Dear reader,

Thud.

So made the noise of Chariot’s annual report, arriving through my letterbox this week. All glossy 78 pages through my letterbox. Quite how they knew I were a shareholder baffles me. It’s the first annual report posted to me since NetScientific posted me theirs in 2021, again out of the blue. I still have it on my bookcase. Annual reports make the best fly swotters. Sending me a glossy report was a bit extravagent was my first thought. How nice it is to have a physical paper report was my second thought.

An afternoon spent in the garden and in the sunshine today with their annual report inspired me to write about CHAR. (A reader also asked me to cover CHAR, and I’m happy to oblige where I can)

Now, I have a small holding in CHAR which is a free carry from a 6p some years back and a top slice, when IC was championing it. I see they champion it still and in an article hidden behind their paywall speak tantalisingly of a catalyst. Despite CHAR halving in price the past year.

No such tantalising occurs here reader - just I will prick your conscience to contribute to my Bowel Cancer UK fundraiser in thanks for enjoying my writing (if that’s what you’re doing). But only if you haven’t contributed already. I’m very proud of the 1% of my readers who did contribute. Thank you. You raised nearly £3,000. But I’d love to bust through that number. Will you help? DONATE

So back to Chariot…. the key question here is to CHAR or not to CHAR?

Chariot has a lot of fingers in pies. Eagle-eyed readers will spot Tharisa is a stock spoken about before, while green hydrogen is also a topic I have OakBloke spoke about too.

The three themes to these pies are:

a/ Transitional Gas - onshore and offshore

b/ Transitional Power - power for mining

c/ Green Hydrogen - Mauritania

THEME 1 - Green Hydrogen

CHAR are not alone in the Mauritanian sahara. They partner with Total.

BP and GreenGo are among those building MW scale projects using solar/wind (Mauritania has some of the best of both) to electrolyse into hydrogen. The European export market beckons all of North and NW Africa.

So far the Project Nour feasibility study has been produced and cost CHAR $1.6m in overhead and expense. The expanse of 5000 sq.km could produce 1.2Mtpa of hydrogen, produced from 10 GW of solar. Stage 1 would be to build 0.15Mtpa and 1.6GW.

Production costs could be $0.03/KWh and electrolysers from Sunfire, Hysata Ceres are capable of producing hydrogen consuming 41.5KWh to 1KG. That’s $1.25/Kg so competitive with grey hydrogen and below the $1.50 said to be the long-term target price for green hydrogen. Hydrogen retails for $14-$16 a KG so clearly there’s some margin in there for producing hydrogen profitably. But it’s early days. Meanwhile there’s costs and no revenues. And CHAR are in partnership with a start up electrolyser maker Oort Energy from Bristol, UK, and a pilot 1MW is underway.

Auctus reckon the value of the project is worth $64m or 5p a CHAR share but don’t say why. $64m valuation on a PE of 10 is $6.4m profit per annum and over 0.15Mtpa works out at $0.042 profit per Kg of Hydrogen. That suggests costs per Kg will be $13.958 per KG. There’s capex costs (i.e. depreciation and maintenance) plus logistics, transport and the $14/Kg is retail not wholesale pricing. Assuming wholesale is 50% so $7/kg and transport $2.30/kg, misc costs $2/kg and capex $0.45/kg (at 5% depreciation and $4m depreciation on $80m capex to generate 1.6GW of solar capacity according to Statista and Electrolysers at $0.4m/MW x 1600MW x 10% is $64m depreciation).

So using those conservative number I get to $1/Kg profit - not $0.042/Kg. That’s $150m profit. A $64m valuation is therefore a tad on the low side since that’s a P/E of 0.4!

Either my published assumptions, or Auctus’ unpublished assumptions are vastly incorrect.

But there are no immediate catalysts here.

THEME 2 - Transitional Power

There are 6 projects/holdings. The Transitional Power lost $2.9m in 2023.

1/ A Djibouti water project generated $80k of revenue for 50 cubic metres of water daily which is $4.38 a cubic metre. That’s actually more than British water (nearly double the UK average of $2.50) but costs in a Desert via desalination are higher too. The costs are unknown but I notice the cost to acquire was a $0.5m charge in 2023’s account, and a circa contingent payment of 1.8m shares (at a cost of ~$0.2m). So IF the water project has no costs (yeah right) there’s a simple payback after 8.75 years. The numbers just don’t look right. You’d have to be nuts to invest in this project.

2/ 15MW IamGold Solar Power at Essakane

Then there’s this. It’s been in operation 5 years yet generates no revenue. Why? CHAR only own 10% (Total own 90%) but it saves IamGold 6m litres of fuel a year, so pro rata 600,000 litres of fuel saved per year should generate something like $0.5m - $1m a year - shouldn’t it? i.e. 83 cents per litre saved?

3/ 430MW FirstQuantum Wind & Solar

This awaits a FID.

4/ 40MW Buffelspoort Solar

This also awaits a FID.

5/ 30MW Karo Solar

This project has been delayed due to low PGM prices.

6/ Etana

The final asset is a power trading entity. It is the only holding I feel excited about. It announced a 195GWH a year supply deal, and a 30GWH power purchase deal. Those numbers sound impressive but a South African MWH is around $100, then we are only talking about $19.5m of sales and $3m of purchases (where a further up to $16.5m of power must be bought less any margin on trading).

Wheeling power is a way to “reserve” it for use by a priority user so you could expect to pay a premium. Let’s say that’s 20%. On $19.5m of sales that’s $3.9m profit. 49% of that is about $2m profit a year to CHAR.

The 49% of Etana was purchased for $5.2m ($1m up front and $4.2m contingent upon success). So this part of the business seems quite reasonable. Exciting even.

Eagle-eyed investors who read the Oak Bloke will know all too well of South African troubles in power reliability, affecting JLP, BMN, SLP and THS. 20% is too conservative given the alternative is diesel generators - and past depressed profits clearly show that’s more than a 20% premium to cost - let alone the business disruption.

THEME 3 - TRANSITIONAL GAS

There are two subthemes here.

Onshore and Offshore

Onshore

The OBA-1 well onshore at Dartois, Morocco, and part of the Loukos licence. CHAR encountered a ~70 m interval with elevated mud gas readings, indicating potential gas pays, and encouragingly no water-bearing reservoirs identified. It has been cased and cemented with a christmas tree for flow testing.

This is being tested in 3Q24. The gas may be able to be sold directly from the well head - which makes it simpler and cheaper to bring in to production. 2mboe of 2P resources has been suggested - which at a $70-$80 BOE netback would be worth $140m-$160m. At 400BOE/day (75% to CHAR) that would generate a monthly netback of $0.65m (assuming $70/boe). This well alone could be transformative. The surrounding area could potentially hold a further 1mboe+ upside too.

Offshore

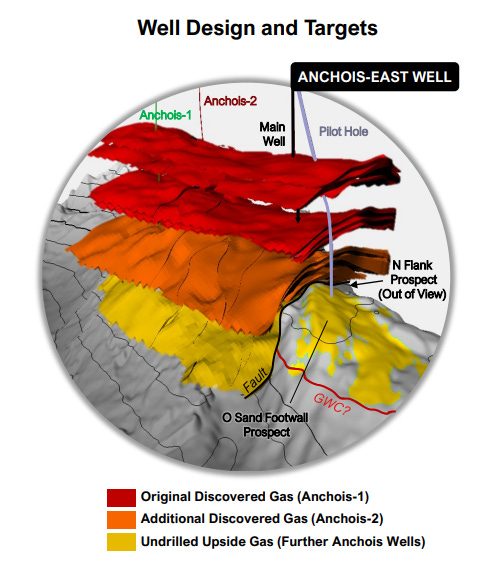

Energean (ticker ENOG) is a £2bn market cap FTSE250 oil explorer. CHAR now has a JV with ENOG and with ONHYM.

Thre are two licences Lixus and Rissana.

Energean acquired operatorship and 45% in Lixus and 37.5% in Rissana, with Chariot retaining 30% and 37.5% respectively and ONHYM maintaining its 25% stake in each licence.

CHAR received US$10 million in April 2024 on completion of this deal, and now has a US$85 million gross carry on Pre-FID Lixus costs which includes the Anchois-East well and flow test planned for August 2024. If successful, this may increase the resource size to 1 tcf (i.e. to CHAR 500mboe)

FID should be shortly after August 2024.

A further US$15m is payable on FID.

ENOG have an option to acquire a further 10% from CHAR for:

a/ a gross development carry of US$850 million to first gas,

b/ a US$50 million convertible loan note (and at today’s £10.28 per ENOG share that equates to 3.85m ENOG shares, and Quarterly dividends on 3.85m shares alone would be an income of $4.6m per year).

c/ 7% royalty payments on their production revenues.

-

Adding it up:

The deal with Energean means of the 75% held by CHAR’s Offshore, that splits 42/33 to Energean. The balance sheet reduces accordingly. $10m cash received is taken into consideration in that CHAR revealed their current assets as at 30/04/24 (which included the $10m received). I’ve assumed $2.2m of cash spent since then because I’ve calculated cash burn at $1.1m a month (more on that in a bit)

$36.9m is $0.0366 per share of assets. So you are paying a 4.5p a share premium to assets today. Is that good value? Read on reader, read on!

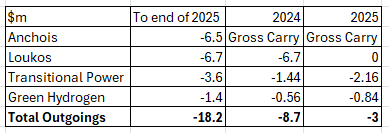

In fact let’s now talk cash. Past outflows were approaching $10m a year.

In the 2023 accounts (note 2) a “material uncertainty” was given. I see in the chat rooms a lot of negativity about this. A lot of ignorance too. So let’s set out the numbers.

The start point of assets is this. This includes the $10m cash already received from Energean.

These are the forecasts. But it’s important to do two things. First to split off the cash which is reimbursable or paid for by ENOG (up to $85m). The estimated $6.5m is to drill Anchois East, and run tests in Q3 24. Second is to split the cash flow forecast into years. We know that Loukos is ASAP, so $6.7m is Q3 2024. For the remainder I have divided the cash into 20 equal amounts so 8/20 in 2024 and 12/20 in 2025.

Since around $0.75m relates to Q4 2024, it appears CHAR could run out of cash in Q4 2024 if it pushes ahead with Loukos.

CHAR has three rolls of the dice:

1 - Dispose of Transitional Power for cash. Ideally excluding Etana. If one or more of the projects can generate cash that could be useful. Would either Total or Tharisa want to buy out CHAR and be 100% owner? I doubt it but you don’t know.

2 - Press ahead with Loukos and get that cash generative quickly. The estimates to first gas is early 2025 so this looks the most tricky option given the cash position. However the netback on that is so strong and 300 boe (400 boe and 75% to CHAR) equates to $0.03m per day net back.

3 - Delay Loukos and rely on Anchois and the $15m following ENOG’s decision to proceed with FID. $15m cash solves a lot of problems. If I had to bet I’d say this is the near term transformative event referred to by the Investors Chronicle.

Outcome

Option 1, dispose transition power, if possible, but I’m assuming below that it isn’t. Once CHAR has decent cash flow having these projects could be quite lucrative.

Option 2, if possible, and I’m assuming below that it is drilled and brought to first gas and the cost is capitalised but owed to creditors.

Option 3, I’m assuming we reach FID so $15m is triggered and ENOG exercise their right to buy a further 10% of Lixos (leaving CHAR with 20%). CHAR retains 37.5% of Rissana.

The balance sheet moves to look like this.

Obviously the cash flow problem disappears - as does the material uncertainty.

The Oak Bloke then Fell off his Chair

The bit that made me fall off my chair, is the P&L once FID occurs and once (if) all the things I’ve described occur. And occur to the magnitude I forecast.

Bear in mind reader this is not a 2024 P&L, nor a 2025 one. Lixos first gas is probably 2027. But Djibouti and Etana are nailed down (albeit $2m is an estimate), Loukos follows in 2025 as could dividends. 2025 could be circa $14m contribution which gets CHAR cash generative.

Longer term - which is what the market “should” value CHAR at. A potential net profit of $111m even before considering upsides from Lixos or Rittana, any of the Transitional Power Projects, nor any value for the Green Hydrogen Mauritania opportunity.

At even a measly 8 times FY27 earnings that’s a £700m valuation compared to £80m today. That’s a 9 bagger and gets you to a 67p share price for CHAR. Now that’s above the other brokers’ target prices. But they do not appear to consider the Royalty and $36m income per annum seems worth considering.

Conclusion

To char or not to char? Two drills and one FID make a 9 bagger, theoretically. But it has risks. CHAR disappointed in its most recent drill. Yet the reservoirs are there and Auctus put the chance of success at 85%. Those are good odds.

Reviewing their strategy there’s grounds for criticism, building out a transitional power business when they should have been conserving cash flow to progress the gas projects seems daft. There’s weird deals like Djibouti, and Essakane - which are either fishy or simply incompetent deals. I can see why the share has fallen, and why people are down on CHAR.

And there’s also a healthy amount of share-based payments made to Directors and employees costing $0.5m. On top of salaries a FTSE100 CEO would be happy with e.g. the CEO earned $0.7m last year, and the year before.

I’m (very) tempted to have more than a tiny toe in the water here. My heart says yes and my gut says no. Ergo, the toe.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Hi Oak Bloke. Care to share your thoughts on the performance of the CHaR share price since yesterday’s RNS? IMO the market has completely over reacted.

You've done some work on this - thanks ! My toe is dipped.....