120th Article - winners, losers and more methane

Progress review of the OB 20 and general musings 27/01/24

Dear reader,

Happy Saturday. In a week where PCE dropped below 3% in the US, and next week where the world obsesses about the (no change) BoE and Fed interest rate (in)decision, many Mfg and Service PMIs are due, as are US payrolls, wages, Michigan sentiment and factory orders. The Mag 5 (of 7) report earnings. Q4 Euro Zone GDP and Inflation are all due. The macro picture that I think will emerge is one of stubborn inflation and even more stubborn growth. The boring “will they/won’t they” interest rate obsession shall continue.

The recession-philes will be disappointed to know US M2 is now growing…. and a soft landing appears to be likely or very likely.

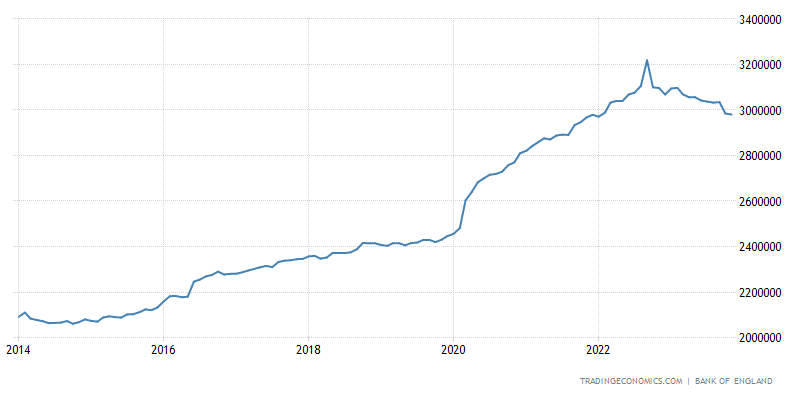

UK money supply is still falling (but remains above trend).

Let’s stop talking macro and talk about deep value instead.

Oak Bloke Top 20 2024 update

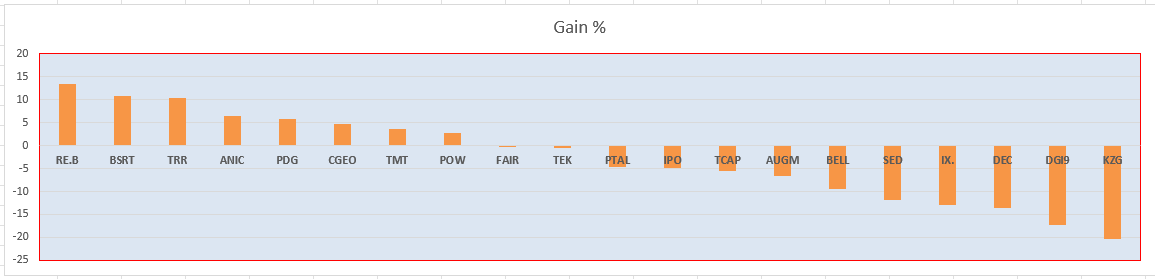

At article 110 I reported a net YTD gain to the OB20. Today at article 120 I report a net loss. 2.5% precisely (albeit after a temporary 5% YTD gain) and that’s net of spread and dealing costs.

Ouch. Has the Oak Bloke lost his way? Is he a charlatan? A clown? Let’s look at the 20 stocks I thought could prosper in 2024 and where I think we go from here. 1 month down 11 to go.

RE.B is now my leader. This week REA confirmed the preference dividend arrears of 11.5p will be paid in April subject to the DSN deal completing. On today’s 91p buy that’s a 12.64% yield plus 9.9% is due for 2024 also. Nearly as high a yield as DEC!

At #2 I wrote about (not) baked in at BSRT this week so am not surprised to see this up - in relation to its NAV it’s not up at all.

At #3 TRR’s recent La Preciosa news which I covered in 110 articles explains its YTD gain.

At #'4 prior leader ANIC has slipped back a little. I covered methane in 110 articles, cellular agriculture and precision farming could be as profound a change as AI. I’m looking forward to news from Agrinomics, oops Agronomics (it’s transformative for agriculture - what can I say!). I suspect we won’t wait long for more news.

At #5 PDG - Pendragon - is steadily rising and the completion draws closer where it offloads its car sales/service business and a phoenix-like software business emerges.

At #6 CGEO continues to buy back, continues to prosper and Georgia’s EU Candidacy may mean this frontier and emerging market gets broader acceptance. MIGO describes Capital Georgia as a “compelling valuation anomoly”.

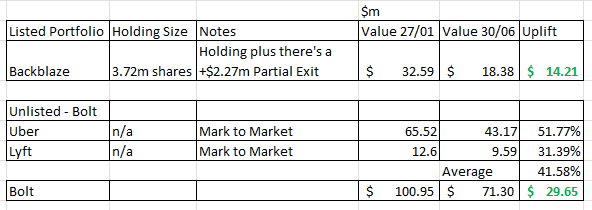

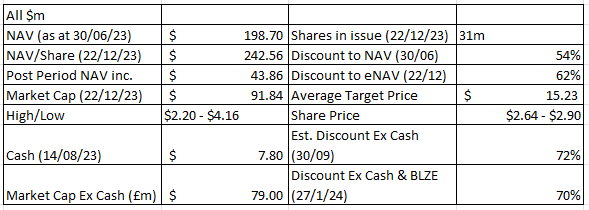

At #7 TMT its holding in Backblaze continues to rise over on the Nasdaq. Backblaze is cloud storage/backups - like Azure or AWS but at a fraction of the price. When I plug in the latest numbers into my model TMT is at an astonishing estimated 72% discount to NAV if I consider BLZE movement and a mark to market of Uber/Lyft versus Bolt.eu.

#8 place POW is covered in POW WOW and as any cliched Native American Chief might say… HOW? (is so cheap)

#9 FAIR continues to buy back although the discount to NAV is now just 2%. But next dividend isn’t far away. Liberum Capital says "Fair Oaks Income - Investment case remains compelling despite discount closing". For example in its monthly report it recently sold a $2m BB-rated note (OAKCL 2021-2A E) at a price slightly above 100. The note was purchased in November 2022 at a price of 88.6 so a 25.3% realised return (IRR). FAIR won the “Investment Company of the Year” award in the Debt category at the 2023 Investment Week awards.

#10 TEK also a previous #1 placing has dropped again and returned to doldrums despite an imminent IPO for Microsalt. It’s true it sold down about a 1/3 of its holding in BELL this week to howls of derision but still holds 7.73%.

What the howlers seem to fail to realise is extremely modest levels of success in any one of the 5 holdings will make this share pay. Look at the 5 addressable markets: Best-in-Class Oxygen for Hundreds of Millions, AI powered SmartEyewear for Billions, Revive for millions of EVs today billions eventually, Guident for hundreds of AVs today and billions of robots tomorrow, Microsalt for Billions of people. The total addressable market sizes are astonishing.

Consider this. TEK’s market price at 30/06/23 was 10.5p. Today it is at a 7.5p buy. Yet the estimated NAV remains nearly the same (1p less), and a slew of accretive value events have occurred since then. If Microsalt’s IPO even gets away at less than 2/3 of the $20m valuation what will that mean? Break even is at a $12.8m valuation then the TEK MARKET PRICE is 100% COVERED BY LISTED COMPANIES. All listed at bombed out prices, mind you, and I’ve explained in prior articles why. Plus that’s where you get Guident and ReVive for free. Plus TEK’s IP report evaluation service for free (the revenue of which covers much of Cliff’s salary for those fixated/angry by the fact he has the gall to get paid).

Remember reader, be fair when you judge me. I fully appreciate TEK and BELL used to be XYZ price and they’ve fallen in price. Judge me for what happens from and what they were priced at on 1/1/2024 - that’s when the OB20 2024 began. The same with SED (Saietta). I simply think there is compelling growth and therefore value from here - and the numbers/evidence appear to show that. I do not pretend they are low risk, but I do present they are high reward.

#11 PTAL gave a (very) positive Q4 update and WTI oil is now approaching $80 so I have no idea why this should be flat.

(No comments on #12 - #15)

#16 SED

VNA Indian production begins in Feb.

Meanwhile for all you avid golfers I see Ayro is touting its EV (powered by Saietta and made in the UK) at the PGA 2024 show. Did you know the US golf cart market alone is worth $1.5bn a year? I was intrigued to read in the Telegraph that non-avid golfing Americans are also buying carts as their 2nd vehicle. Ayro recently raised $48m to expand their manufacturing and to cope with demand… more SED powertrains needed then! (STOP PRESS: Ayro is the best new product winner 2024 at the PGA show)

SED’s progress doesn’t stop there. In Finland, Snowmobile Manufacturer and tour operatior Aurora Emotion are using SED’s AFT motor too for its eSled. Every single punter gives them a 5 star review and judging by a 500 or so reviews across 12 months they must have a fleet of 10 of these. Small beer… or is it?

First of all, judging by this video I can see why they are getting 5 star reviews. The experience is Star Wars-esque. The AFT motor must be quite something to have electric torque on snow.

Second, what better way to get sales traction (to so speak) than by running tours? How many punters go on to buy one of these snowmobiles. Obviously if you’re visiting from London then probably not, but the Snowmobile association says 130,000 snowmobiles are sold each year - about 50k in the US and 50k Canada, but around 10k to Scandinavia. The TCO of an eSled is that you get 100Km range on around £2 of electricity, and if you’re off grid but with power generation you’re able to self fuel your vehicle. The Aurora web site says regular production began December 2023.

#17 IX is slightly down on no news. This is a thinly traded stock and I believe people get bored and cash in. Given the current continued focus on methane and green energy that can only be positive for WasteFuel.

#18 DEC is down YTD and little surprise. My response to the short report DEC-orum est loqui verum is the most read article with over 2,000 unique readers and a plethora of valuable reader comments, and I’ve appreciated those. As I write, the US Friday market closed about 5% above London’s closing price. Twitchy times for shorters on borrowed stock and borrowed time. I am excited for next week’s Q4 update. I imagine they are dreading it. Will we see short covering before the 31st? Panic stations on board the rickety and rapidly melting Snowcap ship. What’s borrowed must be bought back. That’s just mathematics.

Speaking about borrowed time. What of the pause to US LNG export facilities news? This affects future expansion of LNG not currently approved facilities under Construction. DEC-hands can breathe easy. But is the pause because the US government know that it has reached Peak Gas and Natural Gas supply can’t keep growing? The IEA say it’s coming too. Think about it reader, the pause is likely to do with National Security isn’t it? We know Biden is paranoid about keeping gas prices low (as in gasoline), so why not natural gas too? Would Americans tolerate the prices the ROW have to pay? Oh, were I an American. You see Biden also promised to supply his allies in Europe denuded to Russian gas. Germany is merrily building LNG terminals in record time. Why is Biden now appearing to step back from that promise? National Security, it’s got to be. It must be at least the fear, if not the fact, of peak gas.

What does that mean for DEC if future prices are higher and/or more volatile? (no prizes). If gas closes the discount to oil then that would be incredibly, incredibly bullish for DEC. Natural gas development in the US has been described as “another Saudi Arabia”. If my calculations are correct US gas production in 2023 was about 1600 TWH and that equals 9,410mm BOE. US Gas production in energy terms equals 3 months of world oil production (or 25% of supply which is about what Saudi Arabia supplies). Much of new natural gas is shale gas which is famously fast for depletion (like Bob the salesman ragging his BMW in record time)

#19 DGI9 has fallen further YTD. You can buy DGI for £212m. I’ve covered the value at DGI excluding Arqiva here and for Arqiva here. I mused on the approach of asset sales to realise value. Disposing of Aqua/EMIC/Sea Edge would at book value generate a 70.7% special dividend and leave DGI9 debt free with both its crown jewel Arqiva holding and growing Irish ISP Elio. A half price (fire) sale of these assets would pay the debt leaving DGI9 able to realistic extract £50m a year which would afford a 23.6% dividend.

Some readers disagreed and thought a run out of the assets the better approach. I’m not opposed to that (not that I get to decide in any case!). Apart from Sea Edge which to my analysis appears the weakest candidate (even thought it’s performing on target to be fair) has little upside since the asset is leased at a fixed price. Every other holding actually contains an interesting play on the increasing use of the internet and increasing volumes of data which need to be transmitted somehow (we take these invisible information superhighways for granted).

Another reader spoke of Triplepoint’s poor management. It would be difficult to defend their performance that’s true. I’ve written about TP’s TENT but don’t really know their Social Housing IT but am aware it exists at a large discount. There is a Triple Point discount to all their ITs it’s true. But I do think whatever else they’ve done they made smart decisions in their purchase of assets, less so on the sale of assets e.g. Verne, as well as very poor forward planning buying cash hungry holdings and loading up on debt which blocks distributions until repaid (a reader thinks it’s just the interest backlog but I’m sure I’ve read it’s the VRN as well so $170m). Regardless of Triplepoint, my assessment of the management at each holding is positive, and the value is so deep that as Yazz once sang…. the only way is up, baby.

Finally #20 Kazera, brings up the rear. A recent interview explains some diamond feedstock (accumulated gravel) had been stolen “some years ago”. 100s of vehicles drove in, killed security guards, and drove off and over the border. Was it that which crashed the price? Or sheer boredom and weak hands folding. Few have a nice thing to say about KZG in the bulletin boards.

Meanwhile we learn the South African government has brought in Special Forces. The Recces (the SA equivalent of the SAS) - have been brought in and “things are changing” according to Dennis although he admits “it’s like the Wild West”. 100 soldiers are based on KZG’s site tracking down illegal miners and traders. The interview and who are the Recces is covered below.

Dennis confirms the pulsating jig will begin processing diamond gravels in “reasonable volumes” by the end of February. The diamonds will be transferred to government owned Alexcor’s secure storage daily. The go ahead on HMS is imminent, and resolution on Aftan is imminent. Arcadia Minerals (who also have a Hebei agreement) and are KZG’s neighbours at Aftan will give a Q4 update in the coming week. Will that contain further clues to Hebei’s intentions? KZG aren’t reliant on Hebei and other options exist. The OB20 assumes no topping/swapping/dropping - but in my own portfolio I’ve topped up KZG.

Penultimate Thought:

As you can probably tell reader, I remain staunch in my views on the OB20. These are only my views and you must of course make up your own mind. This is not advice is the mantra every time.

I write because it helps me be a better investor. You can help me reader, and you often do, by criticising. I don’t shy away from admitting mistakes and correcting what I write. We can work as a team reader. I’ve written quite a bit now in 5 months of writing and you might not have read some of my material - so I would encourage you to go back and read earlier articles, if you are a new reader, reader. I try not to repeat myself and instead write new and progressive content.

Final thought:

This week I’ve also bought a new holding called Plexus, ticker POS. Any guesses why my research led me to invest in a methane leak technology? Today’s title did promise more methane and I wasn’t referring to my writing (although some would claim it so). It’s easy to snipe, but less easy to produce something better my wise granny used to tell me, bless her. I’d say to her if I could, reader sniping makes me a better investment marksman granny. She’d be incredibly proud I think.

I’ll be writing about this new stock soon. I’m very excited about its POS-GRIP technology and its commercial prospects. which is for Net Zero guaranteed leak-free performance for the life of the well, reducing harmful methane emissions and unnecessary intervention costs.

I have to recognise Stockopedia’s Paul Scott’s coverage of POS which piqued my interest. I am of a habit of listening to his weekly podcast on my Lucyd Smart Glasses during long walks. I hope to provide an analysis that demystifies this stock that he claims is a “complex, special situation”. We’ll see about that.

That’s all from me - now go and enjoy the weekend.

This article is not advice.

Oak

Oak Bloke called it:

Digital 9 Infrastructure ($DGI9) plans to propose a plan to shareholders for a managed wind-down of the company, according to a Monday release.

The digital infrastructure-focused investment company said the plan follows its strategic review and will involve a change in the company's investment objective and policy.

Digital 9 currently intends to retain its investment trust status and listing amid the wind-down procedure, adding that it could reconsider the listing status after the wind-down process.

The company will start preparing the sale of its fully owned assets including Aqua Comms, EMIC-1, Elio Networks, and SeaEdge UK1, and defer the sale process for its stake in Arqiva.

Shares jumped over 14% early Monday morning.

Price (GBP): £28.07, Change: £+3.47, Percent Change: +14.12%

$DGI9

Source: MT Newswires

That was an interesting read, oh Great Wise Oak Man.

I would suggest that the 2 original managers of DGI9 who quit when they weren't allowed to open a private fund, had a unique expertise which was used to pick good investments in this sector. They didn't seem to have much understanding of financial strategy.

However, there must be a higher level board of directors of all the Triple Point funds and they have no track record of success in any of their funds, and that is always a risk factor to bear in mind.