Dear reader

I’m doing this on November 30th otherwise I’ll be going all retro and we all know what that will look like.

I’m not sure I’ll track lots of other Ideas in 2025…. it’s a lot of work. What do you think reader? Is it useful to know one person’s ideas are the best and someone else is the worst? After all what happens when ideas crash and oscillate month to month? As has happened this month.

What happens if during December one of the Mr Roasts gets a turbo boost and beats Mr Scott to the finish? An idea which was better over 12 months and was worse over 11 months. Does it matter, actually? Should we value preservation of capital against loss equally with achievement of gain? What about considering this. You may have only picked 1 of the multitude of ideas, you may have chosen the idea not on the 1st of January, you might have bought and sold and rebought…. there are so many variables (and you make your own decisions of course) that this fun run is in a sense unrealistic. People focus on YTD as though that is a decent metric but is it?

Anyway, the penultimate result is here.

The Results:

#1 Race Leader Paul Scott 24.7% YTD (inc. dividends)

In a real hare and the tortoise moment Mr Scott’s 20 ideas tumbled in November. I say tumbled, 7% isn’t a tumble, I meant stumble. But some names are down 37% in a month. Ouch.

I wasn’t surprised that CMC was down having looked at it back in July in my article “Charlie Mike Charlie” where I felt it was very fully valued and even something as simple as I really didn’t like their web site navigation. Especially relative to my comparable pick TCAP, but also against incumbents like Hargreaves Lansdown. Zotefoams, too, is now barely ahead YTD and its magic carton now needs backing from someone else, but a decent business now at a decent price. Dividends contributed 1.98% to Mr Scott’s 20 so while he doesn’t consider that in his own reckoning I reckon he should and you should too.

I must admit I am considering some of Paul’s 2024 picks as 2025 OB ideas. Considering all Fun Runners’ ideas - as I’m sure are you. Intercede and Volex are probably the leading pair but I do like others. I have plenty of my own ideas (as readers will know) but I’m not too proud to give credit where credit’s due and ultimately the fun run is a co-opetition. We can learn from each other and I’ve learned from Paul in 2024. I’m also delighted to announce that Mr Scott is now a fellow Substacker so for the 1 in 1,000,000 (is that enough zeros?) who doesn’t know his excellent work you can find that over at:

The Oak Bloke featured on one of Mr Scott’s podcasts earlier this year but sadly the Oak Bloke substack hasn’t yet merited any mention or recommendation. This time next year Rhodders, this time next year.

#2 Mr Arby - don’t be active - be passive for a 8.8% gain

There’s no similar excellent work from Mr Arby. I’m not being rude but that’s the beauty of Mr Arby’s race technique. In 8 months and having spent less than 5 minutes Mr Arby has achieved an 8.8% gain since 1st April. Mr Arby weighted his portfolio leaning 40% into US stocks (Vanguard’s VTI) for a 6.1% weighted gain YTD (15.2% unweighted), while his 5% bet on Bitcoin via ticker IBIT unweighted has flipped from a 30% loss now to a 35.2% gain. Turbo boost! If Mr Arby had gone equal weight on his four holdings he’d be on a 13% gain. It provides a lesson to us all that picking stocks and trying to be clever at least in 2024 in this particular fun run has proven in most cases to be profitable than picking an index. There’s probably a depressing element to that statement (for stock pickers) but encouraging for nervous folk and amateurs - just buy an index and you’ll be ok.

So stop reading and just buy an index. $10k becomes how many million over time?

#3 The Oak Bloke - puff puff - think positive, think positive - hooray a 3.5% POSITIVE YTD!!!

Oak Bloke aficionados will join in rejoicing that I’ve hit a positive return. Finally harrumph the detractors. Considering I’m the only runner with a holding which went bust (Saietta - a 5% penalty on 20 ideas) and who started with an array of what were described by fellow races as “highly speculative” ideas which arguably would win over a period longer than just a 12 months period I’m pretty pleased. In fact it’s interesting that the “sucker stocks” as many were back on Jan 1st now appear as “turnaround” or other more positive titles - because the hidden value has revealed itself during 2024. To say I’m a speculative bloke, misunderstands me and how my brain works and the analysis I did. But it’s true that a large slice relied on an environment where growth capital was available and 2024 has been horrendous - again.

My dividend strategy netted me over 6% (128%/20) so far in 2024 (far more than any other runner) and I’ve got another 0.4% in the bag for December. Can I end in #2 place? My new 20 2025 ideas are overall going to deliver at least 5% yield because I see this as a great component of returns. A close eye on both Mr Scott’s and Mr Arby’s success factors too.

Hidden value like at Kazera where the 50% HMS and the sale of Aftan made the whole thing a no brainer if only they could get started. They did just about. Just like this leapt from 0.3p to 1.1p during 2024 I continue to believe it will jump by a similar amount in 2025 once the commercialisation of the next door 35X larger beach Perdlevei begins. The arbitration to recover the $8.8m owed (growing by 8% per annum interest meanwhile) and the imminent opening of the Arcadian mine in 1Q25 means KZG will be able to use this cash to commercialise, I believe.

Hidden value like at Baker Steel which was apparent, really, when you looked at and understood the assets. Like its holding Nussir whose DFS was based on $6.5k copper! (It’s $9.5k today). Yesterday’s RNS on Nussir that it is being acquired by Blue Moon and will be a £6m prospective gain for BSRT. That’s a 10% gain to NAV. 6p a share (if completion occurs)

Yet the market is asleep - up 0.9% on the news yesterday. I hope Oak Bloke readers carefully consider the opportunity at BSRT (make your own decisions) as well as a further Oak Bloke 2025 idea I’ll be announcing this weekend which has OUTPERFORMED BSRT by a country mile over time.

But also the opportunity around Tungsten and, how, while GMET is exciting it’s not the only Tungsten holding to be excited about. BSRT’s Tungsten West offers fantastic upside too.

DEC. Remember reader (if you go back to the start of 2024) I wrote if I could (and Mr Arby later did) I’d make DEC 50% my portfolio? And the other 19 the other 50%? If I’d done that, I would be in 2nd place today….. With a 13.9% YTD return.

Saietta would’ve cost me a -0.5% return instead of -5%. DEC stands at +39% today and in the USA it closed at $16.36 which is £13.08 so about 3% higher still. My frustration has been palpable but I did write “Winter is coming” and just like little Ned Umber up on a wall hissing at passers by it’s little surprise that the short attack is partially melting following a strong Q3 result from DEC. With cherries on top through a new stream of revenue via Coal Methane as well as land sales which will greatly excite Malcy, a Trump victory which will be positive for DEC (at least). More to come from DEC in 2025. Go and watch a Gulf Coast LNG terminal if you disagree.

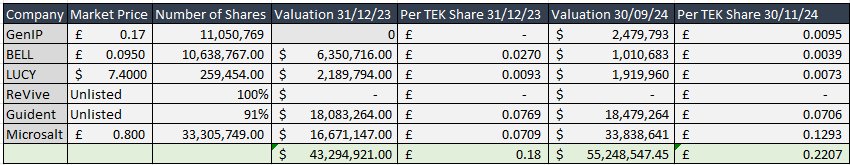

TEK deserves comment too. TEK that it recently managed to raise £1m funds towards a Guident IPO. That an IPO is on the cards is a huge positive. Just look at the progress at Waymo and Tesla. Look at the area of robotics. I see the £1m raise as a hugely positive progressive move yet the market saw it as an immediate negative. The drop down to 8.4p was a further opportunity for me to trade down and buy more. Newly listed Gen IP oscillates wildly day to day and is forecast to reach break even in 2025, and the basic reality that it can provide valuable advice at a low cost (of circa $1,000 per idea) seems lost on the market. BELL achieved a $4m credit facility funding with Sallyport. 2025 is when the 5-year Innomax agreement begins so I’ll admit I was 1 year ahead of events to back BELL in 2024. Doesn’t mean it can’t romp home in 2025. TEK now own a smaller holding in BELL, so BELL-ies should probably buy BELL in its own right. SALT is also on the cusp of a breakout too I believe. The need for lower salt is too great and the Labour victory augers further tailwinds - but patience is required. Food companies move carefully. Another one to watch for 2025. 22.1p NAV put this well above 50% discount with 15p of that in in listed holdings - and soon to be 22.1p!

CGEO also deserves comment. The valuation during 2024 has been insulting. I can’t really use other words. Not that I am Georgian or partisan to CGEO. But since the election a rapid rise is well deserved in my opinion. But a reader has rightly pointed out further unrest following the election so a fall in price is another opportunity to pick CGEO at a bargain price.

Other ideas have been disappointing. Agronomics at a 60% loss YTD yet its fellow investors are happily pouring follow on capital exceeding £300m in to its holdings at a premium to what you can buy ANIC for. It’s a parallel universe which will resolve in time.

IP Group -25% which is buying back shares at an astonishing rate (850,000 shares at 42p in one day is over £0.3m or £1.5m a week on a £400m market cap!). Why? Because the discount to NAV is astonishing and it has proven its NAV through large realisations in 2024.

AUGM on a -12% YTD where its market cap equals its top #4 holdings too and 21 other holdings for free. POW -7% YTD is another with holdings in the price for free. Whose listed GMET holding alone backs nearly its market cap and then has a number of Gold, Uranium and other holdings in the price for free. TMT with listed BLZE and many other holdings in the price effectively for free.

#4 place Mr Thompson Down 7% YTD

Moving forward in November through top ideas in the Bargain Buys 2024 BP Marsh delivered in Thomspon’s likely vernacular an eye-popping result. TENT accounts for the vast bulk of the £685 dividends - effectively a capital return - as PINE was for the OB.

What baffles me is the positive YTD result at ANX. It’s now rated a super stock too at Stocko. Yet Interim results showed debtors rising yet further (and the question investors should ask is how real these debtors are). Stocko call this a super stock but I’m not so sure. Former stocko commentator Mr Scott would have commented with a similar concern I imagine but the small army of replacement commentators have been silent on the matter - probably focusing on larger caps instead. The positive YTD is instead probably due to a decision that a recall on PDDs - or cheat boxes as comedians call them - is binding on the court.

This still makes me chuckle, and kudos or Ein großes Lob to the VW presenter (their CEO maybe?) who continues presenting after this interruption. Without a shade of embarrassment on his face either. Or contrition. Make of that what you will.

Was the Oak Bloke actually behind that prank? Haha, I wish. Simon Brodkin has the balls of steel. From handing P45s to Prime Ministers to rapping with Kanye West he achieved some epic pranks.

#5 place Mr Archer -14.2% YTD

China’s prospective restriction on tungsten which allegedly starts tomorrow according to Nikkei Asia, is a turbo boost for top idea GMET. Well done to Mr Archer who holds the biggest gainer of all runners.

And SVML is up 20% ITD (since this was suggested 1st July I believe) is a great - and unsurprising - result too. But others languish on large losses. BSFA like my Agronomics idea has suffered a large sell off in 2024. I suspect 2025 will prove out some more of these ideas and perhaps a turbo boost upset in December. Mr Archer is also now a substacker and apparent whisky conoisseur alongside other publications he writes in.

Yours truly even got an honorary mention in one article. I generally put out some decent analysis, so do watch out for the non-general proportion that isn’t decent, please reader.

Eagle-eyed readers always speak up where I err in my analysis. I am delighted to have so many eagle-eyed readers. That’s part of why I do what I do. I gain from your comments as do fellow readers. Unlike the chattersphere this forum gives room for analysis without room for idiot rampers/derampers.

The other reason I write is to support a cause - support Emmaus in 2025. Over £850 raised until today reader. Thank you so much to the 22 reader who have donated to give a HAND UP to previously homeless folks less fortunate (presumably) than you reader. To the >5,000 who haven’t please give something this Christmas. Baby, it’s cold outside.

Right, the race continues. Finally on to the Roasts. If you asked me what Roast would I pick? Duck.

#6 Mr Phil Roast - down 45.3%

Yikes. Incanthera is down 80.6% since July 1st.

For a cream able to absorb through the dermis I was intrigued by this idea. But worried about the shallow pockets in their balance sheet. Now reality has er, sunk in. I notice Downing’s fund is in wind down and holds INC as 1.8% of its NAV. Could that be a negative factor? More likely the commercial update that the product launch is on hold due to a legal dispute. That’s the rub.

Being slightly cynical is this legal dispute actually a conspiracy to whack the company and then scoop up the technology? Its vulnerability is obvious looking at the accounts. Regardless of the merits of the technology, assuming worst case conspiracy theory commercial risks is a lesson for me in 2024.

Whackability.

You heard it here first.

Rubbed out perhaps.

POW and JLP are also down 21.3% and 34.1% since July 1st. Could POW turbo boost in December? I hope so and I do believe it is a matter of time. A 200% turbo boost would make Mr P Roast the 2024 winner even if INC goes to -100%.

#7 Mr Kevin Roast - down 45.5%

In his best ideas for 2H24 GMET is now once again at a small 4% profit for the other Mr Roast. Mr Archer picked it back on Jan 1st so enjoys the lion’s share of GMET’s gains. I did wonder whether GMET could rise further in just 6 months. The other two ideas TM1 languishes at -68.7% and EST at -69.6%

But both have made positive announcements in November so can either stage a recovery in December? I remain sceptical about TM1 but EST remains one to watch for 2025.

What do you think reader? I can only select 5 for this poll so if you want to vote for one of the Roasts then use the comments box but otherwise do you think there could be an upset to the finish? A hare and the tortoise story? A photo finish? Vote for who you think could win.

Just 20 trading days left in the year. Three weeks and the days will be getting longer. Hallelujah. Make the most of the short daylight hours and have a good one.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Re: ipo can't knock your logic but 850k shares @42p is £357k not £3m. 👍