to £0.33. How is that possible you ask when the tender is at NAV less costs. Well dear reader, the power of “Potential Distributions”. Those are not in the NAV and therefore offer an opportunity for accretion. If you believe they can arrive.

Ignoring dealing costs even if you buy today and 60% of the forecast NAV is wiped off to zero then you break even.

Back last October that margin of safety would be 81%. That’s because you’d get £466.43 cash for 21.4% of your shares, and that leaves £534 to break even on shares potentially worth £2,807.

This is the expected timetable:

This is not advice of course.

But the calculus has moved significantly here - assuming you believe the Tender can be voted through (seems an obvious decision) and that the remaining NAV is more solid than it was historically.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

so the best is to tender or to keep?

Am I right in thinking it's a no-brainer to buy 21.42% EXTRA shares now (at around 15p), then elect to sell 21.42% of my ORIGINAL holding (the Basic Entitlement) for c. 21.11p in July?

In effect, I'd then be making just over 6p on every share sold.

Presumably the only risk with this would be if the tender offer didn't get approved on 10th July?

Or are there any other risks I'm missing?