**THIS ARTICLE HAS BEEN SUPERCEDED BY WATR LET DOWN**

Dear reader,

Strategic Re-acquisition of Dallas, Texas Franchise

Water Intelligence plc (AIM: WATR.L) a multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water announced the strategic reacquisition of its franchise in Dallas, Texas.

Today’s article considers the implications.

Let’s first consider how the market reacted to this news. Still asleep? Fair enough, but that doesn’t mean that Oak Bloke readers should be. Let’s consider the news.

Key terms of the Acquisition

Let’s use my WATR profit calculator to swallowing up your Franchisees:

What marginal management fixed cost? -A = $0m (Existing Management in Fort Worth)

What are the franchise’s current sales? 22.25% of B ($6m) = $1.35m (22.25% is the difference between average “direct” margin vs the franchise royalty fee)

What annualised upside service performance? 230% of C = $0.65m per annum (Synergies in TX)

What upside product performance? D = $0.4m (Agribusiness rich pickings)

Cost of acquisition: -E = $12m (As reported)

Cost of Debt, if relevant: F = 8% of E (assuming zero)

Assets G = $0.3m (offsets against price)

(B+C+D-A)/(E+F-G)

$1.35m+$0.65m+$0.4m-$0/$12m-$0.3m

$2.4m/$11.7m

= a 20.5% simple return

Or a P/E of 4.88.

Now this is more expensive than Fresno (a P/E of 2.6 - see my article “WATR is a going ona-eh”) and Pittsburgh (a P/E of 3 see my article “WATR stock”). But this deal is different for a couple of reasons.

Will Knell. Today’s inspirational article picture is a bit more dignified than the psychadelic leprechaun hat Will wears in this presentation, but this video gives you a measure of the man. Clearly he is well-liked among the leak-buster audience. His dad Bobby established the Dallas franchise so Will has literally grown up around leaks. From 6 years of age someone shouts.

I would commend you to watch this 10 minute video. Know the man and feel happier about your actual or prospective investment in WATR.

The full $12m payout assumes the increase in Dallas profits by 2.3X in 36 months. That’s no mean feat. As the CEO of ALD Will will have a wider remit growing the business.

There will be cost synergies to merging the Dallas and Fort Worth operations. The 2.3X profits will be partly higher sales and partly reduced costs.

It is probably an obvious thing to say but having an HQ in Connecticut doesn’t make sense. There are 120,000 swimming pools in Connecticut and 800,000 in Texas. So moving the HQ to the Southern States is a good idea. They are the best place to grow your centre of gravity. Florida, California are major swimming pool states also.

In terms of future revenue growth and scale, the Dallas-Fort Worth metroplex is expected to rival New York and Los Angeles in size and concentration of disposable income by 2030. The Oak Bloke has seen businesses in Texas first hand and can confirm there is a vibrancy to Dallas and the region.

Incentives

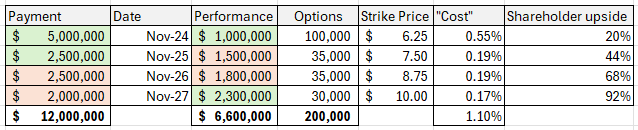

As well as up to $12m for his franchise, Will also gets options and those are dilutive to shareholders. But by how much? The answer is the full options will dilute us by 1.1%. The strike price means that that that dilution comes with an upside that the strike price is 20%-92% above today’s £4.00 ($5.20) share price.

I hope you will agree when I say I am more than happy to be diluted by 1.1% if Will can double bag WATR.

Conclusion

Despite the lack of enthusiasm in the market, contrast that with the enthusiasm felt within WATR on the back of this appointment.

A new CEO that lives and breathes the industry. An inspirational leader that people like and knows his stuff. Someone that already has had success and grown the Dallas franchise into a highly successful operation and who is prepared to take on a new challenge to further grow the business by a 2.3X stretch target in 3 years. The business achieved an average 12.3% growth in the past year so it’s a only doubling that percentage (plus some cost savings).

Compared to my prior forecast I move $6m out of Franchisee Sales and add $6m sales to ALD (Direct) with a $2m revenue upside for 2025. I believe Dowgate have increased their forecast by 9% (I no longer subscribe to Research Tree so haven’t read their take on WATR)

The result is a forecast growth of the network is 10% (up from 7.1%) with a jump in operating profit through higher margin and further growth (assumed at a static 12.3% in 2025 for Direct Sales) plus the Dallas operation where $2m of sales growth is assumed ($8m total).

What emerges according to my forecast is an accelerating growth level where ALD is driving revenue growth and profit.

The above assumptions don’t really factor in much more than an extrapolation of the 2023 → 2024 performance. What I don’t assume is any appreciable growth in the patented products like ALD VersaLiner, the partnership with $29bn t/o giant Ferguson, or Pulse the Sewage Pipe damage detector.

Nor do I place any great emphasis or upside from Insurance companies even though that prospectively could be gigantic. As I pointed out previously in “playing the claim game” 1 in 60 claims is for Water Damage. Who better to fight erroneous claims than experts at ALD? Who better to sort out genuine claims than a company who says no fix, no fee?

Nor do I place any great emphasis or upside from EU contract work from its Irish base, though that upside also exists.

Finally despite a lot of training and investment going into Australia where Water is a national obsession I merely assume a linear increase, whereas an acceleration could be seen too.

For all the above reasons I think WATR could be a fountain of profits in 2025. And once the news leaks I suspect it won’t sell for £4 a share either.

Regards

The Oak Bloke.

Disclaimers:

This is not advice. You make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Great to see in the 3Q24 Trading update this morning from WATR improvements are visibly coming though - particularly the overseas growth of 26% caught my eye