The 2025 Stock Pickers Fun Run

Celebrating St David's Day on this sunny Spring leg of the fun run

Dear reader

It’s that moment you’ve all been waiting for. Whoopee I hear readers exclaim. The runners’ performance. Dressed in Daffodils today, after a glorious blue sky welcoming Spring. Well no one else is dressed in Daffs today; no 6 nations this weekend.

Someone asked was I doing these updates for fun? Er no. It’s a lot of work! The hope is to gain some insights, to reflect on what’s working or not working and to spot trends - that’s what the point of analysing stocks is…. dontcha know?

So who’s winning the 2025 race? How? And whose ideas are working?

#1 Race Leader - Mr Thompson 16.1%

After beating Mr Thompson in 2024 I didn’t want to include laggards in 2025. But it’s such an impressive 2 week performance that this ideas list deserves to be granted entry. Are these fundamentally 9 great picks? Or is it the IC 400,000 reader effect? If it’s the latter then why has Crystal Amber not budged?

The standout performance is OB24 pick Agronomics ANIC already up 81% in a fortnight and gives a nonsense to the idea that the UK stock market is doomed and tech can’t do well in the UK. Just look at the macros. ANIC’s largest holding Lib Labs is nearing completion of its plant. The news that its facilities are nearly triple oversubscribed is incredibly positive. ANIC was a top 3 holding so I’ve been rebalancing into some other ideas while maintaining top 3 exposure. A salutary comment to make is in OB24 terms ANIC is down -13% ITD, while up 81% for Thompson. That describes how far it had fallen to really, really silly levels. The read across to OB24 pick Power Metals is so so so obvious. Commentators have run out of adjectives to describe how mispriced POW is, and now it has a warchest of cash too after selling about 50% of its GMET holding. POW overtook DEC to become my biggest holding.

K3 Business Tech is a funny pick. It acquired a load of ERP businesses years ago. Offloaded its Sage business for a song, its Microsoft D365 business went bust, it’s just dumped its profitable SysPro business for £36m so it’s now 100% gambling on its Visitor Attraction software (POS system) and Fashion Add On for Dynamics plus it has a global support contract for Ikea. Not a share I like and the news that it’s up 20% is a surprise but I’m dubious for its prospects. Look at their FY24 results. Perhaps a reader will strongly disagree? I see Mr Scott wrote negatively about it too some months back too.

I wonder how well these 9 ST ideas will gestate as newsflow comes in over 2025. I held Crystal Amber once and found its activism quite entertaining but do they offer deep value. I’m a little curious.

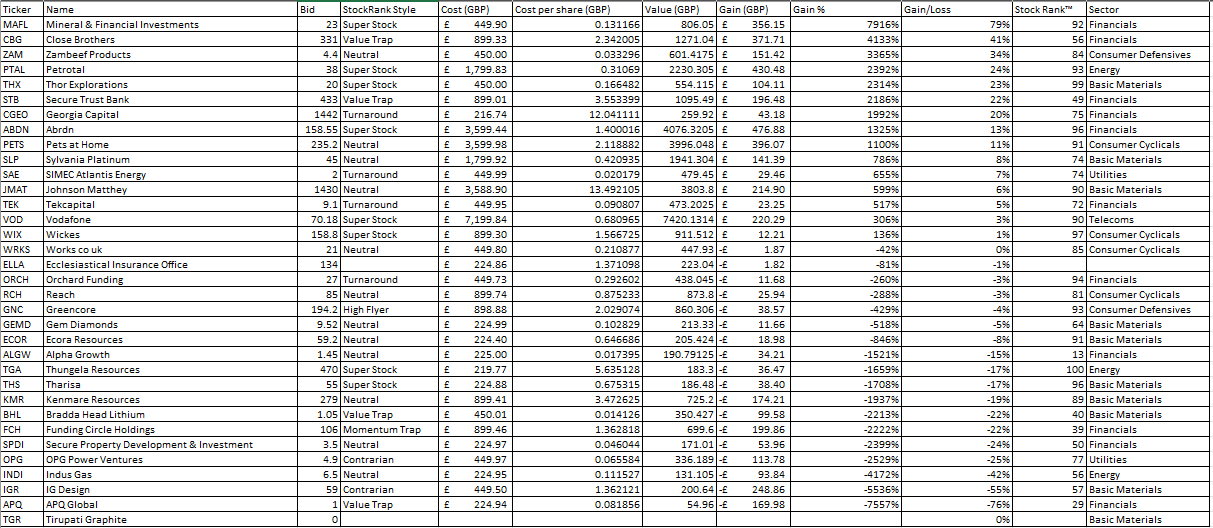

#2 Mr Jon up YTD 5.1%

Congratulations too to Mr Jon who became race leader following a change of fortunes at one of my 6X holdings, Serica. Until Mr Thompson joined of course. Mr Jon and I have lots of ideas in common. MAFL is both our #1 performing pick but neither of us leaned into this on our weightings, and we both probably wish we had. It’s a big personal holding for me. MAFL has gone from fast asleep to suddenly power up in 2025. Record gold prices perhaps have something to do with it and I’ve covered that idea recently where I was astonished to find ex cash a prospective discount of 85%! Even after double bagging so far in 2025. Other Mr Jon ideas are 25 for 25 ideas like Thor and some are OB24 ideas like Petrotal and Georgia Capital - both are doing well too. Some shockers too. IG Design’s poor trading update took many by surprise so -55% YTD.

Kenmare Resources catches my beady eye. At -19% down that looks like an intriguing idea to revisit. Lots of cash. Wonder why it’s down? Others like Ecora down offer really great value too. The DRC have banned exports of Cobalt. I’ll be writing about Ecora again soon, following the new copper royalty as well as news around Cobalt and 2025.

I also like ABDN (a vowel-less stock is perfect for Wales national day too, pity they’re not called CRDFF, although I imagine there’s plenty of vowel-less words in Wales) and might deep dive into ABDN at some point soon (I have 30 draft articles so it’s one of them!). I was also impressed visiting Pets at Home recently as to the extent of its extravagent options for pets and how pet owners were queueing to obtain said options.

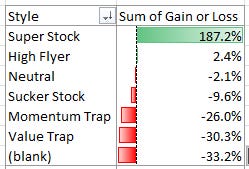

Interesting to see Super Stock ideas are making Mr Jon lots of money. But Value Traps are working well for him too.

Interesting to see some highly scored ideas are profitable with some midrange losers. Kenmare and IG Design are the highly scored “96” losses in case you’re wondering based on the Stockopedia scoring system.

#3 Mr Bloke up 2.2%

Third place again! In my defence I was #1 and leading until storm Eowyn blew me off course. Specifically, Serica one of my 6X holdings. I suppose I do have the joint honour of the race’s first double bagger with MAFL. That honour went to Mr Scott last year but this year he’s keeping his ideas just for his subscribers, although I do keep an eye on his 2024 ideas (which were public) - more on those later.

Overall I’m delighted with how most of the portfolio are developing. MAFL will move a lot higher I think and this is one of my largest holdings today (in my personal portfolio).

Watkins Jones has gone up but more still to come there. I see Mr Rebel is a WJG fan too. LIV has also done nicely although no news flow yet, so more to come there too I believe. THX is up a bit but remains incredibly cheap. I covered PSH in my Fannie Mae and Freddie Mac article and couldn’t believe how much of an opportunity that could be. The US appears to be flirting with some weaker numbers but remain convinced that Trump’s aggressive moves will prove positive overall If any Tariffs are actually levied that they will be offset with tax and incentives; meanwhile DOGE is restoring a more balanced budget after years of out of control deficits. Will we DOGE in the UK? It’s an intriguing thought. Positive for APAX, JPEL, OCN all US beneficiaries.

Laggard Energy Fuels is quite a surprise but Uranium spot prices YTD is down -11.1%. Trump tariffs of 10% will apply to the 95% of Uranium imported, giving UUUU an advantage although the market has failed to appreciate that yet - let alone the Rare Earth refining and processing capability, the only one in the USA. There’s a lot of talk about extracting rare earths from Ukraine. Who will process those? Nothing in the price for Toliara HMS either.

Of course Rare Earth recycler Mkango is another/different answer to that question and another OB25 laggard YTD. The NPV of a US rare earth magnets facility was astonishing. To get there, some level of dilution continues but even so the upside of MKA remains very strong.

Japan Smaller has been up 7% in 2025 but is down as part of Asian jitters surrounding Trump. A quality clutch of companies where the top 10 or so are at a trailing P/E is 16 but the forward P/E drops to 12 even applying fairly conservative assumptions. Considering that a Big Mac costs £3.43 you’re buying quality companies at half price too.

Laggard KAV is at an astonishing 0.6p/0.7p well below the 1p that investors paid just recently. 0.6p/0.7p was the same price as 18 months ago when KAV was on its knees having announced its KSZ drill hole contained no nickel. Of course you'd own 4x as much of KAV with your share being one of 718m, compared to 3.05bn today but there’s no really much comparison to today’s near-term gold prospects and cash generation. With gold at $2,850 having a bit of a consolidation before we get to $3000+ perhaps?

I bought more BOTG robotics on Thursday at BOTG dropped offering a window of opportunity following the NVidia news, and NVDA dropping to $120/share on “disappointment”. Disappointment?! Operating Income up 77% on the year. Expectations are through the roof but I listened to their presentation and it was extremely solid. Their Blackwell Chip is being delivered in volumes of $11bn which is far ahead of what I anticipated. More nonsense about DeekSeek being theoretically able to generate $200m from just an $87k investment. World GDP will grow by over 10% per year if that’s true and NVidia is toast but everyone else is laughing…..

Or it’s simply utter nonsense and fabrication. The $3.05 trillion market cap of NVidia says that it is fake. Or all that Smart Money is really dumb.

Of course NVidia is not the only holding in BOTG reporting strong progress - the #2 holding Intuitive increased its footprint of procedures 18% in 2024, and earnings are up 12% on the year.

This is the Top 10 at BOTG - so more or less the same but Yaskawa is now #10.

OB 25 for 25 scores on the doors

Interesting to see some of my best ideas are also top scoring shares. Lowest scoring are worst performing.

That my SuperStocks are the best performers. I went back to their original style and only 1 (Thor) was a Super Stock at the start of the year. My “Contrarians” got promoted to “Super”, but so far my worst performers are my suckers and traps. Will that carry on? Remember KAV was up 30% in January and was #2 best performer.

Although I recorded their original scores to control for the most profitable stocks are also ones where the scores have increased. I can then see best performers contain 90+ scored ideas but some in their 40s - 70s too. The trend is still there but it is not quite as cut and dried. “Original Score” is as at 31/12/2024.

I also tracked score changes YTD to understand whether increases to share price equalled score changes. Yes, on some but what caught my eye was Gore Street up 24 points and Serica up 17 points. Even Mkango up 10 points - even though they are down in share price. This suggests the fundamentals, the broker estimates or something else is changing.

Perhaps this is something many others have done before but it is an intriguing idea that you pursue unloved stocks which have fallen in price where the fundamentals are improving. Obviously you need to be Stocko subscriber to do this, and you need to record the previous score (there’s no facility to go back on past scores other than using the print report I believe). I spoke of Gore Street this week in Gore Blimey in an OB video and my analysis is that better times appear to be ahead and the change in stocko score appears to draw the same conclusion (although quite what the algorithm is seeing a higher score isn’t clear - broker forecasts perhaps? Obviously it’s a proprietary algorithm but it’s interesting to see whether or not it works).

Interesting to NB Distressed is up 22 points. Note to readers on this idea, even though the spread is very large (circa 20%) do bear in mind that when you come to buy (if) that the spread may be tighter than the published range. I found the same with BSRT where I bought for over 50% less than the spread (51.8p on a 50p/54p bid/ask)

#4 Mr Arby up +2.1%

Mr Arby’s 35% on non-US global stocks in Vanguard’s VXUS is providing the vanguard at +5.1%. BND is 2.2% while US stock index VTI is 0.9%.

Bitcoin is at a -10.6% loss but with just a 5% weighting it’s not dragging down perforamance.

Here’s a cold one Mr Arby to celebrate another demonstration that a passive index can beat active share picking. Stop reading the Oak Bloke and go and enjoy your life. 5 minutes picking some passive picks and you’ll be ok.

#5 Mr Head down -5.4%

Interesting to see Luceco at #1 at £1.46 YTD.

I hold £1.37 of LUCE shares for each £1.55 ESO share I hold, so you own LUCE (plus own Whittards of Chelsea, Pharmacy2U and a few other businesses worth £1.83 as shown below). Seems a bit mental buying LUCE directly when you can get almost the same with other stuff nearly for free.

I’m smoking a faaaaaag share Imperial is #2 performer coughing up for Mr Head. I see TCAP is a common share that was one of my OB24 ideas. Will we see an IPO of its data division in 2025? Very surprised to see Yu bringing up the rear. At -23.4% down that has to be worth a closer look. Could it be that Mick Dundee makes an appearance in an article titled Strewth! Yu Beauty?

#6 Mr Hill down -10%

AGFX is the top performer, expanding to new overseas markets, with an “ahead of” revenue update in Jan, although low profits but accelerating in 2026. AGFX looks like it had a rough 2023 and 2024 and a lot of change. It trades at less than half its prior highs and is investing in a “tech proposition for alternative banking”. I’ve worked through their web site and can’t see anything unique or different. In this interview Mr Hill and Mr G.House speak of having a “single portal” and “multiple currencies in one account”, an “account that is instantly updated" each time you make a transaciton” those aren’t USPs are they? They are SPs but not unique SPs. On the basis it’s not unique I don’t get it. Or am I missing something? AGFX do have a strong client list.

ONC appears to be requiring a fundraise which is why it’s down -88.1%, ouch.

#7 Mr Madone Down -12%

Betting 100% on one idea Touchstone Exploration ticker TXP was going to be a very binary outcome. The Mr Roasts did this with their three ideas each in 2024.

Mr M was #1 in the race for part of January. I covered it and its “Drill to Fill” strategy. I do wonder whether the winner for 2025 will not be Mr M. TXP could easily double bag this year if sentiment towards TXP improved. And it stopped having habitual bad luck too.

BONUS CONTENT

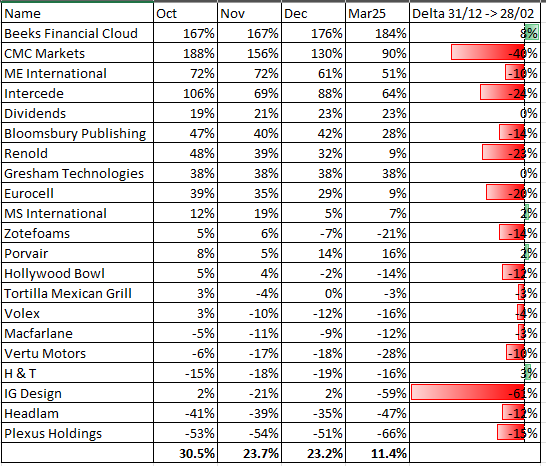

Mr Scott 2024 now only up +11.7% ITD

I was gobsmacked to see how many Mr Scott ideas had declined post 2024. CMC for example, is still #2 performance at +90% but it certainly has come off the boil (I wasn’t keen when I looked at it in Charlie Mike Charlie). It was interesting to see the Intercede gain reduced by -24% too. I considered that for OB25 for 25 although concluded there wasn’t any clear reason why its authentication was unique or differentiated to other offerings.

My eye is drawn yet again to Zotefoams. When I looked at it I didn’t believe in the milk carton and they’ve dropped it now, but the rest of the business looked strong. Perhaps another look is due. Perhaps others too.

OB24 ideas 0% ITD

My own ideas are also down by less than Mr Scott’s but to where the 14 month performance is now 0%.

Noticeable decreases in 2025 actually correspond with more buying on my part.

I bought more Baker Steel this week at 52p which considering its 90p NAV is backed by 13.5p a share of listed holdings which are mainly gold (with tin and tungsten). I can see how even those 13.5p could get to 52p in time where for example MTL is trading 50% higher than when Gold was at $2,000 an ounce, CMCL, is trading 3% higher since then! Silver X is down 16%. Its Silver Mine NSR and Gold Mine NSR are valuable too and not reflected fully in the NAV (discounted etc). Then you have met coal producing Futura and cement producing Cemos whose NAV then equals the share price at the combined NAV where, again, each one alone could be worth at least 52p.

DEC

Diversified is down on news of a secondary share issue which was needed for its monster acquisition called Maverick. Creditors insisted on more equity participation so that has reduced the price for now. In my opinion it’s a great and unexpected opportunity to average down or get in at an attractive price. Appreciate not everyone looks at this in the same way, but if you know something is building in value and if your horizon for patience is there then that is how to successfully build wealth via the stock market. Do what Warren Buffett does. The fundamental picture has only improved and the shorts took the opportunity to reduce at less of a loss this week, I see.

This week’s refinance news was positive. But people can spin anything negatively. I see some people spoke negatively of my article and the name calling continues in the chattersphere. OB is a “sycophant” and a “moron”. Oh dear. And “I should start a Fanzine” (remember those? ROFL). I so need to poll for that gem of an idea. Maybe I’ll call it “Lusty for Rusty” or “Well-ing up”.

An actual criticism used against my article apart from “the share price has fallen” as to why I was wrong was “slower amortisation means the loans will be higher for longer at high fixed rates as we enter into a lower interest rate environment, genius or just plan panic given the flashing red cliff edge which has been created by Rusty”.

Let’s consider the logic (or otherwise) of that statement. If you use leverage (debt) to procure assets which generate a profit in excess of the cost of capital you have just increased your profits. It baffles me that people don’t understand the basic mechanics of business. The Summit deal, for example, according to - admittedly - a highly-useful broker note from Tennyson, illustrates a $42m cost, and EBITDA of $18m.

The comment “The loans being higher” presumably refers to interest payments being higher (since the loans are not higher if you actually think about it). If we take the $18m EBITDA and remove the interest at 6.4%, then consider D&A at 7.6% (DD&A was $240m on $3.17bn assets which is 7.6%) plus ARO plus Tax you get to -$5.11m. That leaves $10.2m ADDITIONAL net profit per year. I’ve set it out below.

PINE

I bought more Pinewood on the news of the acquisition and the fund raise. I’ll be writing about that soon but I’m very excited about the forward prospects there.

CGEO

I wrote about CGEO this week and the madness of the assets you could get paid to take net of listed holdings and cash. I added BGEO in January but only traded it. CGEO’s 19.9% holding BGEO now called Lion Finance announced bumper results.

Who else? AUGM down -17.4% while its main holdings are all growing fast makes no sense and I believe we’ll see a rerate in AUGM in 2025 as I anticipate BullionVault, Zopa, Tide and iWoca all post strong updates.

Other turnarounds in waiting include IPO, BELL and DGI9. I’ve covered the last 2 so have no further comment today.

IPO had a setback with its Istesso holding reporting a failure in the primary endpoint of its Phase 2B study for Arthritis. Success in the seconary endpoint however. IPO’s other large holding Oxford Nanopore is also down in share price on now negative news. Cathie Wood’s Big Ideas 2025 illustrates how ONT could be on the cusp of a revolution in health potentially the greatest evolution. ONT’s January trading update AHEAD OF EXPECTATIONS took it to 158p.

On Friday it was just 112p. Go figure.

The Macro Picture

On this 1st day of March UK stocks still appear to be in a tough place. In this fun run I’ve assembled la creme de la creme of share idea folks to race against yet many are underwater. The shocking movements in Mr Scott’s 2024 ideas shows that the tough market remains despite some folks saying we were at the bottom. The FT ran this research showing UK small caps being 24% below their 10 year average forward P/E. Far cheaper than other markets.

By the laws of averages that is an incredible opportunity.

By the laws of averages record discounts could be an incredible opportunity.

I’m incredibly encouraged about improving prospects for the UK. From better relations with the EU, prospects of some sort of deal with the USA, the membership of the CPTPP (Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam). A massive wall of money being poured into the economy by the government in 2025. That’s not a political point, it’s just the facts.

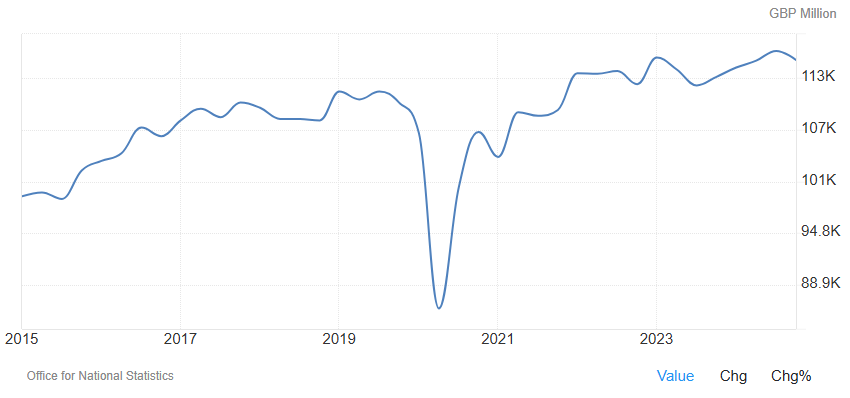

What matters is the ability of companies we buy and part own and hold being able to generate profits. Look at corporate profits over the past 10 years for the UK reader.

Just as you and I reader, invest, so too do our companies. The evidence is over 10 years that fixed asset formation is at its highest ever level.

If GDP comes in at 2% as the OBR believes (an update is coming in 2 weeks time) then that would place us among the fastest growing economies. The Anglo Tiger. What will THAT do to international interest in UK shares?

The UK is considered “part of Europe” by the world regardless what some British feel. So the wider 2025 European share recovery is also a positive driven by events already in 2025. Peace in Gaza, peace in the Suez Canal is huge for Europe. Prospectively peace in Ukraine is massive. Ukraine’s reconstruction cost is estimated at $0.5tn but that is a huge positive akin to post world war 2 Marshall plan. Even the prospect of better relations with Russia may prove to be a positive, obviously depending on events still to come.

Perhaps real politik will mean cheap Russian gas flows into Europe and the UK once more. Perhaps as soon as later in 2025? If Trump’s apparent overtures to Putin are straight out of the text book of Henry Kissinger and part of a US strategy to isolate China then with certainty one of the topics with PM Starmer will have been to change the rhetoric on Russia.

Sounds crazy? So did making peace with communist China in 1972, yet it happened.

Conclusion

I hope the musing on ideas and performance you find useful. If this article gets lots of likes I’ll keep doing it otherwise I’ll leave it for a while. Up to you.

In summary I think there are lots of ideas and opportunities.

But also there are reasons to feel a bit more cheerful than probably you do.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings including those held in an ETF might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks for the efforts you put into this.

Curious as to whether and how you might handle dividends given that both PETS and VOD are declared in one year and paid in the next. At a 6% yield these are solid stocks.

Regarding KMR: it’s a solid company (despite this years political upheaval) that has been available at great value since commodities declined after 2022. Lots of cash but big investment this year into new mining zone

Kenmare Resources is investing up to $341 million (21.5 billion meticals) between 2024 and 2027 to upgrade and relocate its Wet Concentrator Plant A (WCP A) to the Nataka ore zone. This includes $225 million for the plant upgrade, tailings storage facility, and dredges, with an additional $91–106 million allocated for supporting infrastructure[1][2][9].

Sources

[1] "Transfer of Moma Plant to Nataka Secures Long-Term Operations ... https://360mozambique.com/business/mining/transfer-of-moma-plant-to-nataka-secures-long-term-operations-kenmare-defends/

[2] Plant upgrade, relocation to secure long-term production and ... https://www.miningweekly.com/article/plant-upgrade-relocation-to-secure-long-term-production-and-sustainability-2024-06-07

[3] Kenmare Resources Advances Key Moma Mine Upgrade https://360mozambique.com/business/mining/kenmare-resources-celebrates-progress-at-project-in-mozambique/

[4] Kenmare Resources celebrates progress at project in Mozambique https://www.morningstar.co.uk/uk/news/AN_1720099505724419200/kenmare-resources-celebrates-progress-at-project-in-mozambique.aspx

[5] Kenmare plans for the future with new IHC Mining dredges & move ... https://im-mining.com/2023/12/15/kenmare-plans-for-the-future-with-new-ihc-mining-dredges-move-to-nataka-ore-zone/

[6] Returns At Kenmare Resources (LON:KMR) Are On The Way Up https://www.ainvest.com/news/returns-at-kenmare-resources-lon-kmr-are-on-way-up-250210101601750107933a50

[7] Returns At Kenmare Resources (LON:KMR) Are On The Way Up https://www.ainvest.com/news/returns-kenmare-resources-lon-kmr-2502/

[8] Projects Update - 07:00:00 13 Dec 2023 - KMR News article https://www.londonstockexchange.com/news-article/KMR/projects-update/16251475

[9] Kenmare approves upgrade of plant to access 20-year Nataka ... https://www.miningmx.com/news/markets/55302-kenmare-approves-upgrade-of-plant-to-access-20-year-nataka-resource/

https://bsky.app/profile/jjaron.bsky.social/post/3ljkxtle2ks2h