Dear reader,

A short thesis is released; a nemesis steps forward. Snowcap, and not one but two nemeses (who knew that nemesis had a plural?). They reveal themselves. Who are these pair of 20 somethings (who appear older than in their 20s - sorry lads)?

They run a shorting outfit called Snowcap. And who have they shorted before? Three firms, and now a fourth.

Who did they short?

“Victim” #1 - Bingo Industries in Australia. What happened? It was delisted was sold to Macquarie at a 33% premium (which was also its EV). Not much success there lads….

“Victim” #2 - AGL - a short attack 2 years ago led to higher prices today. Not much success there lads.

“Victim” #3 - Santos - a short attack 1 year ago led to higher prices today. Not much success there lads.

Their “ATTACK” #4 - Diversified Energy - red alert DEC-hands! 4th time lucky?

Let’s examine their evidence:

Slide 2 - disclaimer

Slide 3 - key thesis points

a/ Decline rates - decline in production does not equal a decline in resource (854mm boe eq.). Yet no consideration is given to this. Workovers, shutins, RTP, capillary flows can re-invigorate production with a 2 month payback.

b/ Discretionary cash flows - this is based on the assumption that you have to “replace” lost production at a cost of $169m using a 3x multiple, spend $74m on capex (for no apparent benefit), and pay $110m interest (vs my calculation of $90m and falling). The CFFO is assumed to be just the $174.5m taken from June 2023’s results so ignoring the accretive Tanos acquisition. Ignoring the $200m SPV funds.

c/ ARO Funding - Snowdrop’s modelling is described as “marginally more conservative” assumptions, ha, more on that later.

d/ A “recent study” using satellite measurements and AI alleges DEC’s emissions are 16x higher than reported - more on that later.

Slide 4 - rule number one of shorting: Repetition. Repetition is a good way to drill home a point. And repeating yourself allows you to make your narrative seem more impactful. And repeating yourself allows you to make your narrative seem more impactful. Forgive me reader, I jest, but this is classic stuff. We are going to see highly convincing graphs, multiple avenues to try to get something that sticks, repetition, and repetitition and lots of “evidence”. Let’s unpick this together.

Slide 7 - Unique business model - the negative language is now coming through clearly - but still seeing themes emerges “must replenish”, “higher leverage” “claims…” “low productivity” - classic negative stuff. If you didn’t understand DEC then you could really buy this narrative.

Slide 8 - 3.4% leak rate. 380,000 mtCH4 claimed in November 2023, versus a 2022 24,500 mtCH4 (686,000 Mt CO2e / 28). It’s on this slide where Snowcap start to overreach. Why are these results so VERY different to the EPA data? I don’t just mean for DEC. For everyone. The IRA 2022 mandates levels of methane intensity NGSI which I discussed with the below graph in my digging deeper article…. So why would their SELF REPORTED data shown at this link on page 29 be so wildly different? Comparing Exxon, EQT the self reported and the latest (self reported) emissions just don’t tally. I’m not talking about THEIR observed data, I’m talking about the EPA self reported data.

Also I question why would they not report in terms of NGSI? That’s what the IRA uses. Why doesn’t this “credible source” use the same? Here’s the latest EPA data (remember we discuss how this was flawed and estimated, but it doesn’t tally, why?)

I fully appreciate the “Geotechnical” website looks highly impressive but what evidence is there really? Something that looks very genuine even down to the $5,000 report you can buy which conveniently is linked for public viewing by the shorters. The evidence for their methodology is here but this appears to list a bunch of relevant article links but I didn’t find one which actually peer reviews the effectiveness of Geotechnical itself. A satellite. AI. Sounds impressive, I’m sure it’s a really good idea. But how does 246,000 measurements taken from next to DEC’s wells, and from flying low over these wells get it so wrong compared to measurements taken from space? Which is the more reliable measurement?

I did however find a Yale article appearing to be written by Geofinancial which describes how such monitoring could be used to automate financial trading on publicly listed shares and Pitchbook tells me Geotechnical is a business to offer “real-time risk insights” ….. So this is a commercial business seeking to make a profit not some charitable Not For Profit endeavour. But how did Geofinancial analytics commercially benefit here? We don’t know but I have some ideas?

Slide 10 & 11 - back to the decline vs peers - and remember the Bob the salesman analogy? His BMW depreciation was far higher than the OB’s. But it’s the same car. Just I drive differently to Bob and have different skills to Bob.I think that example sums up how you can make something appear a problem when it isn’t (for the BMW OB buyer ekeing out 20 years from that Beemer)

Slide 12 - Decline of 18% - again, decline is not depletion. These guys are supposed to be experts in O&G - why don’t they know that? Or perhaps they do?

Slide 14 & 15 - describes DEC as a conceptual flawed methodology - ironic then that their $249m to $68m waterfall is flawed! First of all Snowdrop double count the cash paid for interest. Adj EBITDA to CFFO includes interest! So the $249m is already net of this as per the presentation below. Second for cash cost for declines, the $249m is already net of this. Depletion in 2022 was $170m yet Snowdrop believe expending $249m is necessary - even though DEC has proven time and again to be able to purchase with ACCRETIVE VALUE e.g. Tanos in March 2023. Third, it uses a 3x EV/EBITDA even though lower than this was achieved in 2023 (they quote multiples from FY21 and FY20). Flawed.

Slide 16 & 17 - once again interest is inflated, CFFO is very conservative (doesn’t reflect Tanos acquisition), and an imaginary gross acquistion to offset is used to create the pretence of no cash.

Slide 18 - the EBITDA from the SPV is overlooked, oops, so it’s not a $35m reduction. The net debt June 2023 number is shown when we know that there was $135m at last update of liquidity plus a 12.3% reduction of debt and $200m liquidity. Suggesting net debt is closer to $1,200m. The ABS are based on ADJUSTED ebitda, not ebitda, but let’s forgive that oversight. Is $457m realistic for FY2024? That’s based on “Consensus” from a single source - Capital IQ. Is consensus an oxymoron then?!!! As of 3Q2023 DEC has achieved $523m adjusted EBITDA (so pro rata that’s $697m). Is a 34.4% reduction in adjusted EBITDA based on a single analyst’s opinion realistic in FY2024? Very questionable in my opinion.

Is a 34.4% reduction in adjusted EBITDA based on a single analyst realistic in FY2024?

Slide 20 - “DEC has pushed back well retirement” - not sure what Snowdrop are trying to achieve reducing the present value of ARO by a discounted amount into the future? This slide is telling you the equivalent of the square root of 9 is 81. It’s all backwards!

Slide 21 - once again compare Bob the BMW seller, OB the BMW buyer. Different valuations different uses.

Slide 22 - Congress - ooohhh - looks very official and impressive. Clever use of fonts. Excellent use of Authority combined with FUD.

Slide 23 - The set up slide - this is what DEC claim.

Slide 24 - 26 - Various “what if” fear, uncertainty and doubt scenarios. But again it looks very convincing but let’s look at this mathematically. The amount of decline is in relation to resources, the depletion charge and the ARO charge are linked. And depletion is LINKED TO REVENUE TOO! So IF the worst possible case occurred then all of these would accumulate faster. So the supposed “crash land” you then see in slice 26 for the “sensitivity case” would not happen. Also this crash land would occur over many years and each year DEC’s management are challenged by its external and internal auditors, by its NEDs and indeed by the consortium of 14 banks - it’s FUD dressed up to scare you - and it’s very convincing! But is it factual?

Slide 27 - now we arrive at a $35k/well ARO. No consideration for actuals achived, which are subject to internal audit and to future audit at Y/end. No consideration for NextLVL its economies of scale or its income, nor for the MERP subsidies - just an assumption that $35k is correct because Wright & Co said so in 2018.

Slide 28 - “No sinking fund” - we discussed in DEC-iding what’s real how net assets are a de facto sinking fund. There are plenty of net assets. Also I object to their comment “FCF covers well retirement in any single year.”. No, actually the grey area in that graph is CUMULATIVE cash flow not annual cash flow. Common sense should tell you FCF in any single year isn’t going to cover $1.7bn of ARO. C’mon please!

Slide 30 - the set up

Slide 31 - FUD on self measurement - that’s not true - why would the EPA be adopting the IPCC measured approach and move away from estimates if theirs were the better approach? Go and read Rusty’s letter or DEC-iding to stay the course - it’s all there.

Slide 31 - 3.4% - as stated above - why are ALL the results higgledy piggledy to the latest EPA data? Why don’t they use a standard measure? Odd. Very odd. Almost like it was all a fantasy….. Does Rusty Hutson have the GALL to write a forthright letter to Honorable Pallone stating nothing to see here if a satellite clearly shows that to be a lie?! I find that difficult to believe. I find 246,000 leak checks in 2023, SCADA monitoring, monitors capable of detecting methane at 1 part per million, evidence that 14 banks with ESG ABS structures, and 4 ESG monitoring outfits have not also found a 3.4% leakage rate. I find it hard to believe it’s accurate. What’s the answer? I don’t know but it doesn’t feel right. The 2023 DEC Sustainability Report will be closely scrutinised by many parties I feel. I’ve offered my view that DEC have invested into methane reduction - it makes SO MUCH BUSINESS SENSE to do so.

Slide 32 - more FUD - $325m → $433m → $542m of fines. Yet if the NGSI is down by 5% year on year to below 2.0 then DEC DOES NOT APPLY A CENT IN FINES! MEANWHILE MERP GIVES BILLIONS OF CREDITS AND INCENTIVES. Of course none of that is mentioned or considered.

Conclusion

I’ve “rushed” this analysis this evening so please forgive me if I’ve not laid things out as clearly as usual (assuming I ever do!). But nor have I directly copied and pasted content from either the Snowdrop report or from the GeoFinancial. So sorry reader you’ll need to refer to their slides and use my commentary as best you can.

I hope my comments provide some food for thought, and supportive analysis why I still feel convinced DEC has a bright future, despite this short attack.

Snowdrop are a more convincing “end of level bad guy” than Ted’n’Kathy, or Bloomberg (and I did call out for an Oak Bloke nemesis didn’t I?). Their short report is well written - but how long will their thesis survive? The Q4 update? The Q1 dividend? The annual results? The 2023 sustainability report? The short attack feels time bound.

The report hasn’t make me feel differently about DEC or DEC’s prospects. I have tried to keep an open mind and look for flaws in my own logic.

If I didn’t know DEC as well as I’ve come to know DEC, I can easily see how the FUD would put many, many people off and also scare some people into selling.

My article’s title is DEC-orum est loqui verum which is Latin for it is honourable to speak the truth. I hope I equip you, DEC-hands, which what I believe to be the truth of this.

As we started with Latin, we shall end with wisdom from ancient Greece. Like DEC-hands scared into selling, Odysseus and his DEC-hands faced the Sirens. To survive they filled their ears with wax, and the sailors made deaf with beeswax saw the Sirens who seemed like hungry monsters with vicious, crooked claws.

They sit beside the ocean, combing their long golden hair and singing to passing sailors. But anyone who hears their song is bewitched by its sweetness, and they are drawn to that island like iron to a magnet. And their ship smashes upon rocks as sharp as spears. And those sailors join the many victims of the Sirens in a meadow filled with skeletons.

This is not advice.

Oak

Very pleasing inline result this morning on the Q4 update. More to follow in due course.

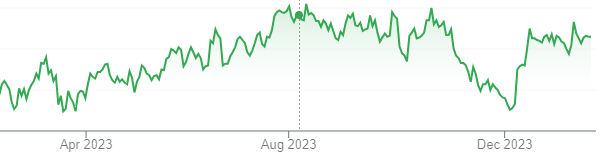

Anyone holding for a decent period of time is now deeply underwater. The massive dividends don't offset the capital losses and the chances of this bouncing back any time soon to the £30 level touted by some analysts is slim.

Yes, you should hold for a few more years like any sensible investor, but you could also get caught out by a low ball offer to take DEC private. Mention of an offer around £14 based on a premium to 30 day average share price would still only get you back to 70p in old money.

Good time to buy in an make a quick profit on the other hand but that's not much consolation to long term holders.