£12.85bid/£12.94 ask, 48.22m shares in issue. $3.5 dividend per year is 21.46% yield at $1.26/£1 assuming a SIPP - no witholding.

It’s interesting to read how some people speak of DEC’s recent woes (woes being defined as a fall in the share price) blaming it on the recent 20:1 consolidation, the US listing, and/or a UK de-listing. Or some generalised darker “the market knows something we don’t”. Like some non-specific curse. A Jonah. A Jonah in our midst. Cursing the entire ship.

See my recent musing on DEC-laration on buy backs where DEC hands should be whooping with joy, because we can offload land lubbers (i.e. buy back their shares) to enjoy a fairer tomorrow. The £100m set aside can jettison something like 1 in 10 from our ranks (hence the title DEC-imation which means 1 in 10). Improves NAV by 7%.

Sailors can abide a great deal but not a Jonah. Arrrr.

Is the reason for weakness at DEC a little more prosaic?

Is the sea change, simply that it ain’t cold enough at the moment? Should we blame El Nino?

US natural gas futures dropped below $2.6/MMBtu, marking a five-month low due to a surplus in supply over demand. Record-high domestic natural gas production in the US has allowed utilities to build reserves, despite a larger-than-expected withdrawal of 117 billion cubic feet (bcf) reported in the latest EIA data. Stockpiles are 7.3% higher than last year and 6.7% above the five-year average for this period. Moreover, forecasts indicate milder weather towards the end of December, thereby reducing heating demand. Meanwhile, US liquefied natural gas (LNG) export facilities are experiencing record-high volumes. Elsewhere, Exxon Mobil has delayed the start of LNG production at its Golden Pass export plant in Texas from the second half of 2024 to the first half of 2025.

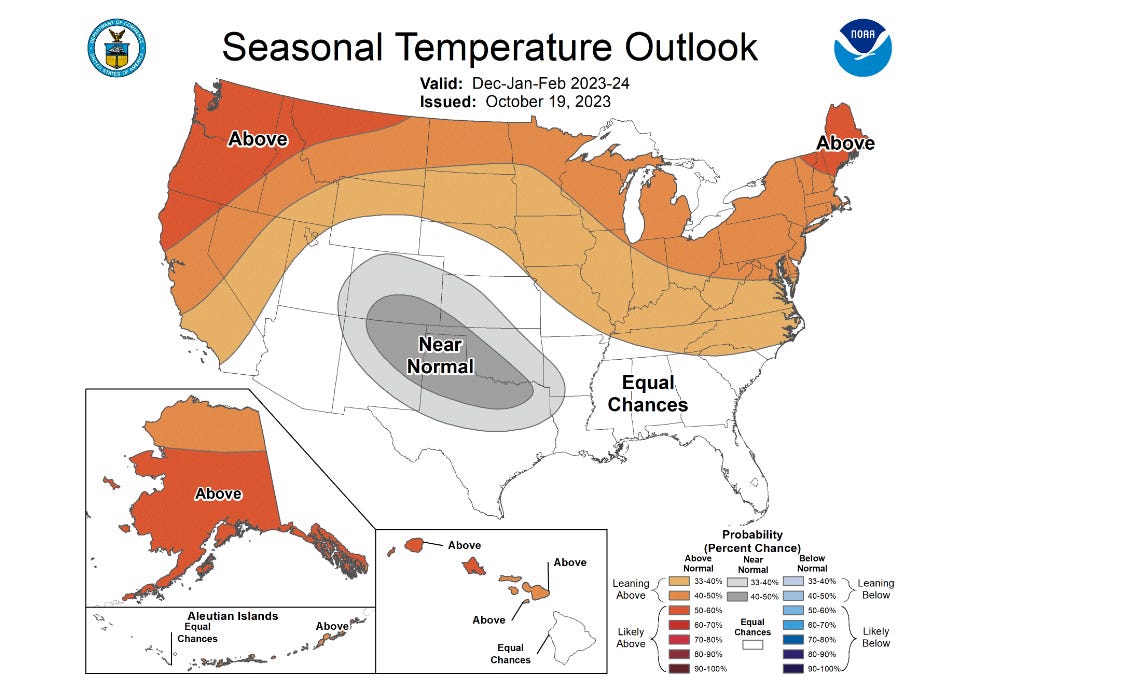

The US Weather service (NOAA) in fact shows us this too: (ha ha, NOAA, how appropriate, the shipping theme continues). The outlook for the next few months is warmer than usual. For some.

It’s also the case that winter gas consumption can been historically higher than summer gas consumption.

But let’s think about this some more:

If only we had hedged a great deal of our forward output. Oh wait.

DEC has 80% hedged at $3.53. In H1 23 an average of $2.54/mmbcf translated to a $2.96/mmbcf average after hedging. So note too, today’s gas price of $2.58/mmbcf is above the 2023 H1 average reader just to keep it in perspective. I’ve not tried to mathematically estimate this but my immediate reaction is that H2 should be a better out turn than H1? (From a price per mmbcf perspective after hedging)

If only we could export US gas to places in the world. Oh wait.

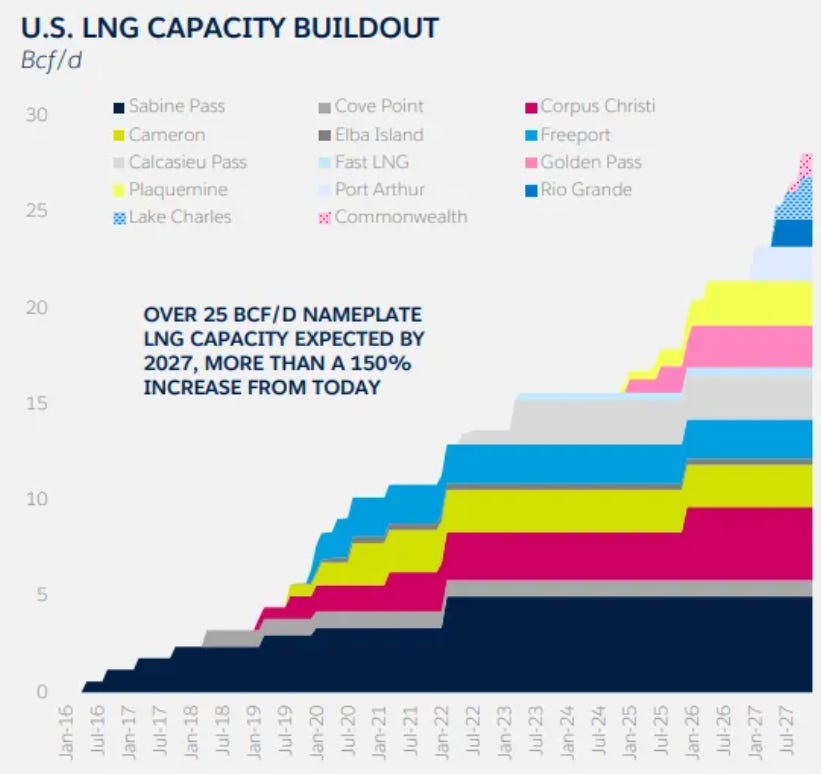

To be fair, there is no immediate (i.e. 2024) boost to LNG exports but 2025 and 2026 adds 20% export capacity per year. Shares will eventually price in the foreseeable future (the stock market is a weighing machine). See my Gassing on Part 1 for more on this.

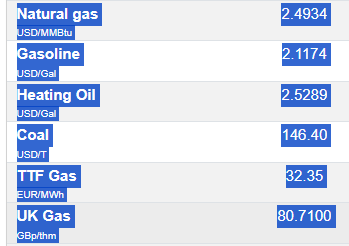

To give you an idea of the profitability of LNG and the potential upside for DEC (and the US) let’s look at world prices. Henry Hub at $2.4934/MMBtu. So that’s £1.95/MMBtu.

To convert TTF Gas we need to multiply by 0.29307107, and then divide by 1.15 to convert Euro to GBP. So that’s £8.24/MMBtu.

To convert UK Gas we need to multiply by 0.1 to arrive at £8.07/MMBtu.

Japan and Far East is $10.25/MMBtu so £8.01/MMBtu.

Exporting LNG roughly quadruples the price (less the $1.5-$2.5/MMBtu transport and compression costs). So it’s not hard to see why the LNG export capacity is growing.

If only the outlook for US gas prices were higher going into 2024. Oh wait.

Per MMBcf the consensus outlook according to Trading Economics is for prices to revert towards $4 from the current $2.58.

If only our margin allowed us to make a profit at such low prices such as $2.58. Oh wait.

While DEC speaks to (and has historically achieved) cash margins above 50% in its presentation I foresee that margin may be mid to high 40s in 2023. But nothing to explain the 45% drop in share price in 2023. Interesting, too, to explore the “adjusted” bit. A footnote tells us this adjusts out $0.08 per Mcfe for Next LVL. For amortisation and asset retirement costs ($27m). So $1.71 if you like. For more on this see my article on DEC-tecting fact and fiction. The fact remains that these margins are very attractive.

Including asset retirement an average $2.58 vs $1.71 is a 33% margin; including hedging might be $3.10 vs $1.71 is a 45% margin.

Weather the course

It’s true that Weather forecasts are always subject to variations. It’s an easy narrative to think “El Nino means warmer winters means sell DEC”. But there’s an opportunity in weather too. There are shut ins, storage, hedging, calls and puts and all kinds of techniques which can be employed to maximise output and the value of that output over time. If you think of DEC like a 72 year (until 2095) train track this thought starts to make sense.

Is obsessing on the weather kind of missing the point?

What do we use GAS for anyway?

Some Americans might get confused at this point and say I put gas in my gas tank. There’s a reason, my American cousins, calling Petroleum Petrol makes so much more sense. Let’s not even talk about aluminium. Or tomatoes. What, potatoes? Oh, you win that one.

Gas use tailwinds

What are the tailwinds in coming years? Rusty alludes to this time and again in interviews.

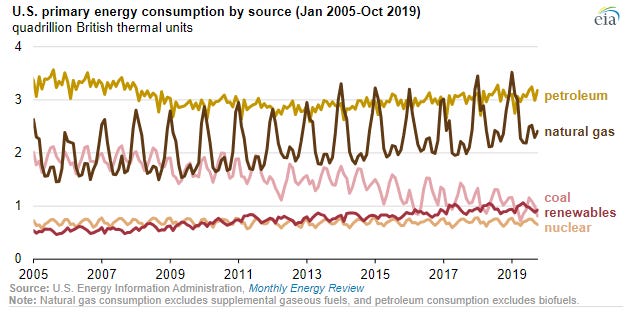

a/ The swap out of coal for gas. Rusty says bring on the wind generation, bring on the solar, we need it all. But the US and the world need other energy sources too. The slice of pie for gas will grow.

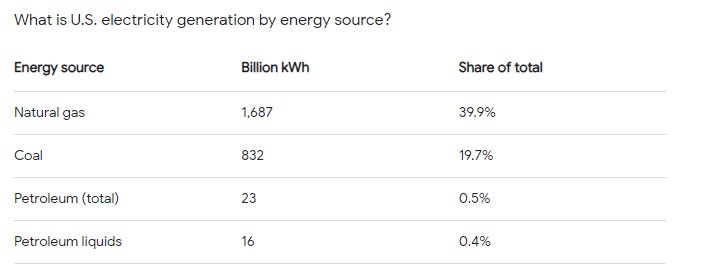

Swapping out 19.7% of coal and 0.9% of oil for gas, nuclear and renewables in the US is a huge tailwind. (Let alone any other country and the need for global LNG imports)

b/ Net zero and electrification means the amount of electricity generated grows massively year on year. The pie itself grows.

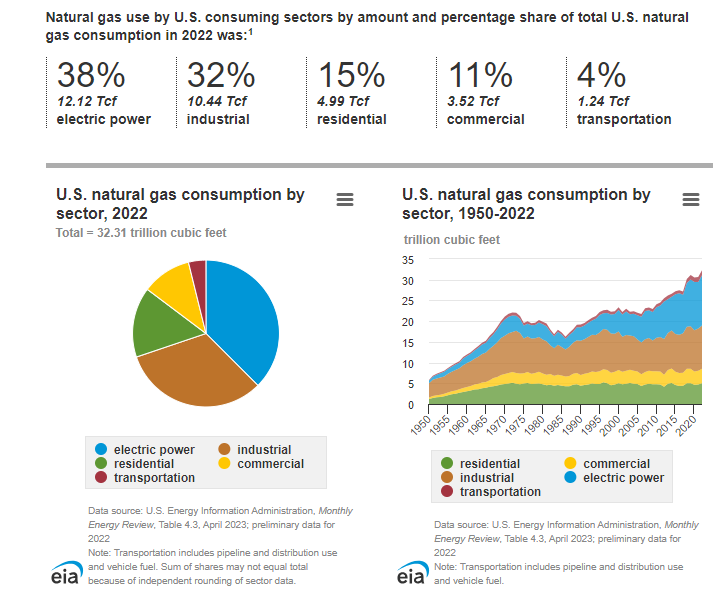

c/ The pie is part of an even bigger pie. Of electricity vs heating. That split according to the EIA is about 2/3 heating and 1/3 electrical generation. But look at the growth (in blue) of electrical generation. Evidence of the tailwind.

d/ Does electricity eat into the heating pie too? Is someone going to say the word heat pumps (remembering too that heat pumps in summer can reverse function and COOL a home, and prospectively provide CHEAPER air con in the future once you factor in capital costs and future efficiencies. I would encourage every DEC hand to consider what happens when you can combine heating and cooling and ventilating through another Oak holding called NSCI and its portfolio company Ventive.

Conclusions

So is the current natural gas market glut anything more than a temporary blip? An opportunity in disguise?

Are you going to be like Hollom and toss yourself over the side at 64.2p (sorry £12.85)? Because what if there’s no such thing as a Jonah curse?

What if the tail winds are there and plain to see if you’ll just pause and listen. What if the wind will blow tomorrow regardless of your deep sea Cannonball carrying aspirations? Icy winds will blow again - and people will put the heating on.

So take ‘eart DEC hands!

This is not advice. If you need advice my advice is to go and get it. Otherwise keep reading entertaining Oak posts!

Natural gas futures through 2029 are comfortably in the $3's and $4's with not a $2 handle to be found after October 2024. I'm sure that fact is not lost on Rusty and the folks at DEC as they hedge future production.

I've done more DD than most on DEC and have yet to find a hole in the investment thesis. I was pretty confident in my assessment of the retirement obligations but your research went well beyond mine and found no holes. This looks like the proverbial $10 bill lying on the sidewalk. I have a very large position.

Purely from an informational point, we (on the other side of the pond) put gasoline in our vehicles and heat our homes with natural gas.

OB, good rational thoughts in an irrational market. The short term gas price drop creates a negative halo effect for the hard of research across the whole sector, as does the El Nino commentary and memories of 2015/16. I think DEC is being sold down as a sector sell off rather than on company merit. The company performance however remains exceptional and the dividend enables a wait for rebalanced to occur.