Dear reader,

It’s that time again and this will be the proxy “half way update” since holidays mean there will an interruption to OB updates from next weekend.

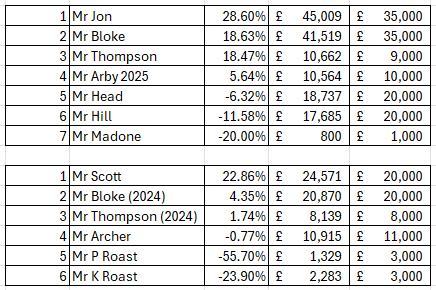

Big congratulations to the first half winner Mr Jon! Only 10% of voters believed in Mr Jon back in January but I was one of those 10%. His portfolio was added moments before the race began and I thought hmm I’ve got my work cut out to beat these - and so it has proved. I kick myself to not have invested in ABDN and PETS. When I saw Mr Jon had leaned quite heavily into Aberdeen and Pets At Home I did think ooh yes I should look more closely. I did a lot of of due diligence in 2024 on the investment sector and ABDN caught my eye back then too. It’s now up 33% YTD but perhaps there’s reason to think there’s more left in the tank.

Equally I visited a Pets at Home and was gobsmacked at the 100s of squeaky toys, books and pet paraphenalia - and how pet owners were loading up on all of that. It’s up 23% YTD.

Anyway I believe there should be a re-vote - so at the bottom of the article please choose the fun runner who you think will win. Is Mr Jon going to get 100% of the vote or do some think someone else can still take 1st place? There’s 6 months left - lots that could happen, and the UK market seems far more upbeat.

Mr Jon is on fire, exceeding even the achievements of 2024 fun runners. Share price growth delivers 24.22% for Mr Jon and dividends add a further 4.38% YTD! So Mr Jon has raced further in 6 months vs all of the 2024 Fun Runners in 18 months. That’s food for thought isn’t it?

#1 GOLD - Mr Jon

Top performer percentage wise is Works - and this is a share that piqued my interest via Mr Rebel’s excellent weekly substack, although well outside my usual hunting ground I did make a mental note to look closer and then the phone rang and life got in the way. I may still look at it. I enjoyed looking at Gregg’s back in March and liked it so much that I’ve bought it three times and sold it twice. It’s at 1904p which is why I bought it a third time. Mr Jon and I have common cause on Thor, MAFL and THS although I was very impressed with the ORCH update and clearly Financial Services is serving well with STB, Close Bros, ABDN all top performers too. The two -100% Alpha Growth and APQ are actually two de-listings so what I’ve done is roll in the “last price” as a dividend. They were only small amounts of money.

If you consider the weighted contributions on the top 6 are the larger weightings of ABDN (£3.6k of £35k), STB (£0.9k), SLP (£1.8k), JMAT (£3.6k) and of course VOD (£7.2k) all support the lead. Don’t bet large on risky stocks! Don’t hold at equal weight could be another way to say the same thing. This is an investment approach I’ve been focused on during 2025 for my own portfolio.

#2 SILVER - Mr BLOKE - up 18.6%

Somehow I’ve inched - no millimetred ahead of Mr Thompson - into second place. Both Mr Thompson and I are exceeding our 2024 Ideas too.

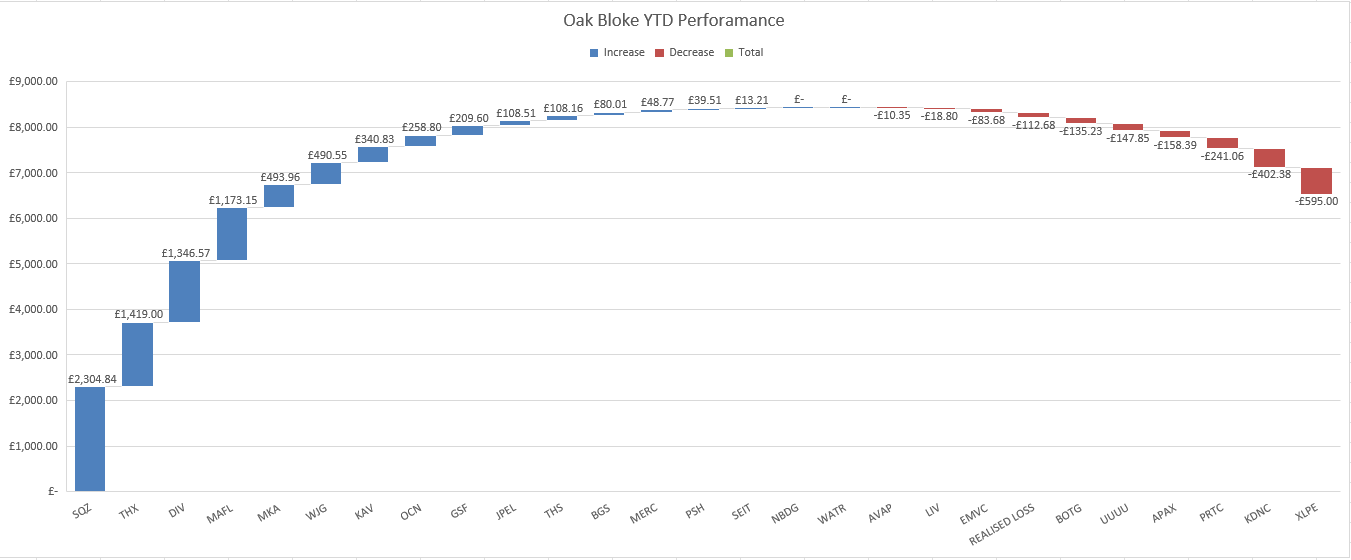

I recorded a video on YouTube yesterday talking through my portfolio and how 2H25 could look. If you’ve got an hour then you can “enjoy” that.

The same chart but with £ instead of percentages

I split out my gains across the current status from Stocko and see Super Stocks are where it’s at. The problem is Serica and MAFL weren’t Super Stocks back when I picked them - they’ve been promoted into Super Stocks. That gives me some encouragement that if you carry out detailed analysis then you can spot something that will translate into results.

I only have 2 suckers which is Kavango, but that’s up 34.1% YTD, and Bill’s Luck might be Bloke’s luck too. Consider that KAV is on the cusp of expanding production but is still priced to be an early stage explorer.

EMV Capital is down but not out. I thought the FY24 results were positive and will be writing about those soon.

Some profits on ideas classed as traps too. Trap the gold more like. PRTC is my “Healthcare” stock and that has been a frustrating sector in 2025, although an idea I’ve written about recently INOV bucked that trend with some cracking deals and realisations, and I’m starting to think Biotech might be a hot area for 2026 so am pondering to position more in this area in the months ahead.

#3 Bronze - Mr Thompson

Bargain Shares 2025 started with the bang and then bang Trump Lib Day dropped it to a loss - briefly. Since then it has been rising with OB 2024 pick Agronomics leading the way.

I’m very surprised to see Creighton’s up as much as it is. Another 176% and Paddy Ashdown’s hat is on the menu for OB consumption - that was the implied upside according to Thompson. The only newsflow is a NED buying about £30k of shares. £1.2m net profit on a £27.5m marcap puts this at 22X earnings. Contrast that with VLG where the UNDERLYING profit is a P/E of 7.6X and an extraordinary gain of £24.1m means the current year P/E is about 2X. Please tell me why the market believes Creighton is 11X more valuable that VLG?

Carr’s is up a small amount so “it will soar” hasn’t quite happened as yet. In my “Considering Bargain Shares” article I assumed a 130p tender yet it is 163p, so that leaves 11m more shares in issue (51.6m vs 40.4m shares) - so the folks exiting CARRs are getting the better side of that deal. And my estimate of a 24.2X P/E rises accordingly to above 30X. Ridiculous!

The power of 400,000 readers I guess.

These are the gains per share….

And the contribution to the gain to date:

#4 Mr Arby

5.6% return is very decent and 2 active pickers are below passive portfolio Mr Arby. Mr Arby spent 5 minutes building this portfolio os 35% Non-US World Index, 5% Bitcoin, 40% US Index, and 20% Bond Index. Active pickers spend hours each week poring over RNS, annual reports.

Not Mr Arby. He sips beers and for 2 years has proven that investing can be rewarding without taking great risk. These 4 holdings are Vanguard. Perhaps you should consider, reader, one or more of these as part of a balancing of your portfolio?

Not that I condone Bitcoin. I saw this week a leading crypto voice loudly declare there shall never again be a crypto winter. I smiled and wondered what he’d look like sat on King Canute’s throne at the shore.

#5 Mr Head

Imperial Brands is the most smoking of these ideas so far. But I am genuinely surprised that Yu has fallen. I reviewed this in Yu Smackdown and concluded its energy business had plenty to go after, even though I thought its Smart Meters business looked quite pedestrian to that of Arqiva’s. When I reviewed it its 1H24 Smart Meter revenue was £5.9m.

Yu Plc (and it’s going to involve DGI9)

Reviewing Yu’s full year results I see I was 100% right. Their Smart Meter business looked unimpressive. YU’s 2H24 revenue for Smart Meters was £6.8m. Its 2H24 Operating Profit for Smart Meters was £0.039m.

So it made 6X less profit than its 1H24 profit! And revenue increased £0.9m period to period.

Arqiva (held by DGI9) was 78X more profitable in my analysis in 1H24 so moves to 468X more profitable (for the Smart Meter segment only) for 2H24!

Despite some harrumphing by some readers who owned Yu, it looks like my analysis was spot on. Doesn’t mean the power supply part of the Yu business is performing as poorly - quite the contrary.

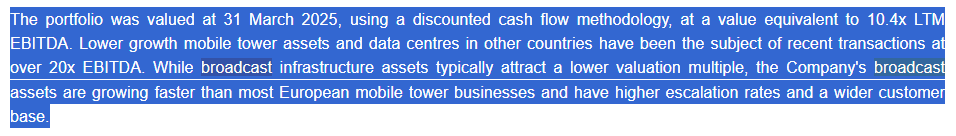

While I’m talking about Arqiva I noticed that Cordiant (ticker CORD) released their FY25 results and declared their discount rate for their two Broadcasting businesses in Czechia and Poland reduced by 28 bps. Do UK broadcasting businesses get to be less risky too? Or just Eastern Europe? All three countries face the SAME challenge of DTH broadcast declines, and all three are evolving into new digital services - but Arqiva most of all.

If the above statement from CORD is true about a 10.4X valuation then Arqiva is worth £3.2bn. 10.4X EBITDA of £154.5m. But could be worth 20X? Arqiva is valued by DGI9 (based on the NAV) as being worth £0.64bn (for 100% of Arqiva).

So it’s at an 80% discount to CORD’s valuation, and the DGI9 share price is at a 73% discount to that 80% discounted NAV?! So a 95% discount then.

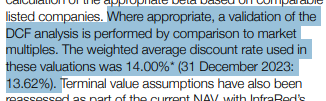

The other interesting nugget that demonstrates the DEEP VALUE at DGI9 is that the DGI9 NAV is 34.4p a share and that’s based on an eye-watering 14% DCF (discounted cash flow).

A 14% rate wipes 67% off the value of future cash flows over 20 years. Contracted and inflation-proof cash flows, mind you.

Each 1% reduction in the DCF would add £32.82m to the NAV and that equates to an extra 3.8p a share. Of course if they ramp it in up to 15%+ then the dial goes the other way.

Nearly identical assets in Poland and the Czech Republic (at Cordiant Digital) are now weighted at a 9.22% DCF so 4.78% lower. Using that rate would equate to a £157.7m difference to valuation at DGI9, or 18.4p per DGI share. Over 200% the DGI9 share price.

Anyway rant over and back to Mr Head….

Mr Head called time on 4 of his ideas 1st April because they broke his rules. XPS Pensions is down since then “with growth expected to slow over the next year or two, the valuation is starting to look a little more stretched” he says, but dropping Luceco, Harbour and Morgan has cost him. HBR is up a third since I looked at it, and profoundly disagreed with his calling time, and bought in (not that that is relevant to the Fun Run 2025 - we don’t chop and change in this race). Today at 206p HBR still remains very good value, in my opinion.

#6 Mr Hill

Mr Hill has suffered some sharp setbacks in a few ideas. The first and only -100% of 2025 (so far!) was Oncimmune (the OB held that honour in 2024 with Saietta which Mr Hill was also a fan of). Mr Hill’s star share Argentex plummeted too. Mr Hill announced he’d called time on Ixico on 19th June at 11.5p during his weekly podcast saying it was too niche. I reviewed this share recently and concluded there were huge risks or perhaps it’s better described as little control (customers have the power). I believe there is an identical problem at Hvivo, which suffered a sharp move down at the end of May for exactly this reason.

Top performer is CVS which has a CMA risk hanging over it. Vet Services are being investigated for transparency and what Mr Hill describes as “possible Vet industry fixing”. I would think pet owners would want vets to fix their pets.

This month a 6 month extension was announced. Dealing with the CMA enquiry cost £1.4m in the last period to 31/12/24, so the continued delay is a disappointment given that this being cleared during 2025 was central to Mr Hill’s investment thesis.

VLG is the #2 performer up 25.7%, and lots more to come from VLG I believe.

I also really liked AOM Active Ops when I looked at that recently.

My eye is drawn to possible bargains in Mr Hill’s detracting ideas. CML, MPAC and Victrex might all be worth some investigation at 20%-30% off YTD.

#7 Mr Madone

Mr Madone’s single pick on Touchstone Exploration initially gave him the lead but several placements, albeit one to fund an acquisition, haven’t helped the price. A disappointing 1Q25 result too where production dropped to 4,317 BOE/d far short of the 8KBoe - 10Kboe hoped for.

The “Drill and Fill” strategy isn’t yet filling if Oil production is the measure, and not refill the coffers through several raises.

Having written positively about TXP in various Jason Bourne themed articles I’m fairly close to calling time on TXP. It’s in last chance saloon as far as I’m concerned. Good luck Mr Madone, and of course if the recent Shell acquisition and drilling at Cascadura comes good and the filling proves out then Mr Madone might still beat us all and take gold.

Conclusion

It takes quite a bit of time and calculations to produce this article, but the benefit of this task is pretty good. It lets me think about priorities, it keeps it real, to think about my choices and whether I should back one or more of fellow fun runner ideas. In the real world we don’t actually pick 25 ideas on the 1st Jan until the 31st December do we?

It’s a bit of fun too.

I’m going to just stick to covering the 2025 ideas in this article, but my eye is drawn to the 2024 list where 16 ideas remain and not a single sucker stock - all of their styles have been promoted and the lowest Stocko score is 34 (Kazera). It needs a separate article. Or perhaps a video.

Having said that, do I feel that the 2025 ideas are better? Well they are performing better YTD - that’s just a fact. How do I separate hindsight, luck, better market conditions? Would I choose 2024 or 2025 picks as the better set for 2H25? I genuinely do not know the answer. There remains vast upside potential in the 2024 picks. I’ll leave it there or that separate article will get written here.

I’d be interested in reader’s thoughts on which Fun Runner ideas (2024 or 2025) they think could do well in 2H25. Comments below.

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

There is still a long way to go on junior precious metal miners OB (maybe after a breather next few weeks?), although I am not calling out any specific ones. Also SQZ was an excellent call - I like the idea of cencentrating where the asymmetric risk vs upside is very clear. I have suffered a lot on biotech - something whose time should have come but hasn't. It maybe 2026 is biotech year. And it may not be, so pls be sure. You have some excellent fund ideas, are these allowed?- I much prefer sector exposure than individual small caps which I view as very risky (just speaking from hard experience!)

Great article thanks for sharing, my pick would be Mr Jon he is a shrewd operator